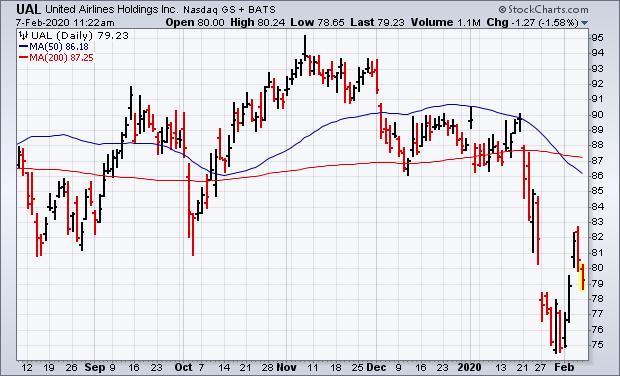

My Tuesday message showed a number of travel and tourism stock groups with heavy exposure to China finding support near moving average lines; or regaining them. Today's message shows those same groups under pressure again today. Let's start with airlines. Chart 1 shows the Dow Jones Airlines Index retesting its 200-day moving average today. Chart 2 shows United Airlines (UAL) still remaining well below that red line. UAL has heavier exposure to China than other U.S. airlines. Chart 3 shows American Airlines (AAL) backing off from its 200-day line. Delta (DAL), however, remains above its red support line.

Judging from this week's strong rebound in global stock markets, it seemed like concerns about the coronavirus had receded into the background. Today's selling in travel and tourism stocks, however, suggests that may not be the case. How those stocks with the heaviest exposure to the Chinese virus end the week may help determine whether the market is out of danger. Investors are turning a bit more defensive just in case.

Chart 1

Chart 2

Chart 3

Editor's Note: This is an excerpt of an article that was originally published in John Murphy's Market Message on Friday, February 7th at 12:14pm ET. Click here to read the full article, which includes Charts 4-6.