From our vantage point; the S&P 500 SPDR (SPY) is poised to outperform the Consumer Discrectionary SPDR (XLY) in all-time frames (short-intermediate-long), with a new highs expected to be reached in the late-2007 to 2008 time frame. Our reasoning is such:

-

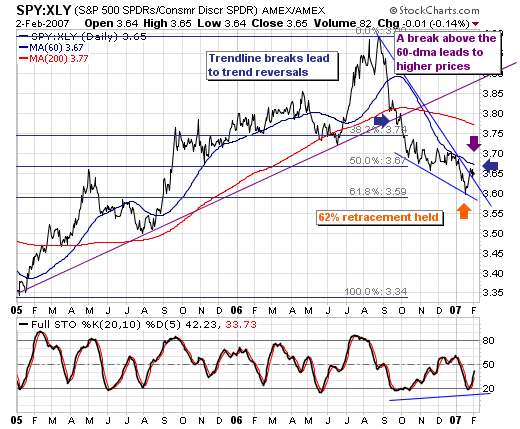

First, the fibonacci 62% retracement level was obatined, and indeed did hold as it should during a bull market.

-

Secondly, a bullish declining wedge is confirmed, of which steep trendline resistance was broken. Prices are consolidating short-term, but given the postive 20-day stochastic divergence...the path of least resistance is higher.

-

Thirdly, if the 60-day moving average is broken, then we would expect to see mean reversion in the least to the 200-day moving average. This will be next "large fulcrum point" upon which we can either confirm or deny our thesis of new highs dependent upon whether prices breakout above this level or not.

-

And lastly, even if we are wrong in our long-term assessment and prices are headed lower, we shall have ample time and an optimal entry point as prices "fail" to brekaout above the 200-day moving average level.

How to trade: One can either buy SPY and sell short XLY in equal dollar amounts; or, one can focus in upon shorting the consumer discretionary stocks given the general SPY overbought conditions. We are focusing in upon shorting the consumer discretionary stocks; and in particular...are looking for a high in the homebuilders after they have retraced quite some distances of their declines. Also, we have put on a "long energy/short consumer discretionary" trade that is proving to be quite profitable.