There are three ETFs covering the defense and aerospace group and all three recorded new highs. Even though these ETFs cover the same industry group and have similar price charts, they are quite different when we look under the hood and one is seriously underperforming the other two.

There are three ETFs covering the defense and aerospace group and all three recorded new highs. Even though these ETFs cover the same industry group and have similar price charts, they are quite different when we look under the hood and one is seriously underperforming the other two.

The Aerospace & Defense (ITA) from iShares has just 34 stocks and is quite top heavy with the top ten stocks accounting for around 75%. Boeing (BA) is the top component with a 21% weighting. Even though BA hit a 52-week low in mid January and remains below its falling 200-day SMA, ITA is holding its own with a 52-week high on Friday.

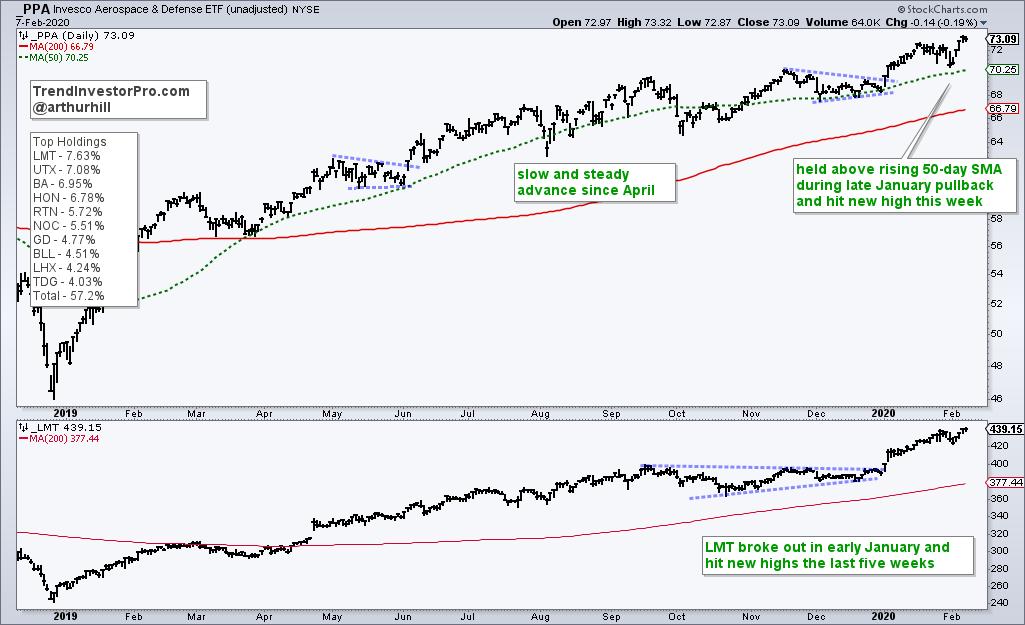

The Aerospace & Defense ETF (PPA) from Invesco is a little more balanced because the top ten holdings account for around 57% and it has 51 stocks, 18 more than ITA. Boeing still features in the top three, but its weighting is much less. The other big stocks, Lockheed Martin (7.63%) and United Technologies (7.08%) recorded new highs this week to power the ITA to a new high.

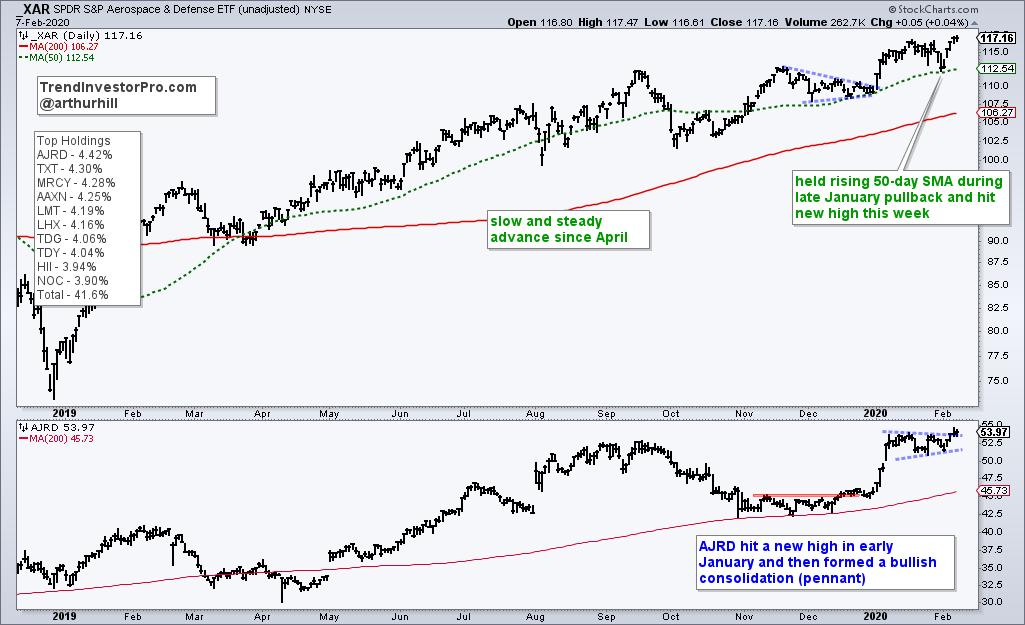

The Aerospace & Defense ETF (XAR) has the fewest holdings (33), but the stocks are equally weighted, more or less. The top ten stocks account for 41.6%, which is the lowest of the three. Aerojet Rocketdyne (AJRD), a name that reeks of defense, broke out in December and hit a new high in early January. The stock stalled with a pennant and this is a bullish continuation pattern.

All three ETFs are in strong uptrends, but Boeing is dragging on ITA. Even though ITA is hitting new highs, note that the ETF is up around 20% over the past twelve months. In contrast, PPA and XAR are up around 29% and seriously outperforming ITA. Chartists looking for more exposure to Boeing, and betting on a turnaround, should opt for ITA. Chartists looking for concentration in large-cap names should opt for PPA and chartists looking for broad exposure to the group should opt for XAR.

This weekend at TrendInvestorPro.com, I will highlight five stocks with bullish setups from the defense & aerospace group. XAR is also part of our core ETF list and followed on a regular basis. Subscribe today for immediate access to the weekly ETF report, ETF ranking tables, market timing models, ETF ChartBook, weekend video, Saturday stock setups and more.

Click here to take your analysis to the next level!

-------------------

Choose a Strategy, Develop a Plan and Follow a Process

Arthur Hill, CMT

Chief Technical Strategist, TrendInvestorPro.com

Author, Define the Trend and Trade the Trend

Want to stay up to date with Arthur's latest market insights?

– Follow @ArthurHill on Twitter