The S&P Small-Cap iShares (IJR) hit a new all time high this week and led the market higher over the last six days. Just a few weeks ago, this group was lagging and relative weakness hung over the market The ETF broke above its December high and this is a vote of confidence for both small-caps and the market as a whole.

Unfortunately, this vote of confidence from small-caps is overshadowed by a no-confidence vote from techs. Like small-caps, tech stocks typically have higher betas, higher volatility and higher risk. Investors are risk loving when these two groups lead and risk averse when these groups lag. Small-caps are doing their part with a breakout and new highs, but techs are not keeping up and investors are getting choosy.

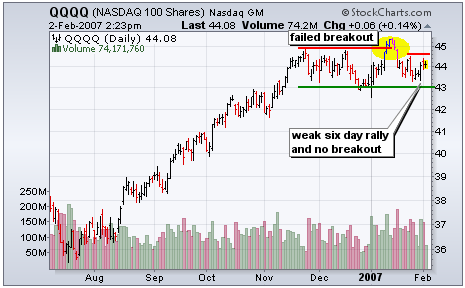

The Nasdaq 100 ETF (QQQQ) broke resistance on 11-January, but failed to hold this breakout and moved right back into the December trading range. The broader non-tech portion of the market rallied this week with the S&P Small-Cap iShares (IJR), the Dow Diamonds (DIA) and the S&P 500 ETF (SPY) hitting 52-week highs. In contrast, QQQQ could not even break above last week's high at 44.47. This no-confidence vote casts a shadow over the broader bull market and I will be watching key support at 43 quite closely.