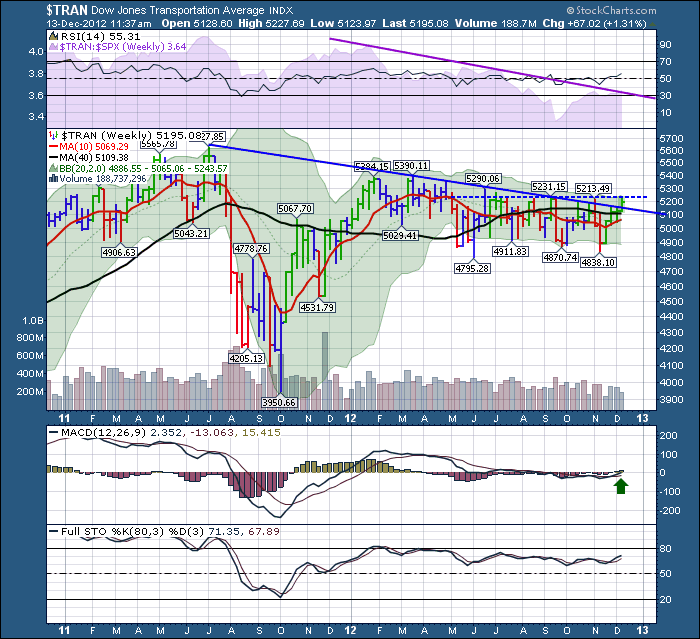

Here is the chart of the transports. The Three major subsectors are $DJUSRR, $DJUSTK, $DJUSAR.

We have been stymied waiting for these transports to break out. The Transports topped shortly after the rest of the world stock markets topped out. Most global stock markets made their tops in March of 2011. The Transports made it up for two more highs in May 2011 with the US market top and the $TRAN made one last attempt in July as seen below. So the transports have followed the world order lower, but with no downward enthusiasm in the last year. Really a sideways trading range, with a downward sloping top.

As I pointed out yesterday, the MACD line has entered positive ground for the first time since the spring. Looking for green shoots in December!!! As I sit with a fresh new blanket of snow in the back yard, it seems early.

But it is travel and tourism season, it is FDX and UPS season, it is containers from Asia season and it is the season for Automakers to start focussing on 2014 models.

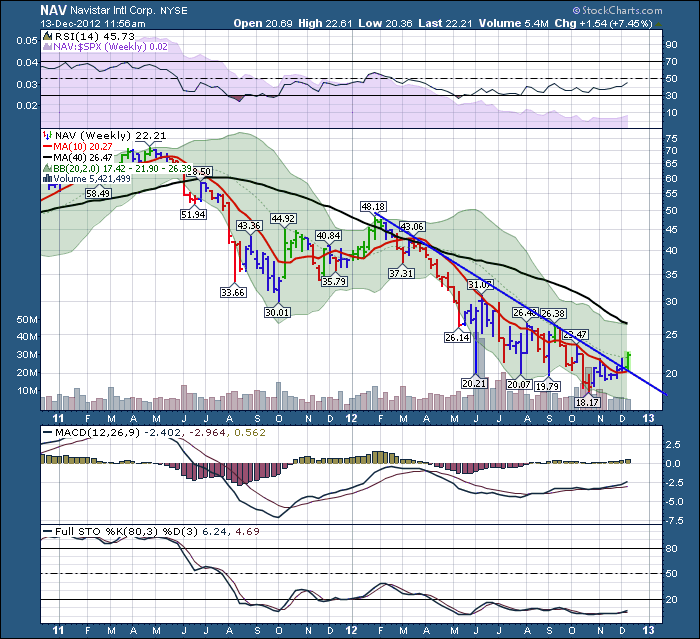

I had a scan running yesterday that brought up CLNE with a burst of volume. The trend in WPRT or WPT.TO looks promising. Here is Navistar.

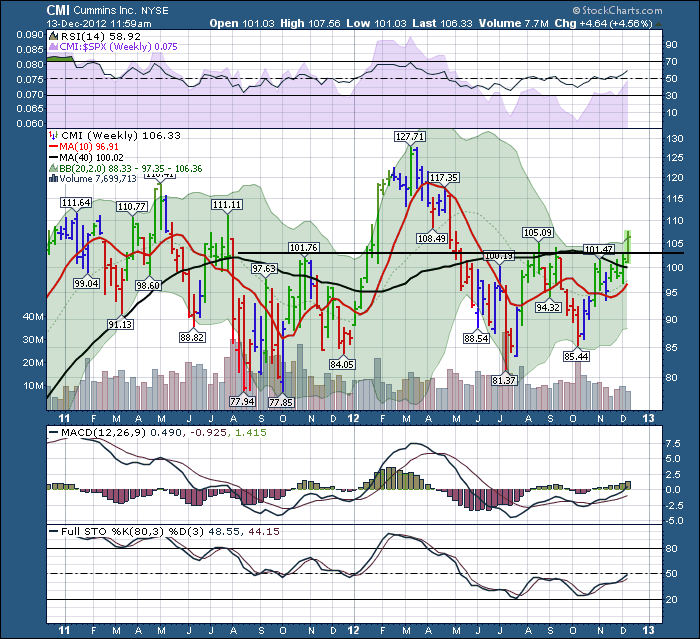

Here is Cummins Engine.

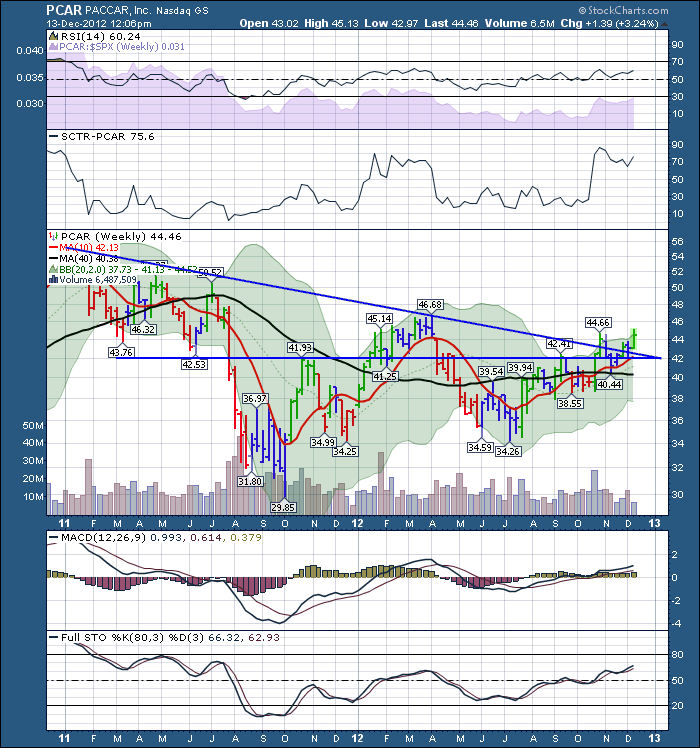

Here is Paccar which owns Peterbilt and Kenworth.

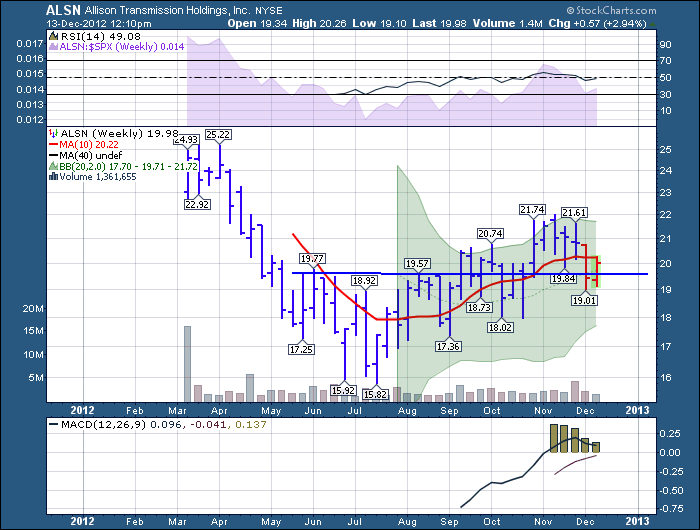

Here is ALSN transmission. Not quite bullish yet.

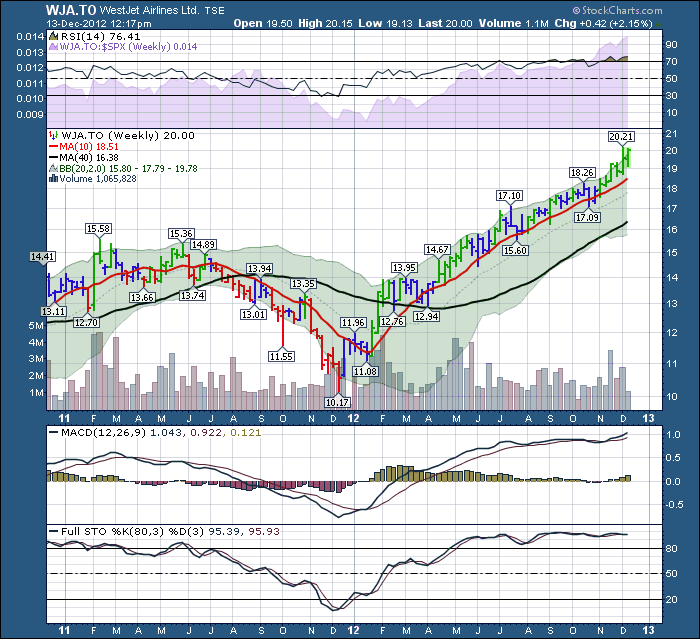

So as the Canadians get on Westjet to warmer climates.

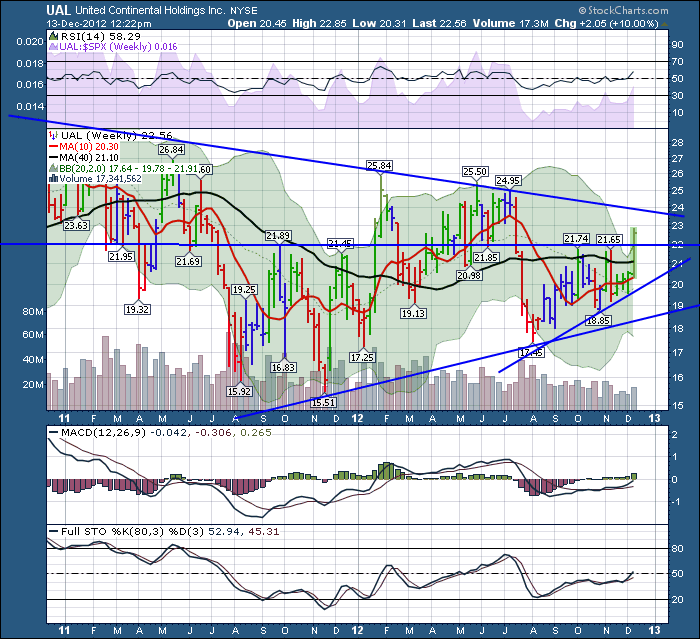

As the Americans get on United Continental.

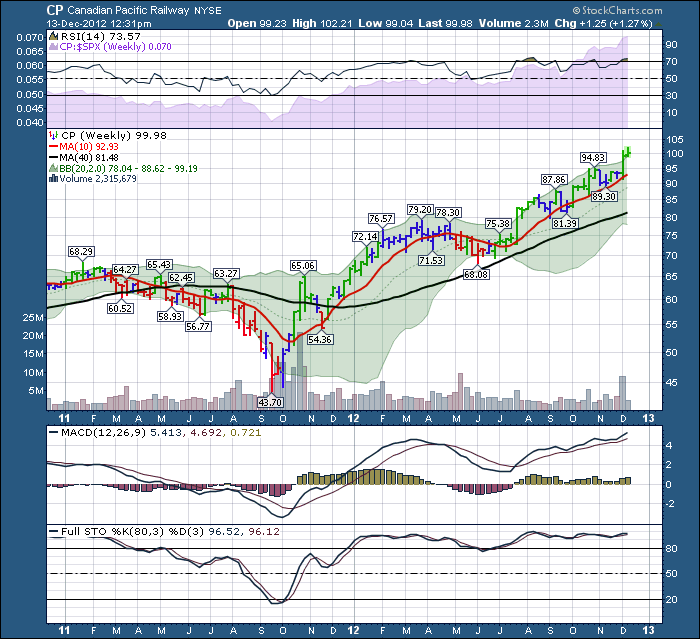

CP Rail.

Things and people are starting to, I repeat, are starting to move. But when charts are breaking trendlines, thats why technicians find optimal entry points.

I hope you are finding some in here as well.

DON'T Forget To Register For SCU. Stockcharts University. The link is on the home page on the right. Time to make some money if this market is going to start moving!

Hey, if you have comments about my blog, feel free to comment. Both positive and negative. I love getting the feedback.

Oh... can't resist! All Aboard!!

Photo: Attribution to CP Rail.

Good Trading,

Greg Schnell, CMT.