ChartWatchers February 14, 2007 at 11:06 PM

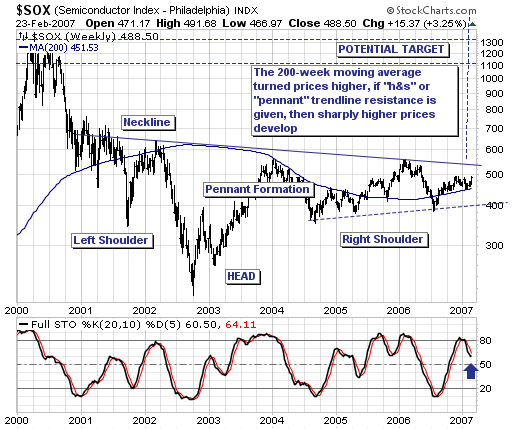

We have been very bullish the equity market for months and we continue to be. But one wild card has been the semiconductors. In order to truly sustain a nice market rally, we felt the semiconductors would need to participate. Well, we've been waiting...and waiting...and waiting... Read More

ChartWatchers February 14, 2007 at 11:05 PM

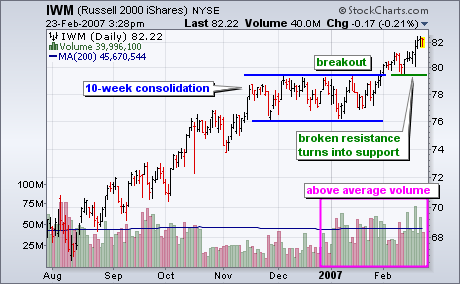

The Russell 2000 iShares (IWM) broke consolidation resistance this month and two key volume-based indicators point to strong buying pressure. The first chart shows the Russell 2000 iShares (IWM) and volume... Read More

ChartWatchers February 14, 2007 at 11:04 PM

In my 2/16/2007 article, Cash Flow Shows Wall of Worry, I asserted that the dearth of bullish Rydex cash flow was a sign that the rally would probably continue because the bulls were still not committing in a big way... Read More

ChartWatchers February 14, 2007 at 11:03 PM

The technology rally from July-to-present has occurred without the participation of the Semiconductor Index ($SOX)... Read More

ChartWatchers February 14, 2007 at 11:02 PM

Someone, we honestly don't know who exactly, sent us the following feedback earlier this week. It completely blew us away: "I'm astonished at how customer friendly your service, website, and daily charts are. Thank you, thank you, thank you... Read More

ChartWatchers February 14, 2007 at 11:01 PM

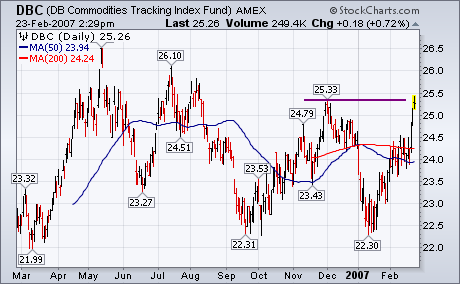

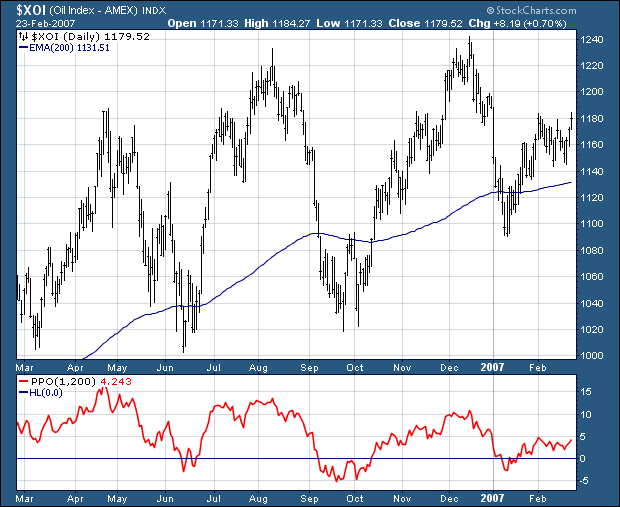

Just when it seemed like inflation was on the wane, another rally in commodity markets suggests just the opposite. [This week's unexpected jump in the core CPI also caught the market's attention]... Read More

ChartWatchers February 14, 2007 at 11:00 PM

Mary W. writes "I'd like to see how much above or below the 200-day moving average a stock currently is... Read More

ChartWatchers February 03, 2007 at 11:06 PM

Money generally rotates from one sector to another. Identifying the rotation early in the cycle can make a big difference in trading successfully... Read More

ChartWatchers February 03, 2007 at 11:05 PM

The S&P Small-Cap iShares (IJR) hit a new all time high this week and led the market higher over the last six days... Read More

ChartWatchers February 03, 2007 at 11:04 PM

Timer Digest has ranked Decision Point #1 Bond Timer for the 52-week period ending 1/26/2007. We were also ranked #3 Bond Timer for the year 2006, and #5 Bond Timer for the last five years... Read More

ChartWatchers February 03, 2007 at 11:03 PM

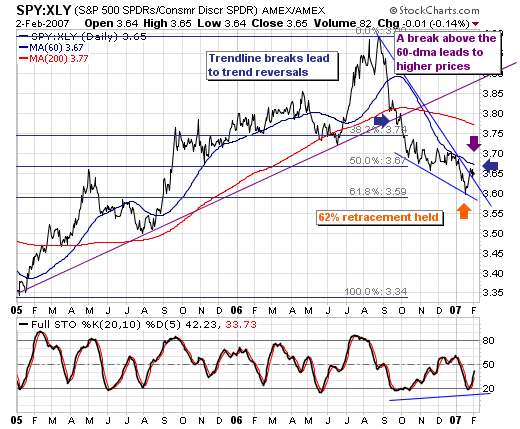

From our vantage point; the S&P 500 SPDR (SPY) is poised to outperform the Consumer Discrectionary SPDR (XLY) in all-time frames (short-intermediate-long), with a new highs expected to be reached in the late-2007 to 2008 time frame... Read More

ChartWatchers February 03, 2007 at 11:02 PM

SERVER ROOM PROGRESS REPORT - We've had a bit of a set back on the construction front for our new server facilities. The building management team veto'd some of our construction plans at the last second (Chip was livid) and we are redesigning some things as a result... Read More

ChartWatchers February 03, 2007 at 11:01 PM

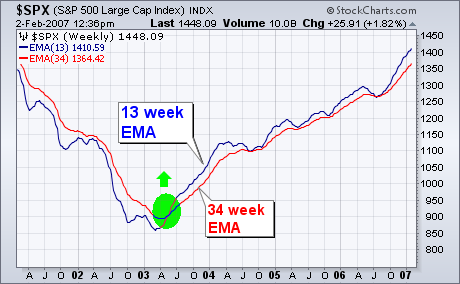

Last July, I reviewed a moving average technique that used weekly exponential moving averages. [I first described this system in October 2005]. I'm revisiting it today because it continues to do remarkably well. And I'd like to suggest expanding its usefulness... Read More