The broader markets took it on the chin today as news of a sharp increase in the number of coronavirus cases brought fear-induced selling across most areas. Hardest hit were businesses that rely on healthy economic growth in China to buoy their bottom lines, while defensive areas held in well.

Of course, no one can predict how much harder the markets may get hit. That said, we can certainly use history as a guide to help formulate a solid game plan to buffer against the inevitable knocks that will come as the deadly virus spreads.

Below are 3 stocks in defensive areas of the market. All 3 offer above-average yields while having improving growth prospects, making them quite attractive at this time.

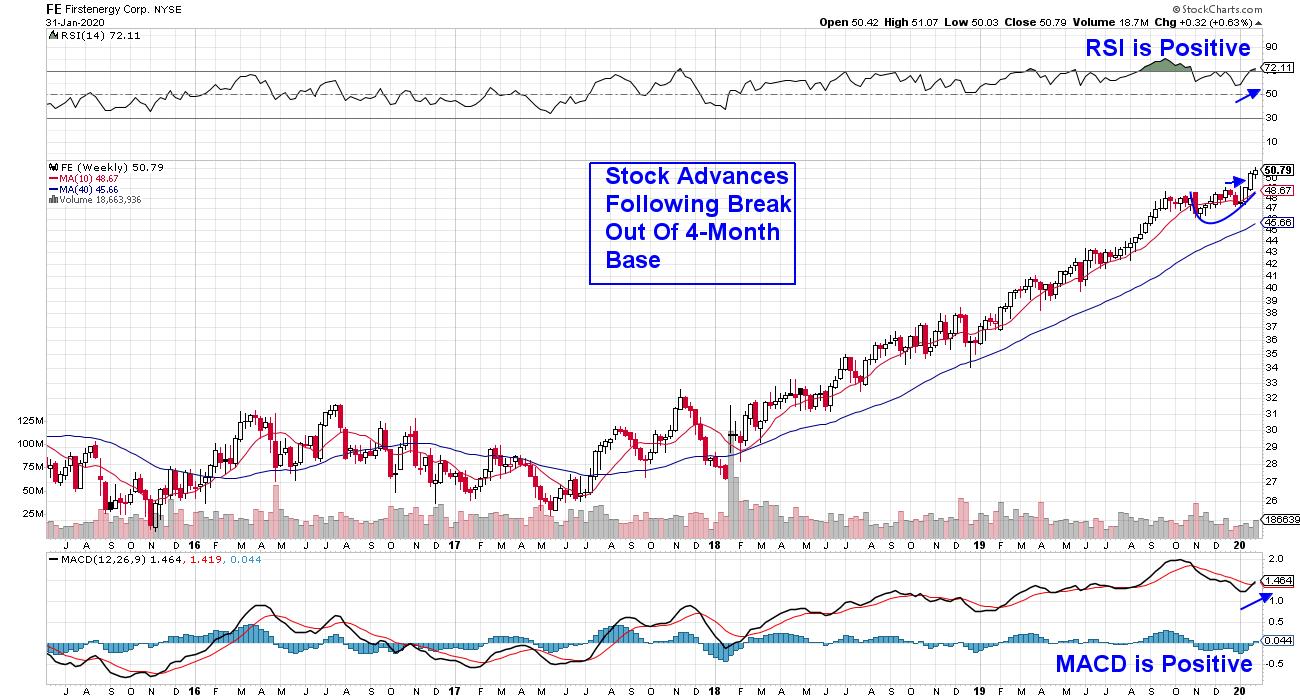

WEEKLY CHART OF FIRSTENERGY CORP. (FE)

We'll begin with a company in the Utility sector that offers a 3.1% yield, with analysts raising earnings estimates. Firstenergy Corp. (FE) generates and distributes electricity in the Northeast area of the U.S., and the recent elimination of fees by regulators has improved Wall Street's outlook.

FE was a solid winner for most of 2019 before peaking in price in late October. The outperformance came on the heels of solid year-over-year earnings growth, which was above 50% for at least 2 quarters. A recent move back into the stocks has pushed it out of a 4-month base and up to new highs on volume, pointing to further near-term upside.

DAILY CHART OF COCA COLA CO. (KO)

Next up we have a different kind of energy provider as Consumer Staples stock Coca-Cola Co. (KO) marches to new highs. KO's uptrend started earlier this month, following a Wall Street upgrade ahead of the release of their earnings this week. The company reported solid growth following a pick-up in their energy-infused Coke-plus-coffee drink and zero-calorie sodas.

The stock gapped up in price following yesterday's bullish report of 4th quarter earnings, which, in turn, pushed the RSI into an overbought position. I'd be a buyer on any pullback as the 2.7% yielder appears poised for further upside, with an upgraded price target over 10% higher than the current price.

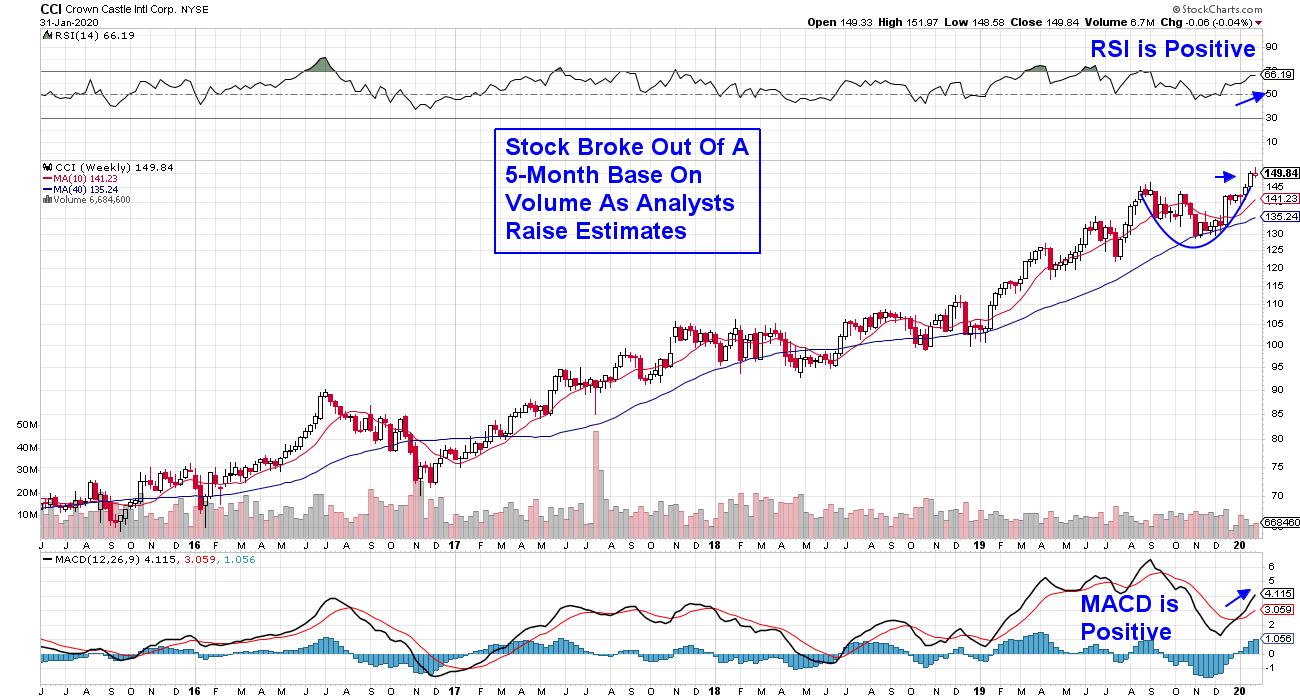

WEEKLY CHART OF CROWN CASTLE (CCI)

Last up is a REIT stock that owns and operates over 40,000 cell towers across every major U.S market. Crown Castle (CCI) continues to add to that number while also increasing their vast network of fiber optic cables. All this points to a steady income source for the company, enhanced by built-in price increases in their leases.

This stock was another big winner last year before peaking in price in September. REIT stocks fell out of favor at that time as growth stocks moved to the forefront. More recently, this 3.2%-yielder began regaining its momentum with a recent base breakout that has seen the stock hitting new highs - putting it on the path to more upside.

As the U.S. gears up for Super Bowl Sunday, smart investors will be getting their defenses ready for a potentially bumpy ride over the coming weeks. A quick look at performance during the 2002-03 SARs outbreak shows that Utility stocks outperformed, as did select beverage stocks from Consumer Staples. (REIT stocks cannot be tracked to that date period.)

For those who'd like to stay closely tuned into market sentiment as investors' fear is poised to rise, I urge you to trial my top performing MEM Edge Report for 4 weeks at a nominal fee. This bi-weekly report provides broader market insight as well as refined sector analysis, complete with stock buy and sell recommendations. CLICK HERE to get this Sunday's updated report as well as updates throughout the week, including the Wednesday Midweek Report.

In addition, fellow StockCharts contributor Bruce Fraser and I will be launching our High Growth Income report next month, which will focus on stocks such as those mentioned above. If you'd like to receive more information, just drop a line to support@thememgroup.com.

Warmly,

Mary Ellen McGonagle