OK. I like to buy stocks with high growth rates...these lumber stocks have had cement shoes on the profits for years.

But this is why we need to pay attention.

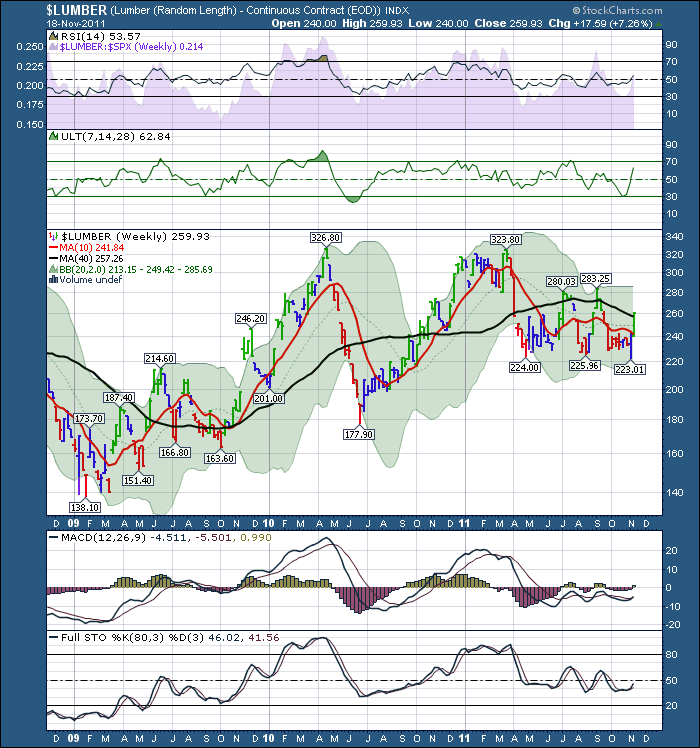

Here is the $LUMBER chart Weekly

Inthe past 2 weeks It has gone from below the 10 week and 40 week to above them both. What makes that so remarkable is the downtrend the overall markets have been in.

Is it a buy here...no..not when the markets are in a downdraft like a Canadian Thermometer in November. But, we need to put together a buy list if we were to buy a lumber stock.

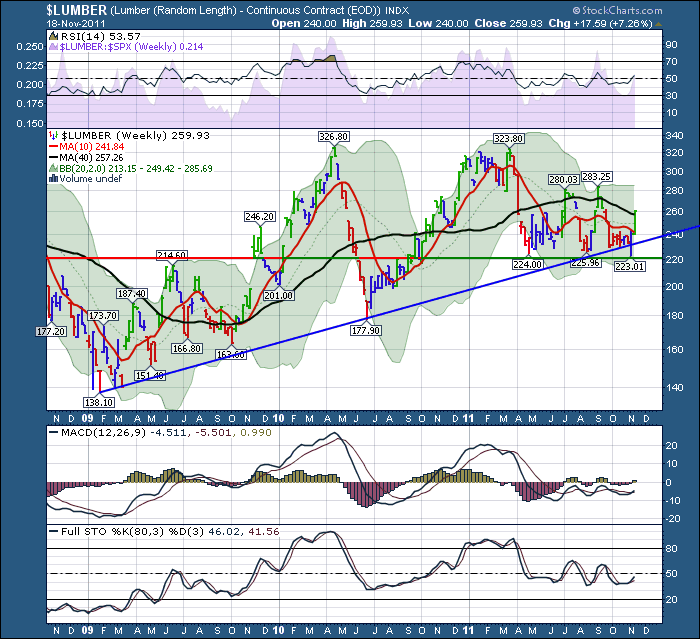

Here is the same data with Support drawn in. Look at how important the 280 level is above. On the first rise, it formed a red elder candle when it fell through. On the second rise, it was a support level for 15 or 16 weeks. Recently it was resistance on both the tops lumber made in the second and third quarters. Now we are in a sideways channel.

Before we look, what should we expect the stocks to look like?

Well, I would expect most of them ot follow the overall market lower. I hear CHinese demand is still strong, but I hear their housing industry is feeling a bit overbought currently and has pulled back. America has recovered from the ICU for housing, but still on life support.

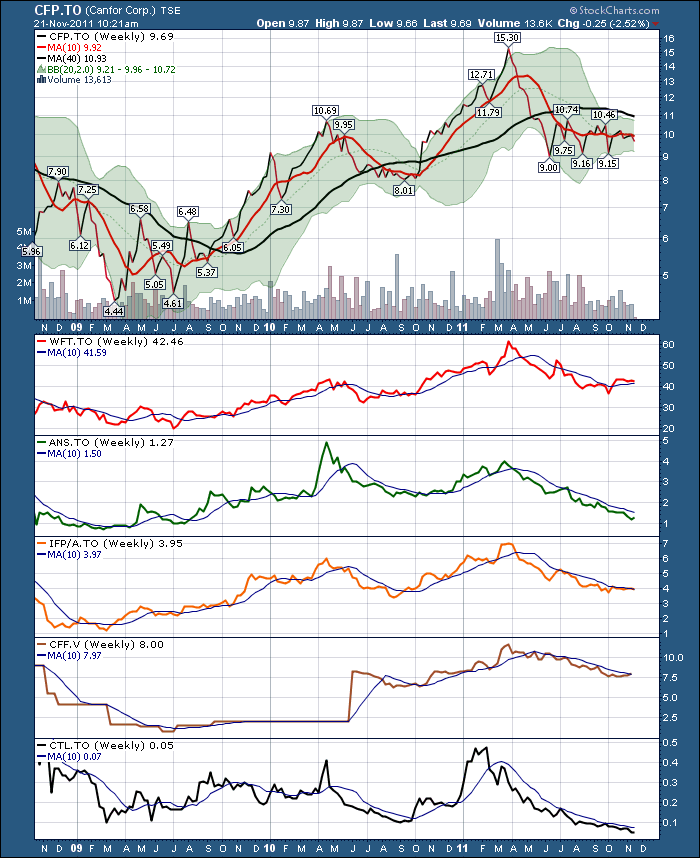

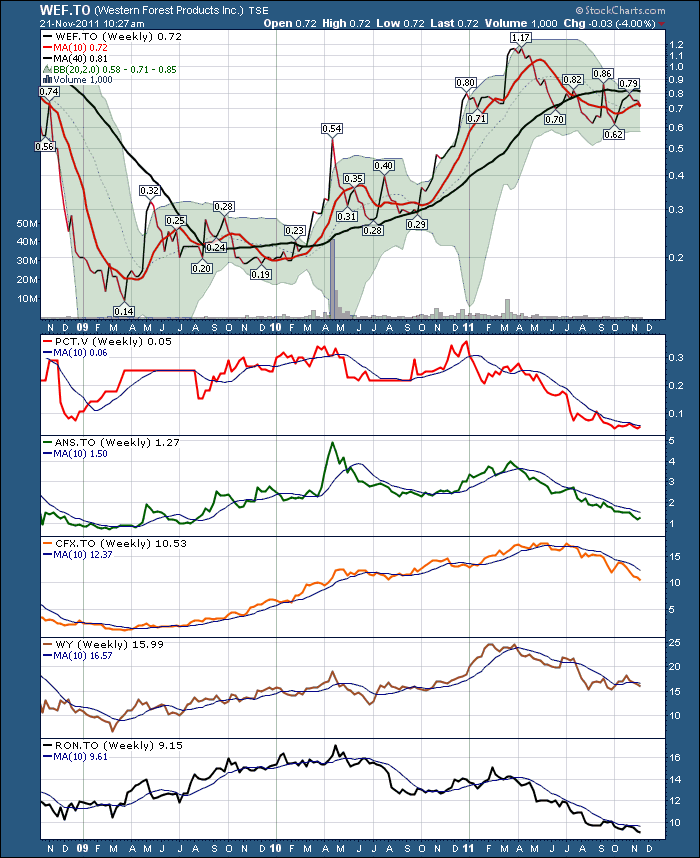

So what is pushing lumber up? New home sales have picked up moderately. Aha, that's the issue. We are looking at single family starts and we need to look at multi-family and seniors residences. They have some substantial growth currently. So do we play it through HD or Lowes? How about RONA? Or other building supply companies? I won't bother to list them all here, but lets build a couple of canadian dashboards for the stocks so we can glance at the sector quickly.

Well none look like compelling buys at this point, but there are a few oscillating above and below the 10 week lines. I would start setting some alarms on my trading platform if they start to move up. Or globeinvestor allows members to set alarms. I would probably do something like a buy point at an 11 day high. I'd need stops of course if the trades go the other way, but that simple type of buy order will keep me out of most downdrafts.

Sounds difficult? Not really, look for the highs from the previous 2 weeks on a weekly chart. If it can climb above there, I might have a trade to start managing, especially during a downdraft in the rest of the market.

This is not a recommendation of course, it is a strategy. The lumber stocks are behaving different than the overall market, which in itself is interesting. My real problem with the sector is I have not found anything with high growth of earnings or sales.

Follow the link under the Blogs heading, click on the Canadian Technician blog and hunt for the subscribe button top right, if you would like to receive this in your mailbox. Its on Stockcharts twitter and facebook.

Good Trading,

Greg Schnell, CMT