We have been very bullish the equity market for months and we continue to be. But one wild card has been the semiconductors. In order to truly sustain a nice market rally, we felt the semiconductors would need to participate. Well, we've been waiting...and waiting...and waiting. Finally, a critical technical move was made this week. Semiconductors got the fundamental lift from Analog Devices (ADI) which said that January business conditions were improving. That was music to technology investors' ears. We've seen the fundamental news before, however. We wanted to see price action follow. On Thursday, price action followed in a big way. We had two technical issues to resolve on semiconductors. First, we needed to break a recent downtrend line spanning the last thirteen months. That issue was resolved on Thursday, as can be seen below (Chart 1):

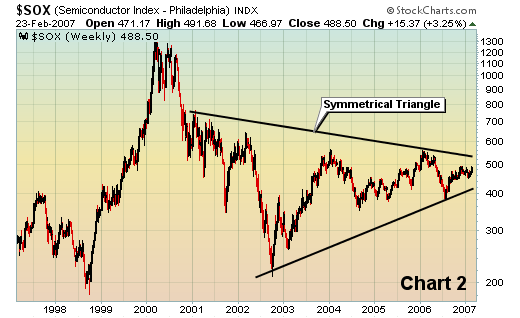

There still remains a longer-term technical picture that must be resolved. Yes, the intermediate-term break of resistance was bullish this past week. But we will need a catalyst to break the symmetrical triangle that has developed over the last six years (Chart 2):

KLA Tencor (KLAC) added a little bullish semiconductor fuel Thursday after hours as they said they were "accelerating" their $750 million repurchase program and authorized another 10 million shares to be repurchased. That's a serious vote of confidence from the Board of Directors and shouldn't be ignored. However, we haven't seen the long-term symmetrical triangle break. Money speaks louder than words. While the break of the recent downtrend line was quite bullish, semiconductors still have much work to do.

We favor the group at this time and expect their contributions to be felt for weeks and months as the bull market continues to gain momentum.