ChartWatchers February 29, 2020 at 12:19 AM

It was a tough week for investors following last week's sharp drop in the markets, particularly as many individual stocks sold off even more than the averages... Read More

ChartWatchers February 28, 2020 at 08:59 PM

The selling we saw this week was one for the ages. Yes, I've been extremely bullish for a long time and it's primarily because of the economic environment... Read More

ChartWatchers February 28, 2020 at 07:50 PM

Are the markets oversold? Yes. Is it reasonable to expect that next week will see the markets recover at least a bit after this week's mayhem? Absolutely... Read More

ChartWatchers February 28, 2020 at 06:39 PM

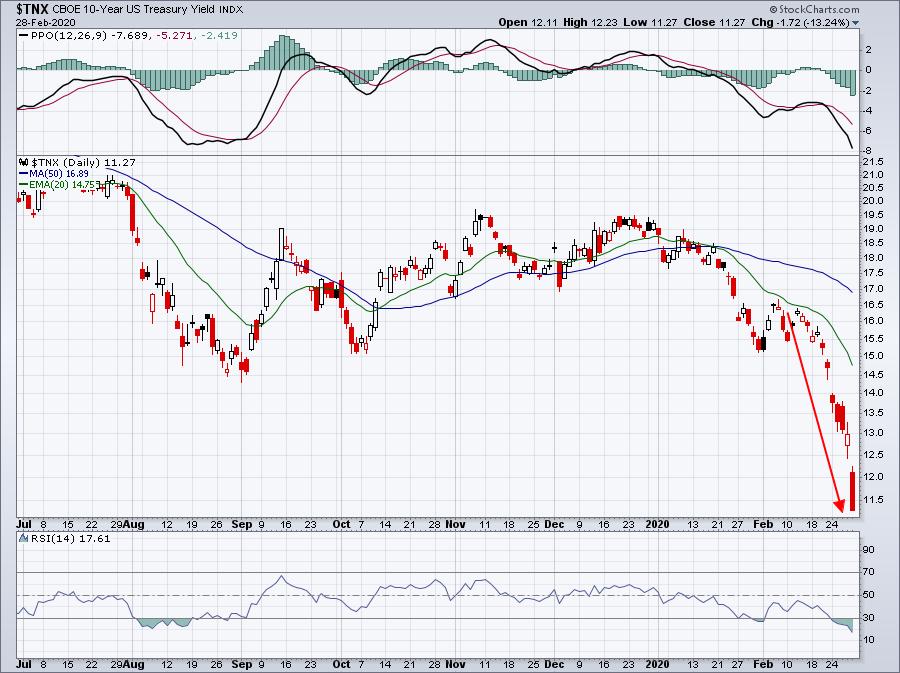

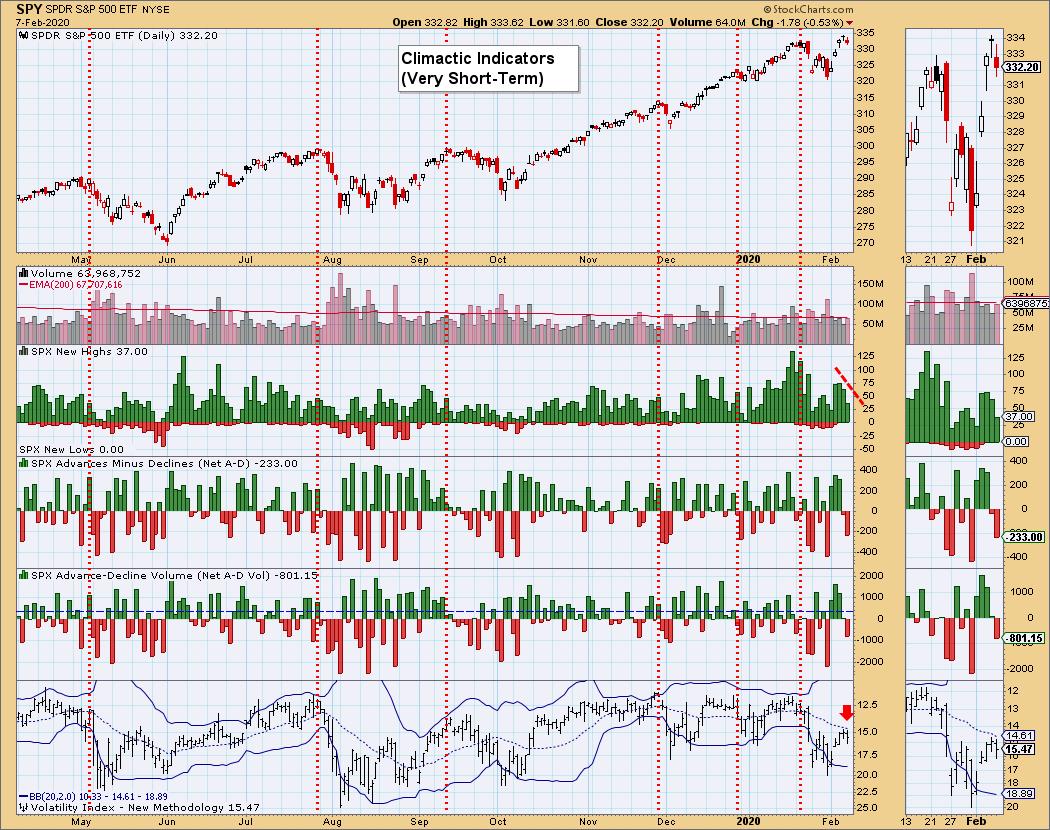

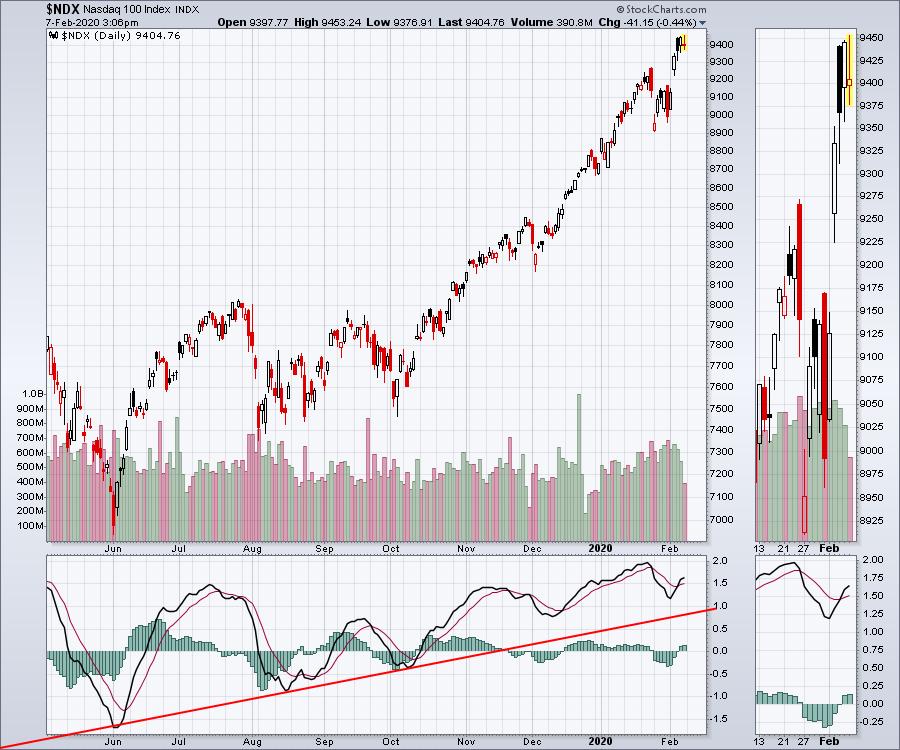

It's been quite a week, but the charts are starting to look to me as if a bottom is close at hand. In order to identify one, I look at a couple of factors. First, are there any signs of a one or two bar reversal pattern? Take Chart 1, for instance... Read More

ChartWatchers February 28, 2020 at 06:00 PM

What a week... Where do I start??? Let's just say that this was not a boring week for the markets...... at all! When markets go crazy and swings get out of control, I have learned to step back and look at the bigger picture - and keep it simple... Read More

ChartWatchers February 21, 2020 at 08:06 PM

With gold surging again today to another seven-year high, gold miners are having an even stronger day percentage-wise. And are nearing a major upside breakout... Read More

ChartWatchers February 21, 2020 at 07:59 PM

Earnings season has come and (mostly) gone, with all of the major companies reporting Q4 numbers. The consensus is that, overall, earnings were strong, as witnessed by record levels in the market... Read More

ChartWatchers February 21, 2020 at 06:58 PM

This week's big winners were $GOLD and TLT, though the Dollar also did fairly well. Carl will be writing about these three (as well as Oil) in this week's edition of the "DecisionPoint Weekly Wrap" on DecisionPoint... Read More

ChartWatchers February 21, 2020 at 05:50 PM

Before I tell you what we've just done, I need to issue a formal apology. To your family, your friends, your co-workers - everyone in your circle - I am sorry... Read More

ChartWatchers February 21, 2020 at 04:42 PM

After falling for over a year, the Regional Bank ETF (KRE) finally got its mojo back in the fourth quarter of 2019 and broke out to new highs. The ETF then became overextended in mid December and fell back to the 200-day SMA here in February... Read More

ChartWatchers February 21, 2020 at 02:07 PM

It has been an unbelievable run in the large-cap tech stocks, as the portfolio managers have been moving their bets into a smaller and smaller circle of names. After what could only be described as euphoria, 10% annual growers have had their stocks wildly bid... Read More

ChartWatchers February 14, 2020 at 09:54 PM

This week's federal court decision to allow the T-Mobile (TMUS)/Sprint (S) merger to go through has reignited select areas of the market that will be positively impacted by the boost in 5G adoption in the U.S... Read More

ChartWatchers February 14, 2020 at 07:50 PM

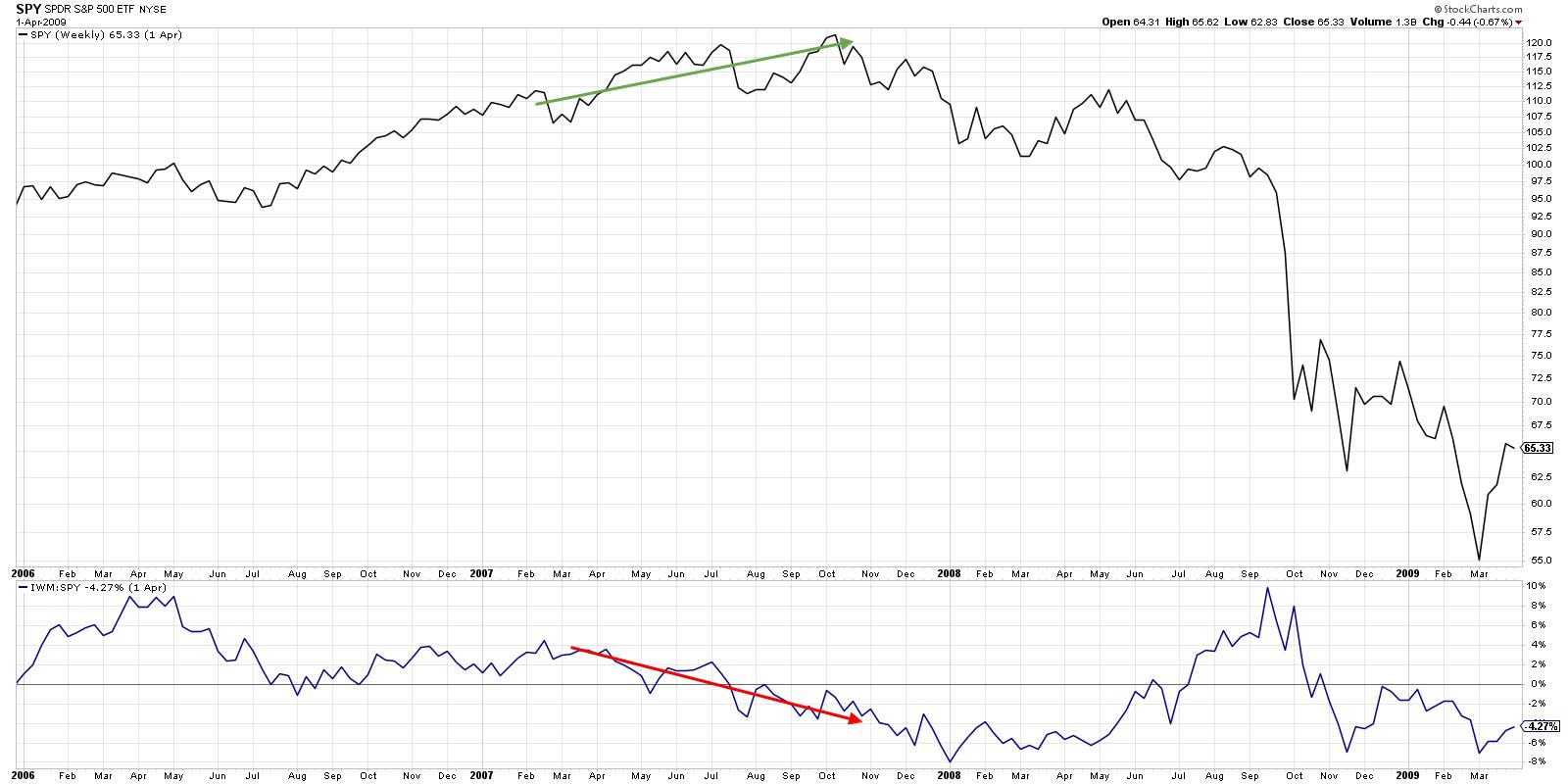

"How come small-caps aren't doing better when the market's making new highs?" I've heard some version of this question many times over the last couple years, starting with the emergence of the FAANG trade... Read More

ChartWatchers February 14, 2020 at 07:27 PM

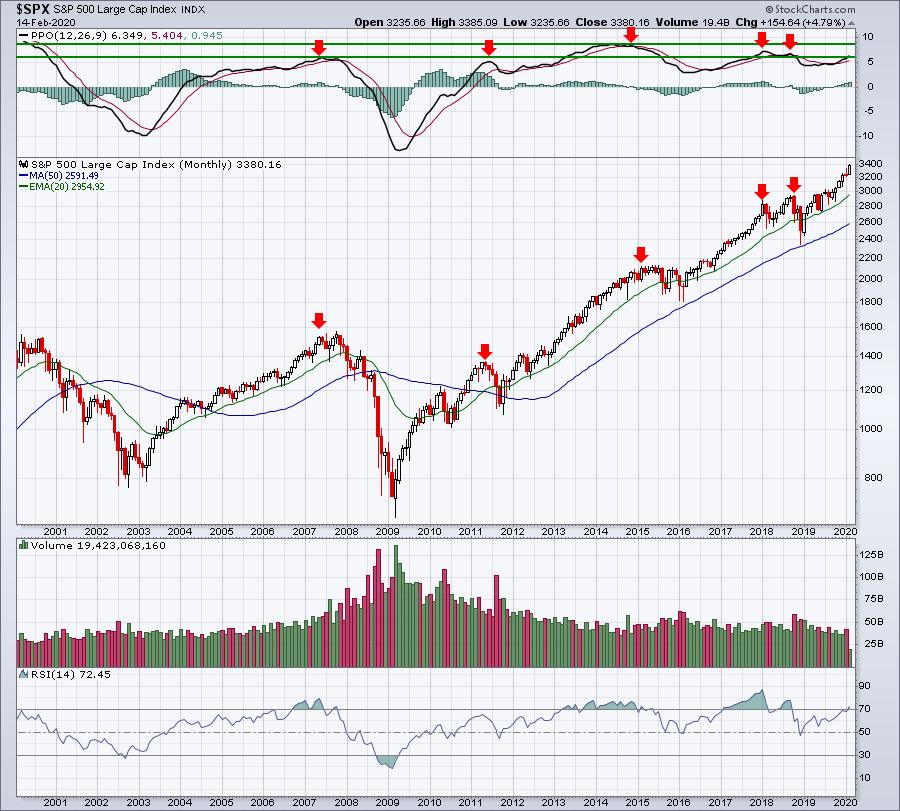

Embrace this rally. As far as bull markets go, this is truly the Perfect Storm... Read More

ChartWatchers February 14, 2020 at 06:30 PM

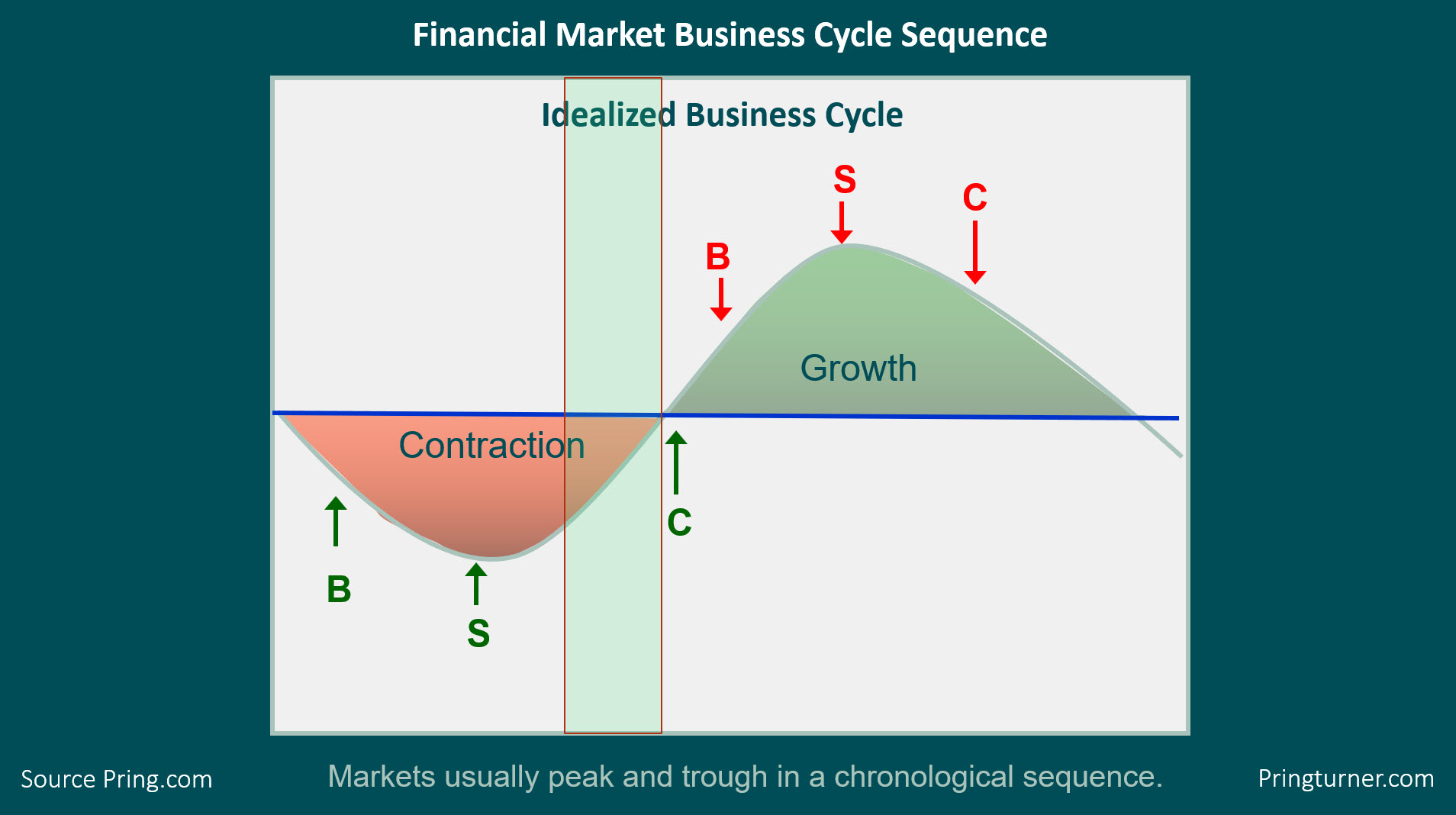

Back in December, I wrote an article pointing out that the business cycle was nothing more than a set series of chronological sequences... Read More

ChartWatchers February 14, 2020 at 05:30 PM

As we were walking out of a meeting the other day, my good friend Dave Keller (our Chief Market Strategist here at StockCharts) said something that momentarily floored me. It made me stop what I was doing, zoom out mentally and really reflect on the past few months... Read More

ChartWatchers February 14, 2020 at 02:05 PM

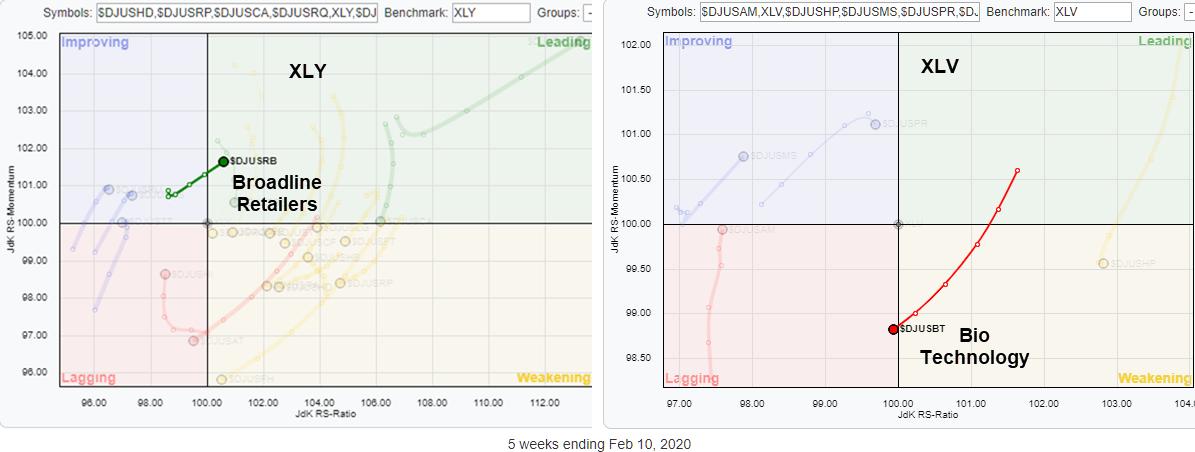

Two weeks ago, I wrote a ChartWatchers article titled "RRG Suggests Aggressive Trade Setup for XLY vs. XLV... Read More

ChartWatchers February 07, 2020 at 10:34 PM

The market has shown incredible resiliency lately, shaking off the coronavirus epidemic, any negative economic reports, an impeachment trial and other developments that one would think could derail stocks... Read More

ChartWatchers February 07, 2020 at 08:06 PM

It's been some time since I revisited my sentiment charts. I used to do a weekly sentiment update on MarketWatchers, but since then I haven't written or talked about sentiment much, so it is long overdue... Read More

ChartWatchers February 07, 2020 at 06:00 PM

My Tuesday message showed a number of travel and tourism stock groups with heavy exposure to China finding support near moving average lines; or regaining them. Today's message shows those same groups under pressure again today. Let's start with airlines... Read More

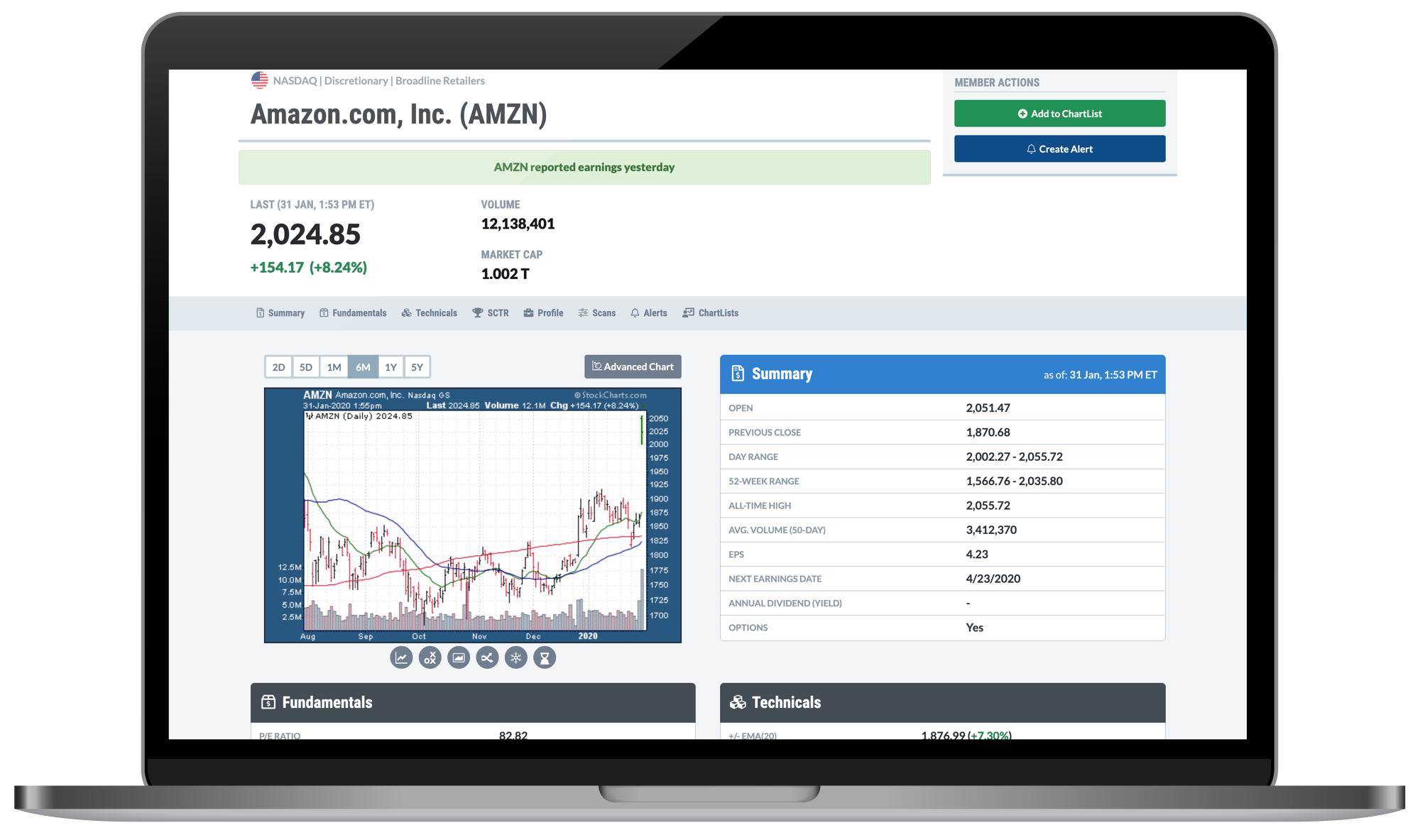

ChartWatchers February 07, 2020 at 05:32 PM

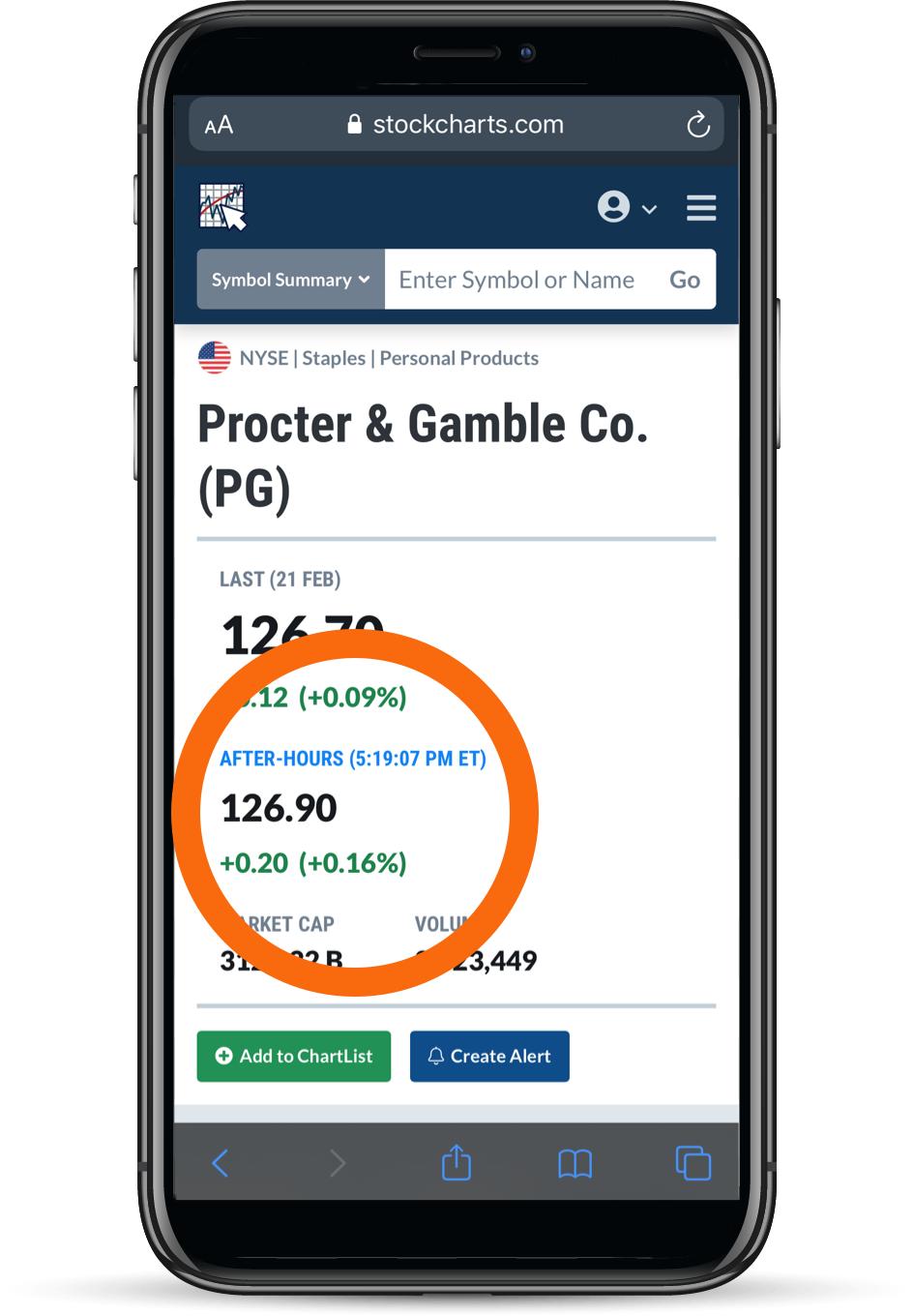

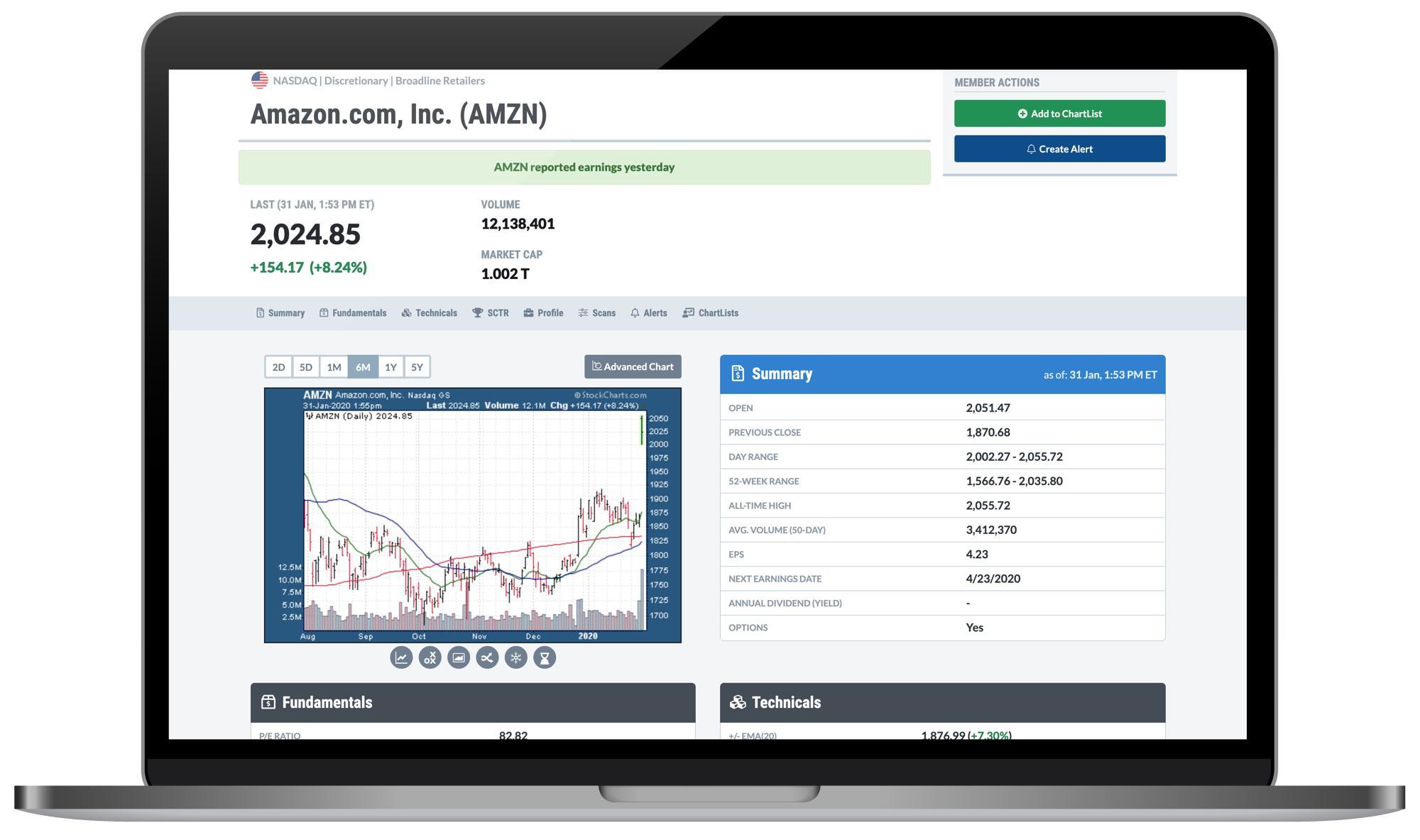

"This new Symbol Summary is a game changer!" ----- "Holy smokes! The new Symbol Summary page is amazing. Like WOW. StockCharts is now truly my one-stop shop for everything stock related." ----- "I just wanted to tell you how much I am enjoying the new Symbol Summary feature... Read More

ChartWatchers February 07, 2020 at 04:10 PM

There are three ETFs covering the defense and aerospace group and all three recorded new highs... Read More

ChartWatchers February 07, 2020 at 03:37 PM

While it is only a week, it was a crackin' bounce in the high-flyers club. The bulls trotted a trail of optimism that the drive-by-shooting caused by the coronavirus was a big buying opportunity on the back of more Fed and Chinese liquidity injections... Read More

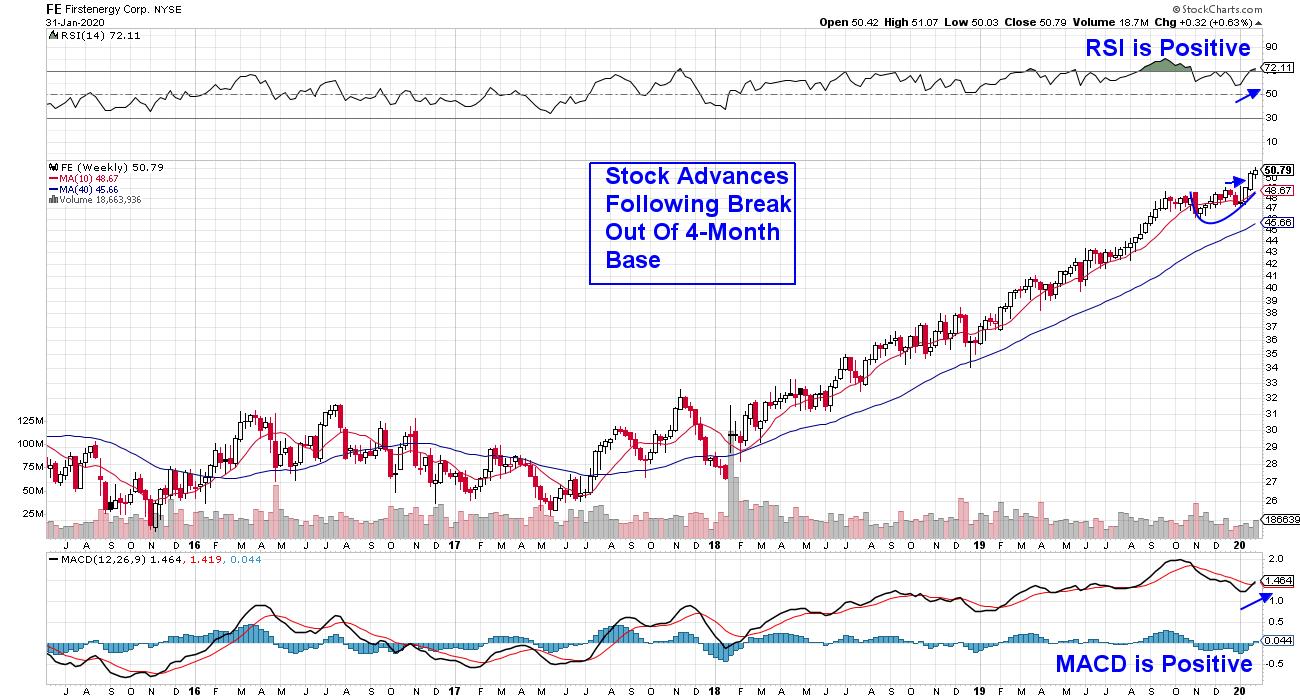

ChartWatchers January 31, 2020 at 10:19 PM

Relative strength. It seems easy enough. Wall Street meets with management teams continuously throughout the year (except during quiet periods). Analysts evaluate not only business strategy, but also business integrity... Read More

ChartWatchers January 31, 2020 at 09:44 PM

The broader markets took it on the chin today as news of a sharp increase in the number of coronavirus cases brought fear-induced selling across most areas... Read More