Magna makes car parts for the OEM's. It trades in the USA as MGA.

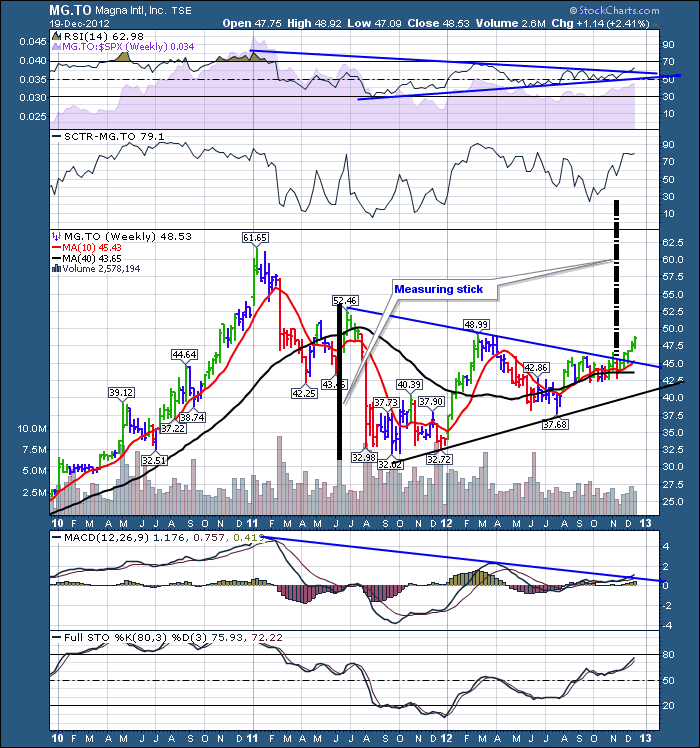

It has been a difficult 2 years for Magna. But the bright lights are hitting the stock. The price action is breaking out of a big pennant. The measuring stick in black points to significant upside.

Magna recently popped out the top side of the pennant. We can expect a little horizontal resistance at the spring highs of $48.99. The Black Measuring stick target is to break out to new all time highs. I'll paraphrase Tom McClellan here. When you are looking at a base don't try to find the top. There is another day for that. It's an 18 month pennant. We'll try to look for the top over roughly the same time frame.

We can see just about every textbook recommendation on this chart.

The MACD breaking above a trendline. MACD turning up near zero and moving above zero. Full sto's trying to break through 80. RSI breaking above the trendline. RSI recently held support at 50 which is a great sign. Purple SPURS area is breaking out from a downsloping trendline and appears to be ready to take out the annual high in relative strength. Volume drying up as the pennant is formed. We would like to start seeing volume hitting the stock now.

Just some footnotes.

Its only 45 days to the Calgary SCU. Dallas and Orlando are coming up fast. Don't forget to enroll. Follow this link to find the Stock Charts University.

As we near the holiday season, I want to wish everyone happy holidays today so I catch most of the readership. Some will start travelling today as the kids wrap up school and families continue travelling over the next 2 weeks. I'll be travelling between Christmas and New Years. Back in the saddle around the 7th. I receive so many nice comments over the year. Lots of ideas, lots of responses to the posts. Thank you for taking the time to write. Hopefully you are finding good ideas in the interpretation of technical analysis. Wishing you all a prosperous New Year...

Good Trading,

Greg Schnell, CMT