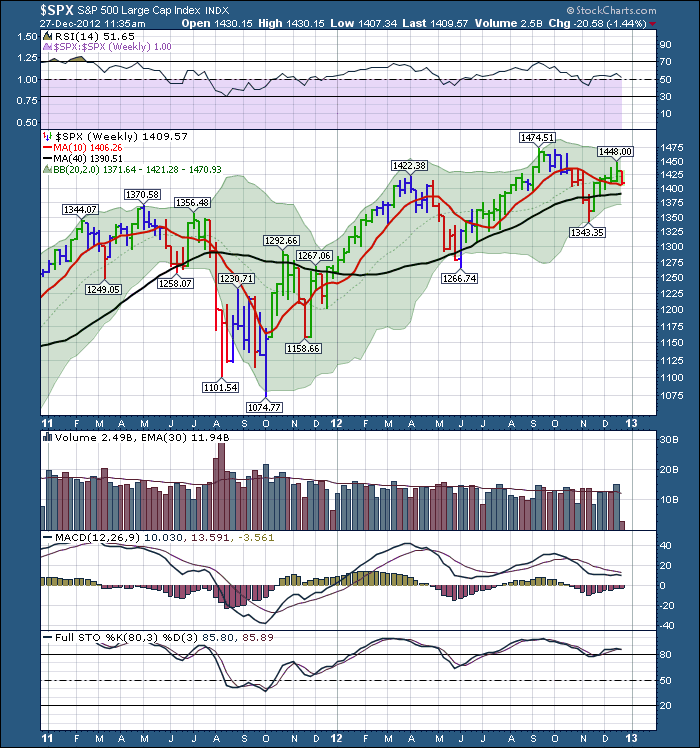

The Canadian Technician December 27, 2012 at 03:57 PM

Here is the $SPX. A few weeks I wrote a note about how the globe was turning bullish, and we should watch closely. If the world does break out, its time to get long. That blog can be found here. Bullish. I would encourage you to read the long blog... Read More

The Canadian Technician December 22, 2012 at 09:18 AM

The Canadian Energy industry has been hard hit. We are close to finding a bullish breakout. This would be important to watch for. This chart would be a good indicator of a conversion to a bullish trend... Read More

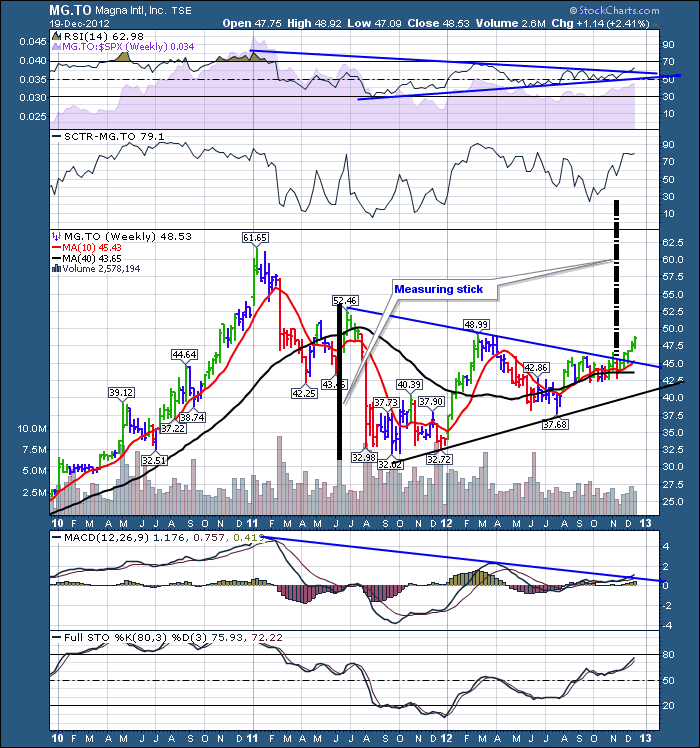

The Canadian Technician December 20, 2012 at 12:20 PM

Magna makes car parts for the OEM's. It trades in the USA as MGA. It has been a difficult 2 years for Magna. But the bright lights are hitting the stock. The price action is breaking out of a big pennant. The measuring stick in black points to significant upside... Read More

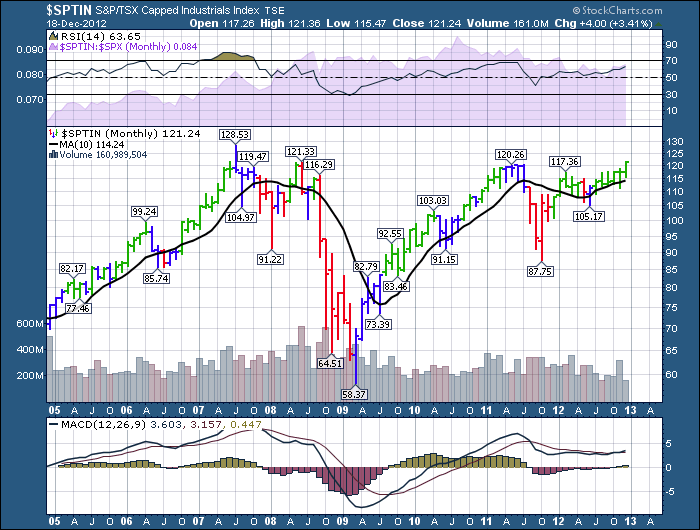

The Canadian Technician December 19, 2012 at 05:16 AM

There is an old saying that when you are making new highs you are not in a down market. Sometimes the bad news can really sound overwhelming. The stock market can be a leading indicator and may be starting to price in a pick up in the second half of 2013... Read More

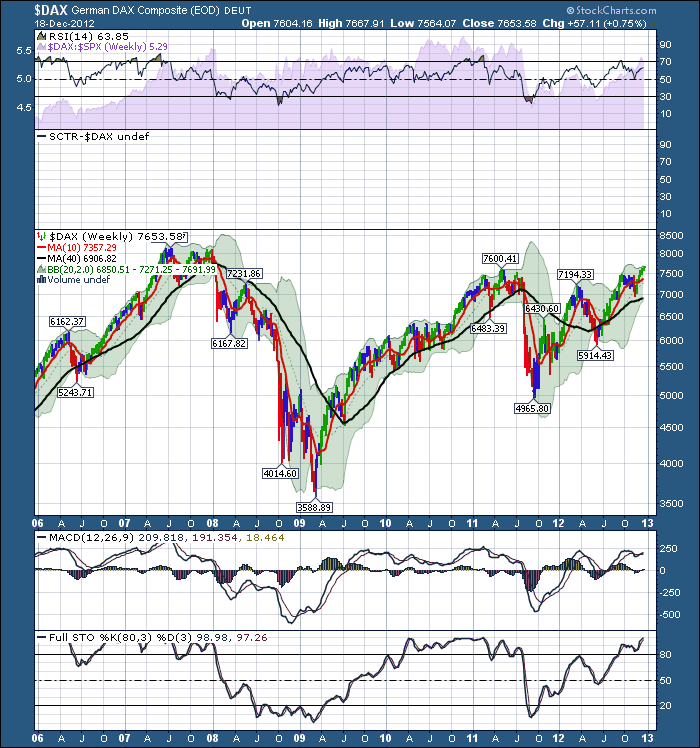

The Canadian Technician December 18, 2012 at 09:46 AM

The German $DAX has broken out to new 5 year highs. After meeting resistance at the 2011 top, it has now cleared that hurdle and looks to be moving higher with the rest of the globe. You can see on the chart how the 7500 level was providing some resistance... Read More

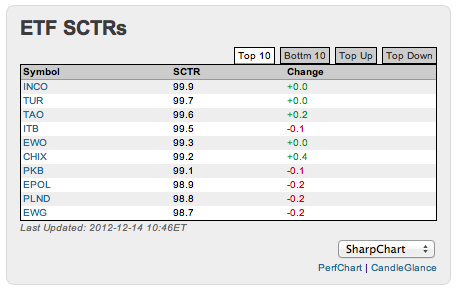

The Canadian Technician December 14, 2012 at 03:32 PM

I received this question today from a regular reader. It's a great question! Greg, I read your articles regularly - Arthur's and John's articles as well. Thanks for the great charts and interpretation of them. It has really helped me over the last few years... Read More

The Canadian Technician December 14, 2012 at 04:42 AM

I like this chart when it is going up. Today scares me a bit. This is my wall of worry chart. As you can tell, it is my comment or mood board. Let's call it overannotated. I try not to delete stuff even if I'm wrong. Today thats a good thing... Read More

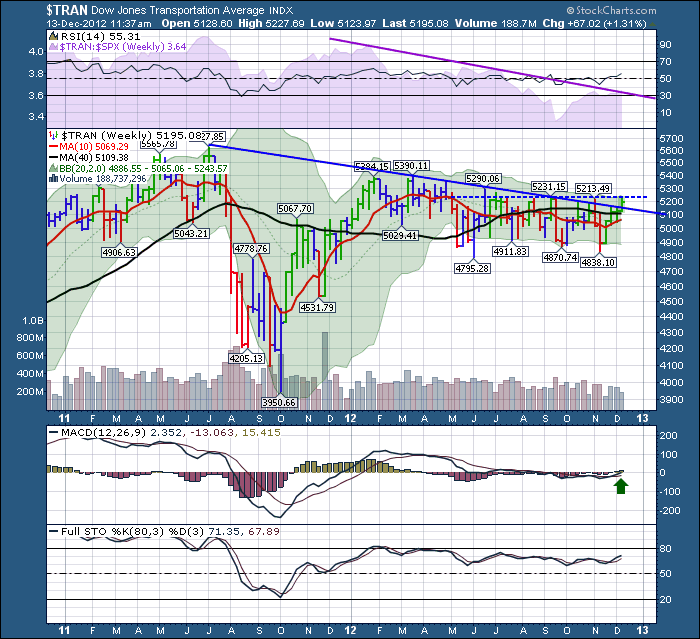

The Canadian Technician December 13, 2012 at 03:39 PM

Here is the chart of the transports. The Three major subsectors are $DJUSRR, $DJUSTK, $DJUSAR. We have been stymied waiting for these transports to break out. The Transports topped shortly after the rest of the world stock markets topped out... Read More

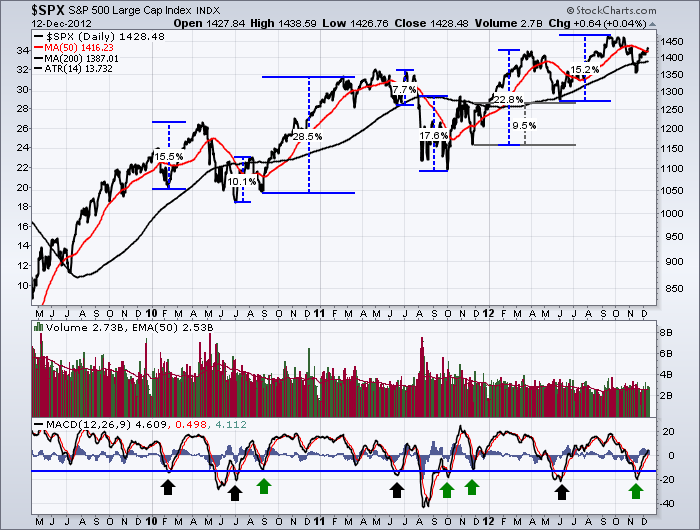

The Canadian Technician December 12, 2012 at 11:22 AM

Now that I have your attention, let me back it up with facts. It doesn't do us any good to look in the mirror and say that we have been in a big bull market since December 2012 when we have missed the move... Read More

The Canadian Technician December 11, 2012 at 04:19 AM

The chart below is not of the $SPX. It is not Gold or Crude Oil, or a Bank ETF. What is it? Look at all the confirmation points. Let's go through them. First, all the major highs were within days of the $SPX tops... Read More

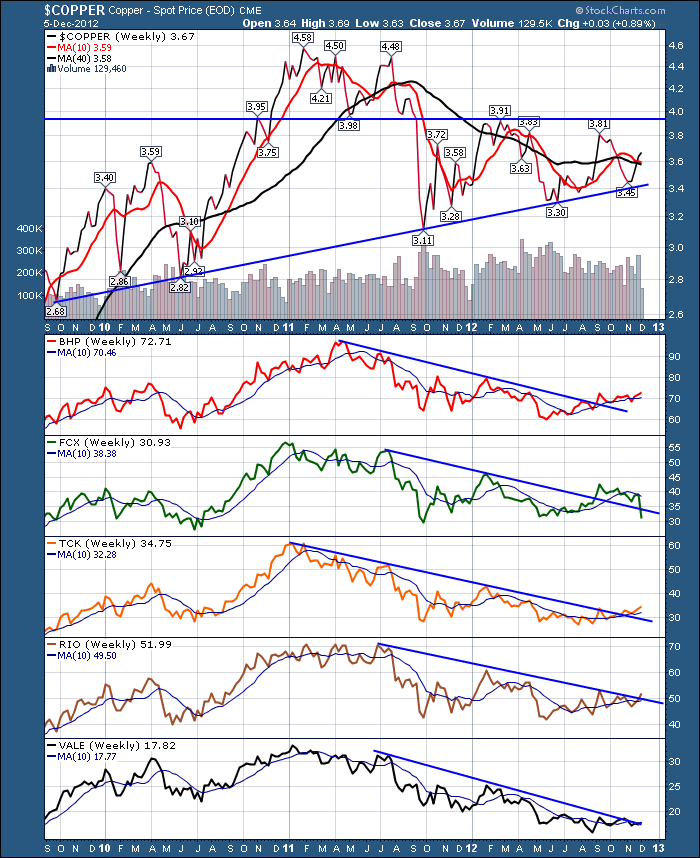

The Canadian Technician December 06, 2012 at 01:28 PM

My blog earlier this morning generated some discussion, so I thought I would top it up. What about that move in FCX? I always like to watch FCX from a copper standpoint. FCX gets more blurred as a copper monitor as $GOLD goes higher. However, $COPPER is the real deal... Read More

The Canadian Technician December 06, 2012 at 04:35 AM

Finally, The $SSEC market catches a break. Hopefully it can become a full blown breakout. Love that. My blogs over the last few months have been subtly pointing to Shanghai, looking for a turn which should help spur commodities globally... Read More

The Canadian Technician December 03, 2012 at 03:39 PM

Some interesting charts showing up in the materials sector. Here is one I like. This one has so many positive technical Queues I like. Here is a link to the Gallery view. Is there anything not to like? Gallery The materials are performing stronger... Read More