Here is yesterdays blog with new data!

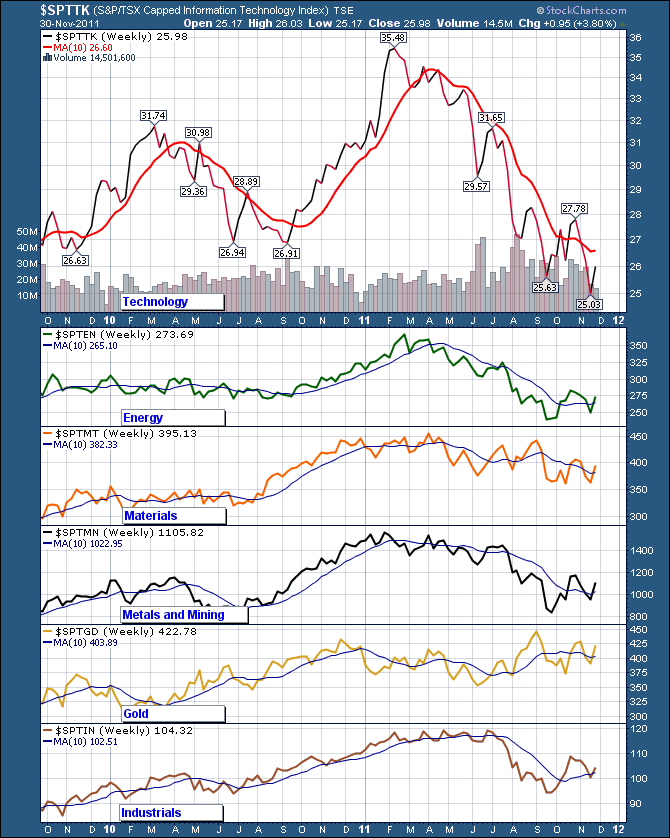

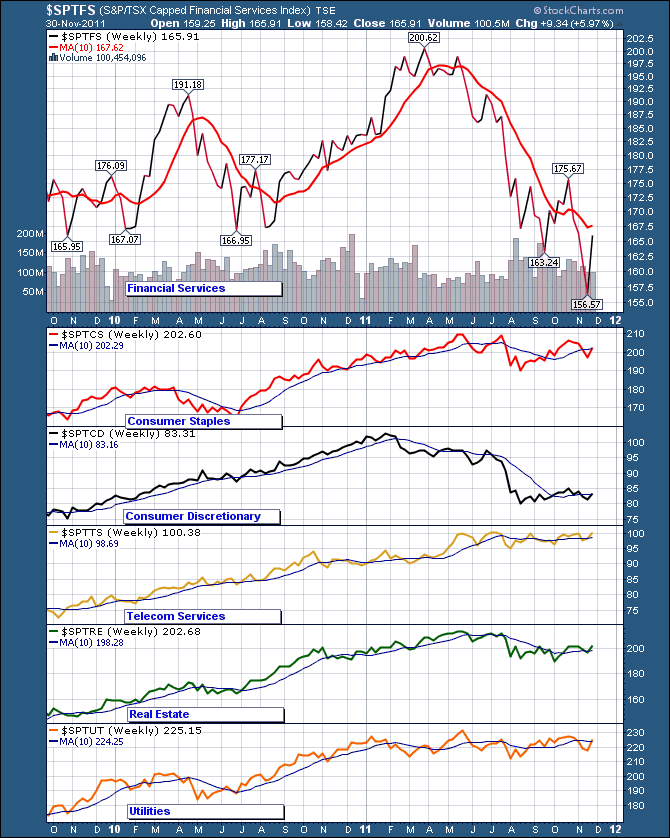

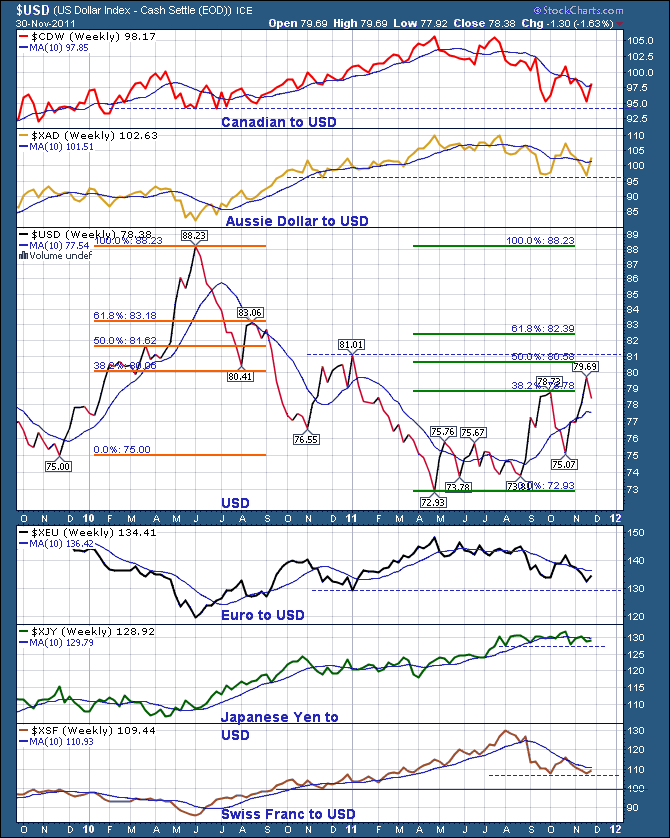

Yesterday, we blogged about how everything was below the 10 week. Well, every sector except Tech is above the 10 week today. The USD is moving down and the commodity currencies of Australia and Canada are moving up above their 10 week lines.

Here are the currencies.

Keeping it simple. When everything is above the 10 week you want to be long. My market timing signal yesterday was still teetering as to whether the market would rise. Both Monday and Tuesday gave the same readings. Just guessing, but I think I got the all clear to go long today!

I think it is interesting to note the pattern on the MACD for Fed Intervention.

The real question is can we invest on the same pattern next time?

Trivia, There were 70,000 contracts of $6 calls bought on B of A yesterday. Cost. $0.25 per share or $1.75 million USD.

What makes it so interesting is the S & P downgraded the banks last night and BAC was teetering at $5.00. More importantly, BAC hit a low yesterday even after Monday's strong up day. It was also the lowest price since the March 2009 rally. Below $5.00 and many funds would be forced to sell it as they can not own shares under $5.00.

Nice buy signal for $1.75 million! The only problem I have is I don't see one. While these contracts were not all bought by the same party, the volume action was remarkable according to Jon Najarian of optionmonster.com

Net profit today $600,000. Profit in one day.. 34%.

Good Trading,

Greg Schnell, CMT