The Canadian Technician November 30, 2011 at 11:08 AM

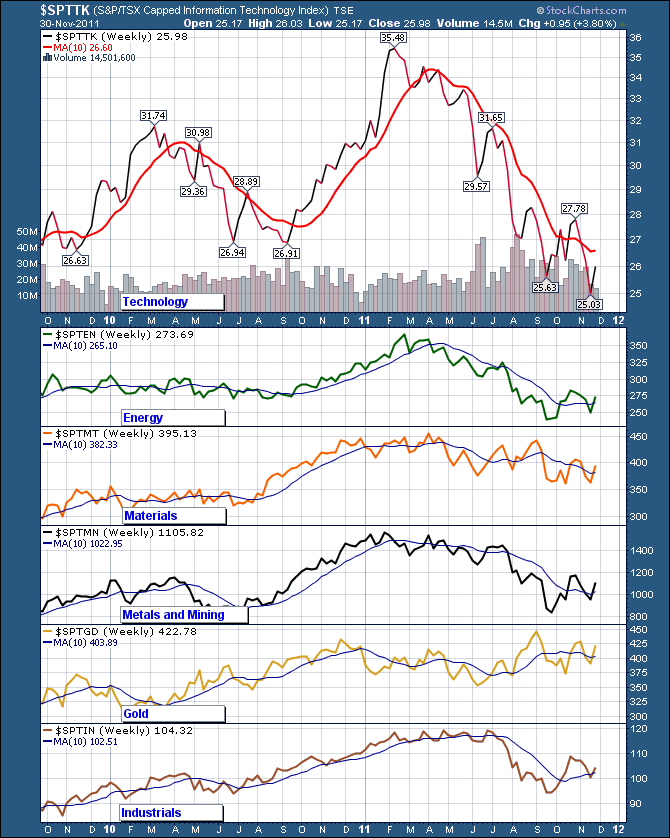

Here is yesterdays blog with new data! Yesterday, we blogged about how everything was below the 10 week. Well, every sector except Tech is above the 10 week today. The USD is moving down and the commodity currencies of Australia and Canada are moving up above their 10 week lines... Read More

The Canadian Technician November 29, 2011 at 03:10 PM

Using volume to help with your analysis is widely considered as the best tool in Technical Analysis. Today, let us compare three charts. I have marked the distribution days within the last month on the chart... Read More

The Canadian Technician November 29, 2011 at 08:42 AM

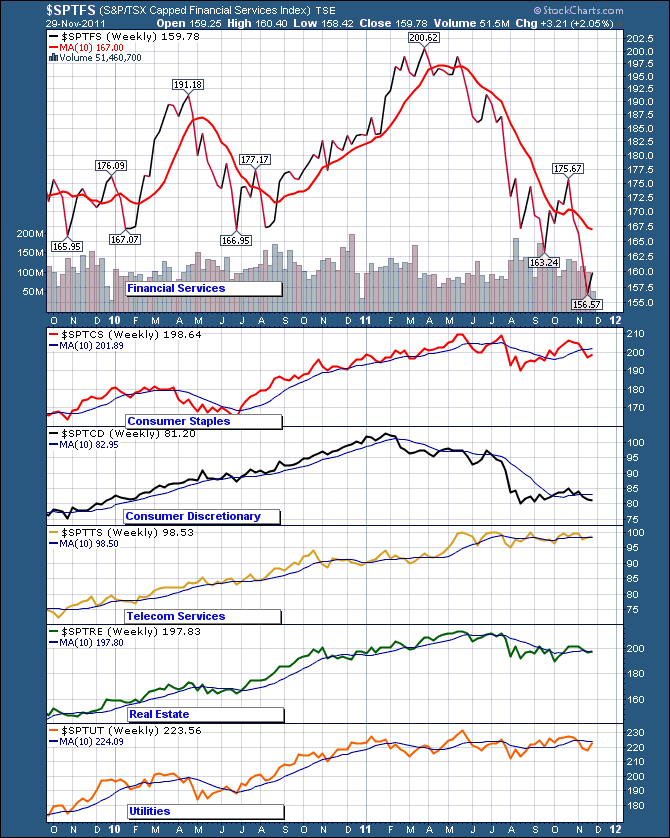

Today, Just a brief look at the different sectors. A quick scan says things are still weak. The Euro currency as well as the Yen were quiet today. The bond market has not confirmed the big move of yesterday. Here are the Canadian Sector charts... Read More

The Canadian Technician November 25, 2011 at 03:08 PM

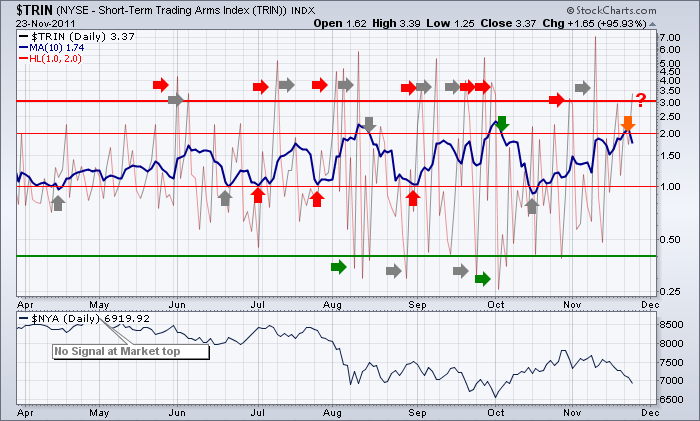

I use a variety of indicators grouped together to help me spot trend changes. The stockcharts website has some great indicators. How you use them is up to you. I'll try and show a few that I like. I have a list of 20 or so. Then I like to look the Bullish Percent indexes as well... Read More

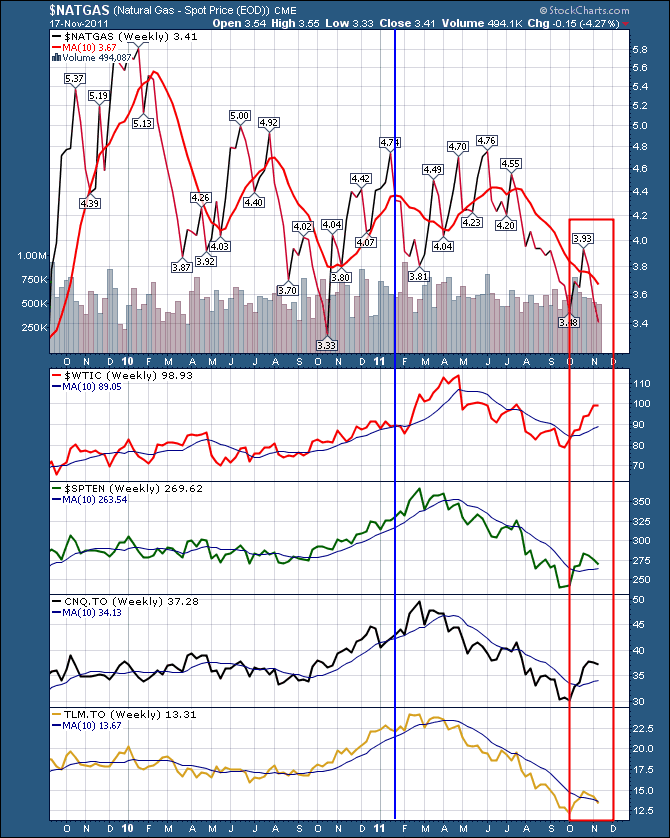

The Canadian Technician November 25, 2011 at 08:14 AM

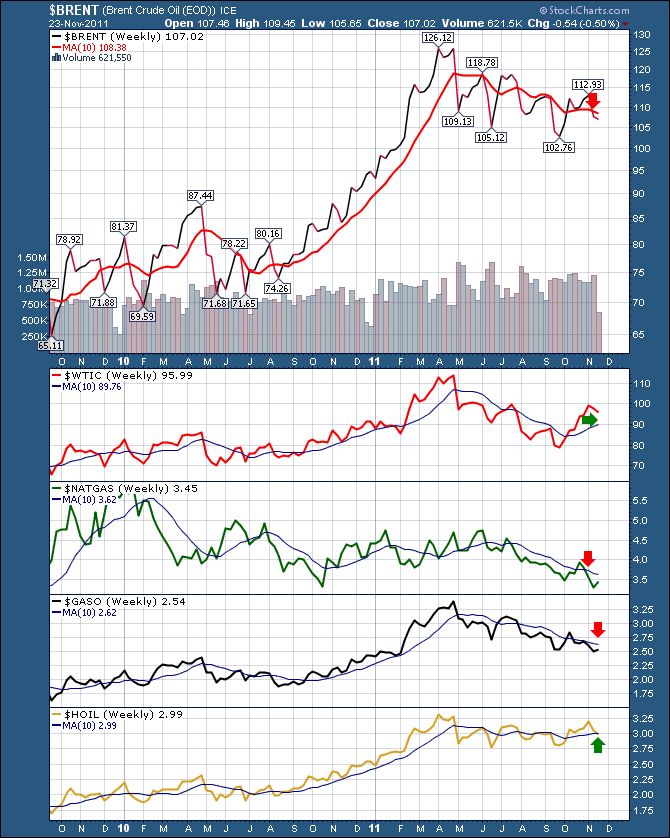

Here is the Energy dashboard. I like to look at two things. 1) Position relative to the 10 week... Read More

The Canadian Technician November 23, 2011 at 01:00 PM

First of all, Happy Thanksgiving to all our american readers and friends. May this celebration find you happy and healthy. This also includes all the staff at Stockcharts... Read More

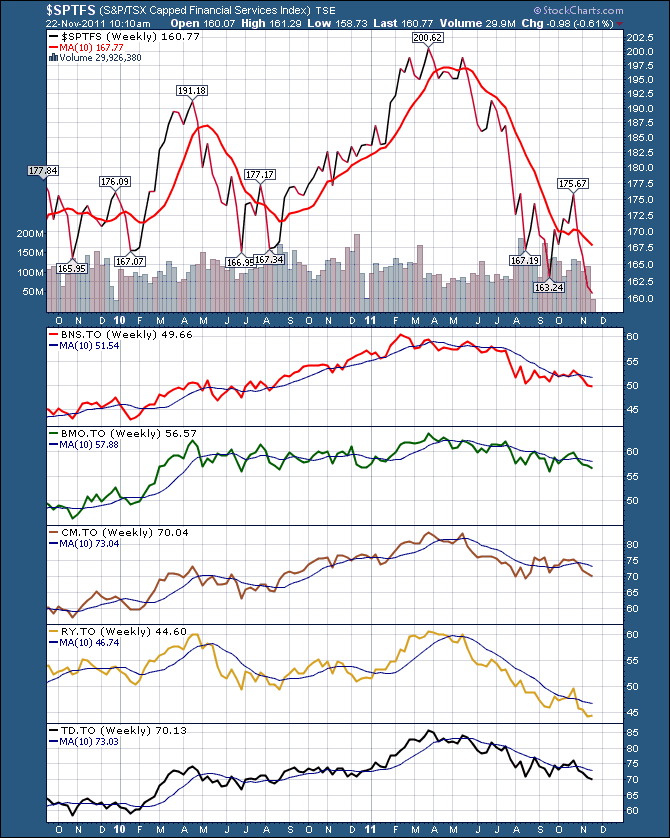

The Canadian Technician November 22, 2011 at 01:38 PM

We know they are weak.. what we are watching for is any signs of a bottoming process. Here is the Canadian Dashboard. Here are the US Banks Here are the Investment Banks Spanish,Dutch, German and Swiss Banks... Read More

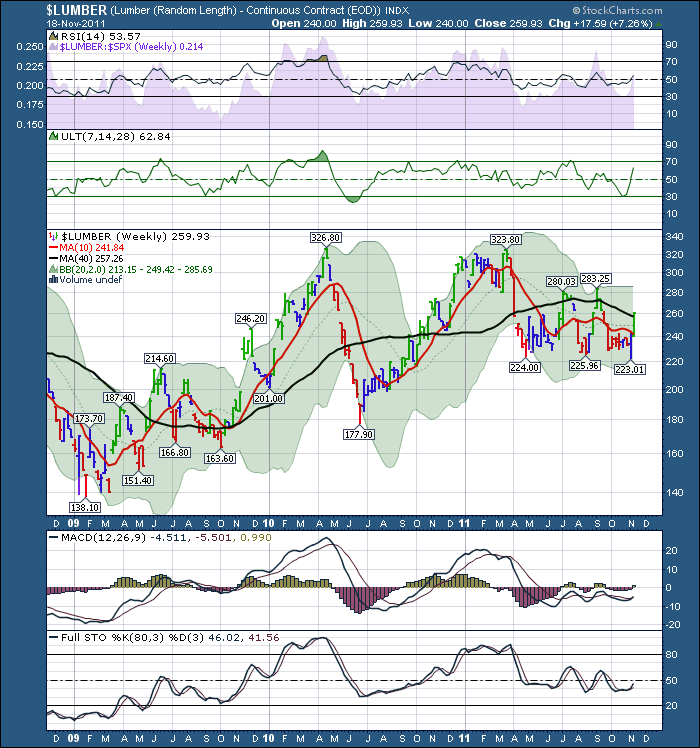

The Canadian Technician November 21, 2011 at 01:56 PM

OK. I like to buy stocks with high growth rates...these lumber stocks have had cement shoes on the profits for years. But this is why we need to pay attention. Here is the $LUMBER chart Weekly Inthe past 2 weeks It has gone from below the 10 week and 40 week to above them both... Read More

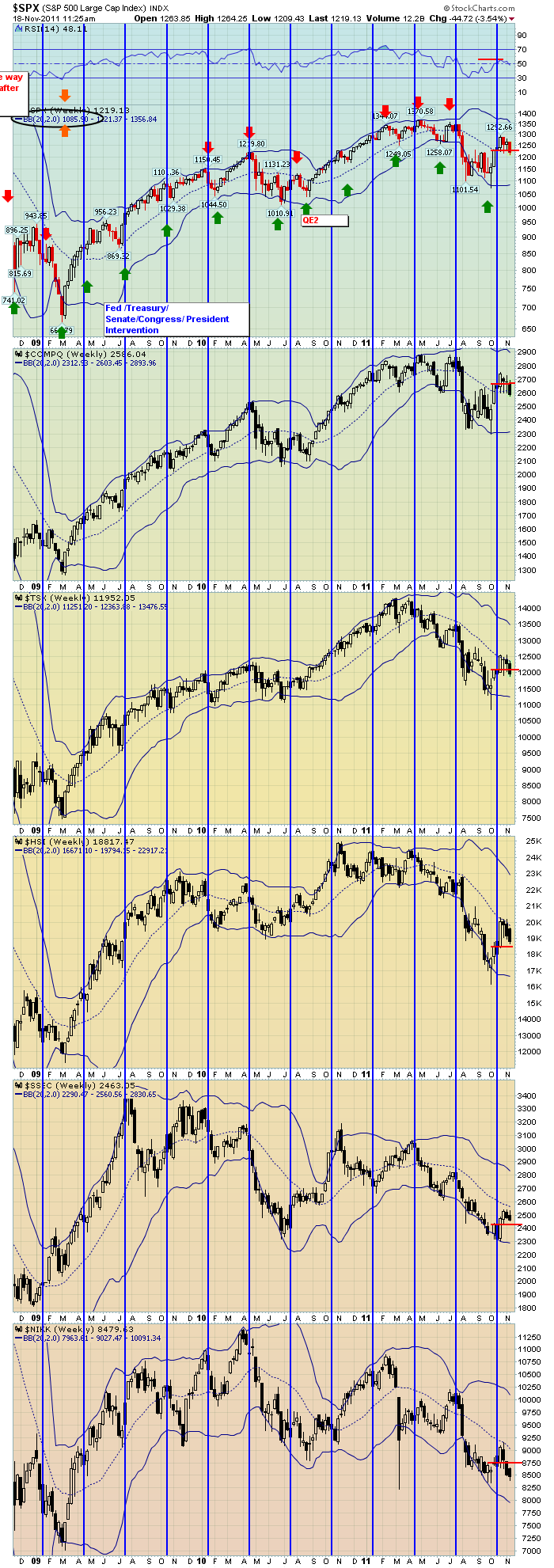

The Canadian Technician November 18, 2011 at 03:26 PM

Here are 6 Pacific rim Markets. The blue vertical lines are the approximate options expiration weeks. Options expiration dates during earnings season (January, April, July, and October) are pretty pivotal. Notice how the markets ran up for one more week after OE... Read More

The Canadian Technician November 17, 2011 at 07:19 AM

Here were some of my comments in the blog two days ago. 6) We have hit the fib levels on the index and on crude. Gold made moves above the fib levels, but the gold stocks have not. 7) Gold and oil opened higher today but the TSX opened weak... Read More

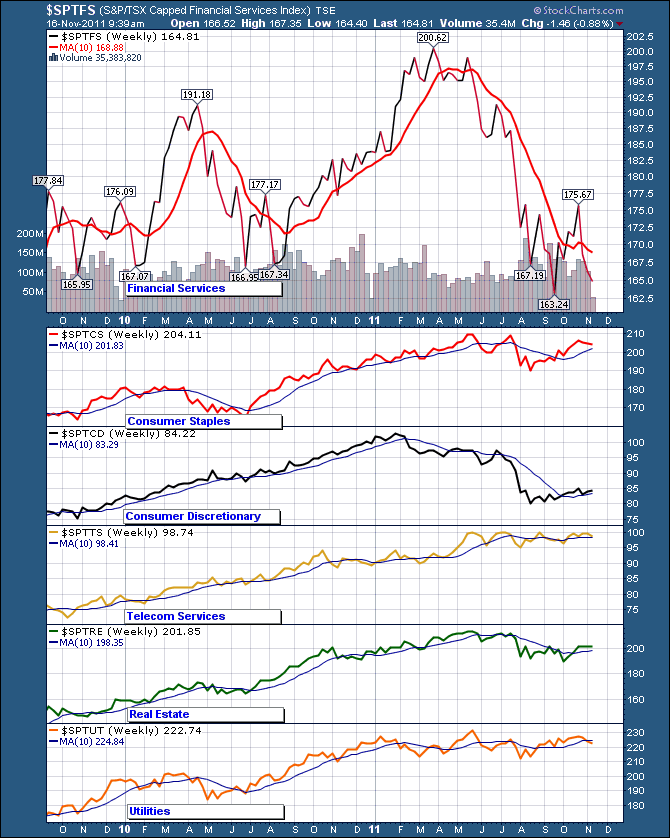

The Canadian Technician November 16, 2011 at 02:31 PM

Today we want to investigate which sectors are leading and following. The easiest way to do that is: a dashboard view. The Canadian Sectors outside of Energy, Finance, Gold and Materials are incredibly thin. Like 10 stocks in each sector, some with even less... Read More

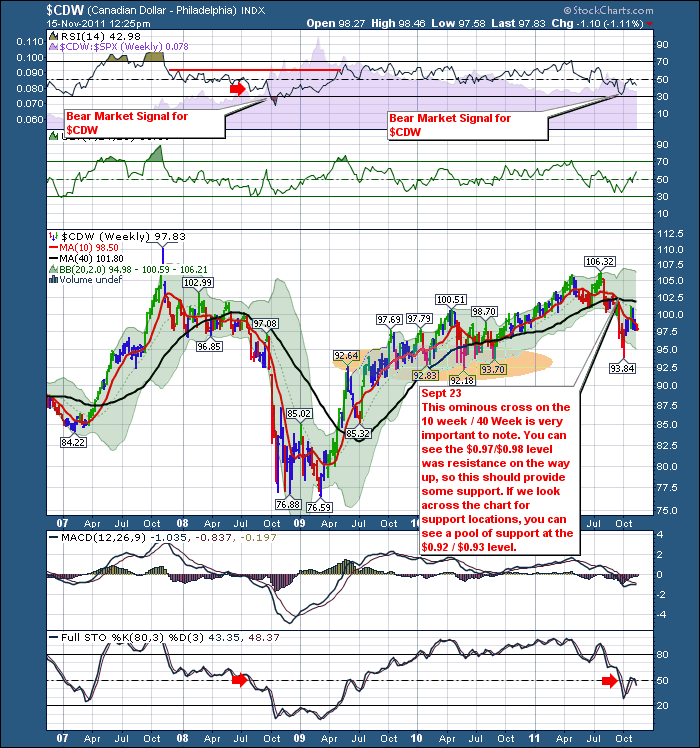

The Canadian Technician November 15, 2011 at 08:26 AM

Is this a market of opportunity or a quiet market like a canoe on a still lake above water falls? I don't know but I'll share my observations. You'll have to decide. For all the non-canucks reading the blog today, maybe we better explain the title... Read More

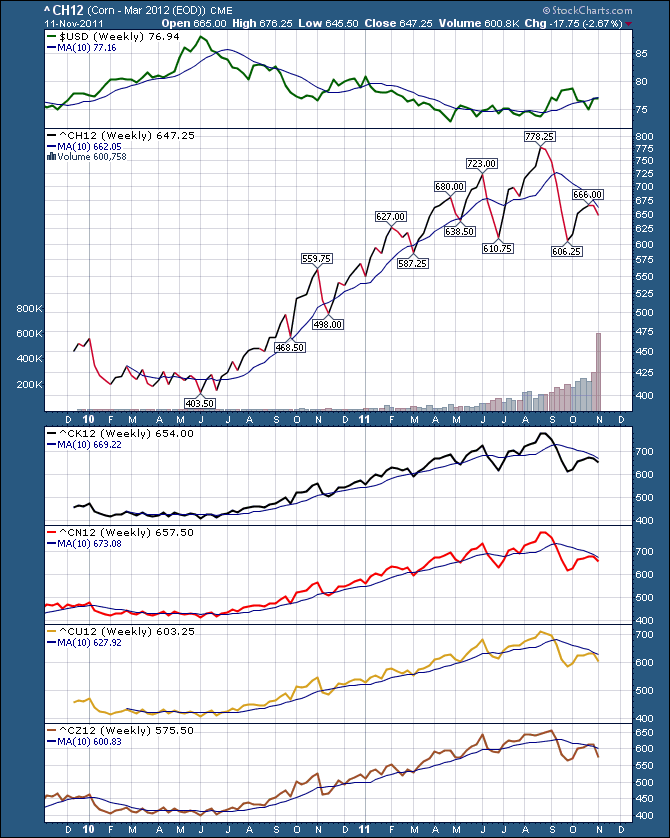

The Canadian Technician November 14, 2011 at 01:06 PM

Good Day, Lets just briefly check the dashboards. All of the symbols for the charts are just farther out months on the futures. So each chart has the nearest month first, then progressing to the longer months.Usually a year out. Here is Corn. Trading below the 10 week... Read More

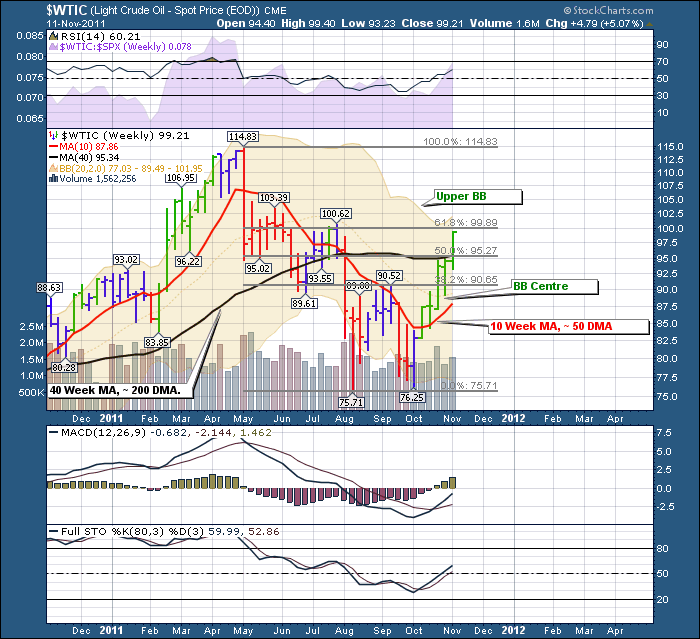

The Canadian Technician November 13, 2011 at 07:40 AM

Well, that was a very interesting week in the oil and oil stocks market. First of all, let's review crude oil and where it is priced. In the blog a few weeks ago, we suggested a good upside target for oil would be arond $99... Read More

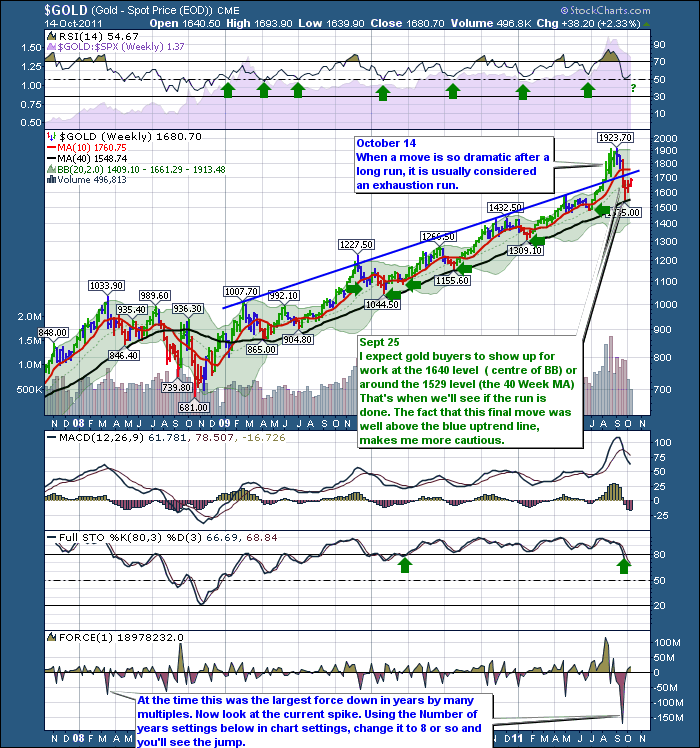

The Canadian Technician November 10, 2011 at 02:49 PM

Living in the city where BRE-X was born, I have seen the stock soar, scored, scarred, scared and scuttled. Therefore my enthusiasm for the metal is always muted. My broker sent out BRE-X shares for Christmas after they went bust. So my concern is always where is my exit... Read More

The Canadian Technician November 09, 2011 at 04:10 AM

Normally, I focus on the Canadian market, but today we need to explain what the dynamic currently in play is on the $SPX. Recently, my blog of November 1st tried to explain bull and bear market cycles using the RSI... Read More

The Canadian Technician November 08, 2011 at 03:01 PM

Below are four different markets. I have standardized the chart style to make the look similar. I have left the 50 and 200 DMA on the charts. I have erased the name, value or price of the stock, commodity, currency or index... Read More

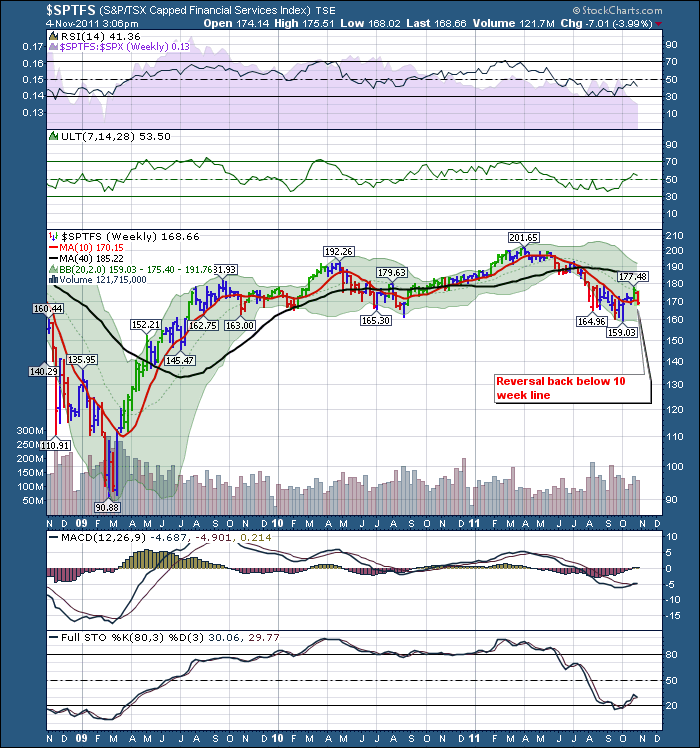

The Canadian Technician November 05, 2011 at 03:40 PM

Here is the Bank Sector: I don't like the red candle that made new 4 week lows this week. Here is the daily. I am very surpirsed that the Canadian banks did not get a relief rally at all after the Monday / Tuesday drill down. Maybe we tested the lows today and held... Read More

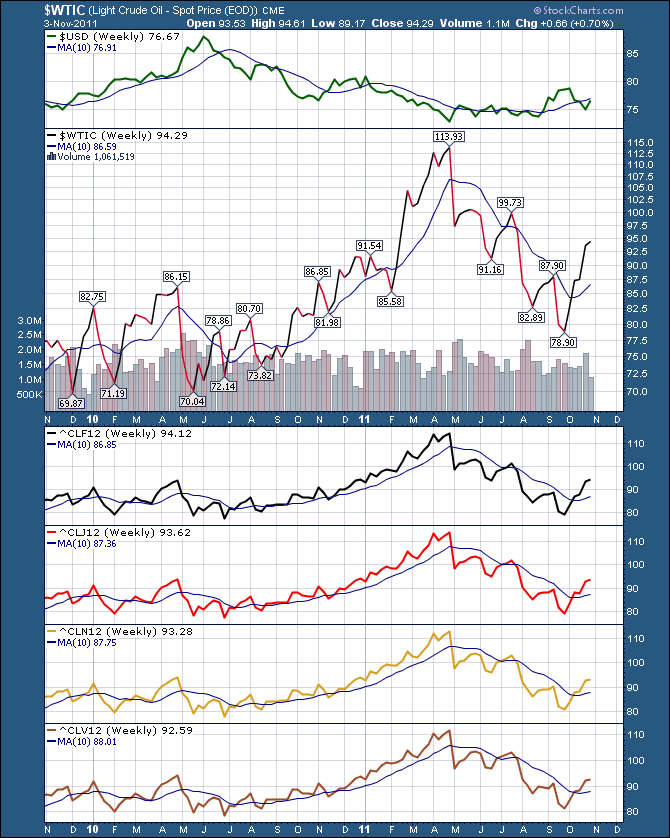

The Canadian Technician November 03, 2011 at 12:55 PM

Lets check the commodity dashboards: Here's $WTIC - Looks Bullish! Here's Copper: Testing support on every date....caution warranted: Corn: Testing resistance...buying opportunity with a tight stop? What I can't understand is why Potash is not getting a bid... Read More

The Canadian Technician November 01, 2011 at 07:23 AM

This is a long but important blog. It clearly illustrates why this point in time is so important. What Point? How price behaves at this 200 DMA. How the 50 DMA reacts right now. What do we need to see to confirm the move higher... Read More