ChartWatchers January 20, 2013 at 08:11 PM

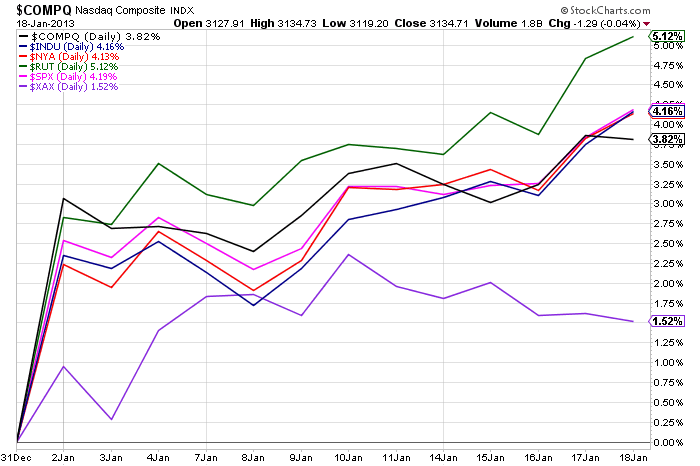

Hello Fellow ChartWatchers! So far, 2013 is proving to be very interesting with bullishness dominating the stock market so far. Since the start of the year, most of the major US market averages are up over 4% with the Russell 2000 (+5.12%) leading the way... Read More

ChartWatchers January 20, 2013 at 04:46 PM

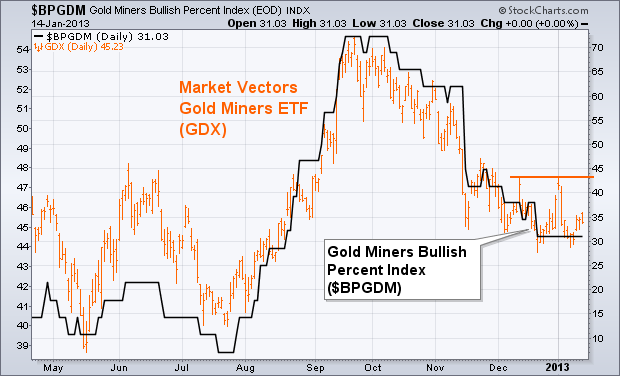

Whenever we look at gold, it's a good idea to check on the trend of gold miners. The orange bars in Chart 1 show the Market Vectors Gold Miners ETF (GDX) still in a downtrend, but trying to stabilize... Read More

ChartWatchers January 20, 2013 at 04:20 PM

Back in November I blogged about the currencies and the events around them. Recently in Early January, 4 of the currencies in the Dollar Index were testing the trend line for the dollar cross... Read More

ChartWatchers January 20, 2013 at 04:02 PM

Technicals do change and I reserve the right to change my opinion as price action evolves, but the energy sector looks like THE ONE for 2013. I remain bullish the stock market overall so I expect most sectors will perform well in 2013... Read More

ChartWatchers January 20, 2013 at 03:48 PM

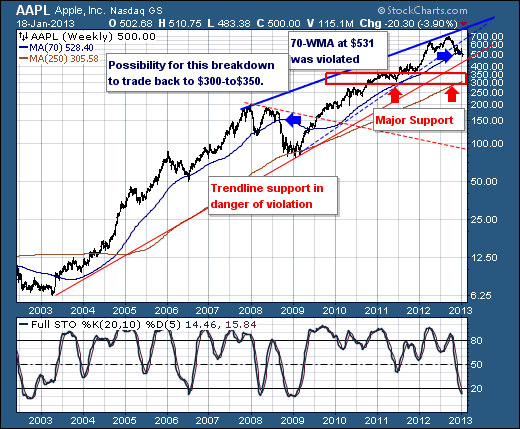

Next week, the markets will be focused upon the incoming earnings reports; and in particular - Apple's (APPL) earnings after Wednesday's close... Read More

ChartWatchers January 19, 2013 at 04:26 PM

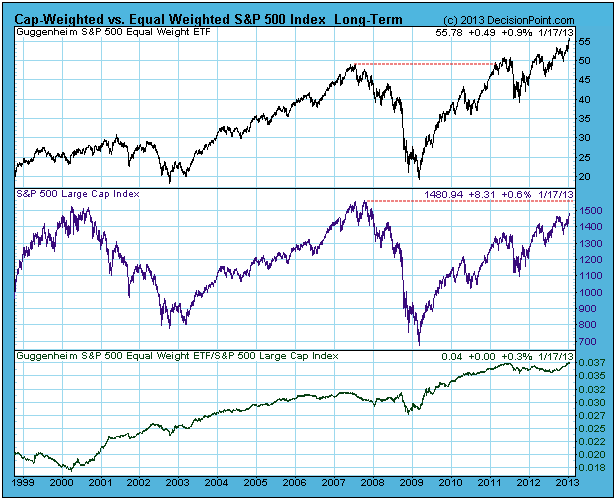

I have long been a cheerleader for equal-weighted indexes versus cap-weighted ones, and now seems like a good time to demonstrate why. In a cap-weighted index stocks influence the price of the index based upon their market capitalization (price time number of shares)... Read More

ChartWatchers January 19, 2013 at 04:26 PM

The Technology SPDR (XLK) has been lagging the broader market for some time now, but the trend since mid November remains up and a bullish continuation pattern is taking shape this month. Weighed down by its top components, XLK has been lagging the S&P 500 ETF since September... Read More

ChartWatchers January 05, 2013 at 10:40 PM

Gold has become pretty unloved. That in itself is usually bullish. This week we look at why it might be time to renew your interest in Gold and the miners. First of all, Lets look at the Gold Miners. Here is a link to the live chart. Gold Miners Index. Lets start at the $BPGDM... Read More

ChartWatchers January 05, 2013 at 06:56 PM

Hello Fellow ChartWatchers! Happy 2013! I'd thought we'd start the year off with a bang by announcing a major new section of our website - the StockCharts Videos Archive... Read More

ChartWatchers January 05, 2013 at 05:51 PM

One of the most impressive technical developments of Wednesday's stock surge was the ability of the Russell 2000 Small Cap Index (RUT) to reach a record high. [The S&P 500 Midcap Index did the same]... Read More

ChartWatchers January 05, 2013 at 05:45 PM

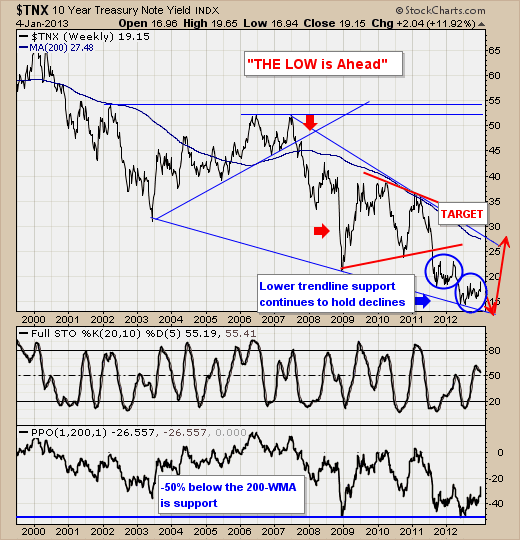

January 2013 has rolled in, with the "fiscal cliff" solved for the moment; and now there are concerns "QE-4" will end sooner rather than later...and perhaps below 2013 ends... Read More

ChartWatchers January 05, 2013 at 05:40 PM

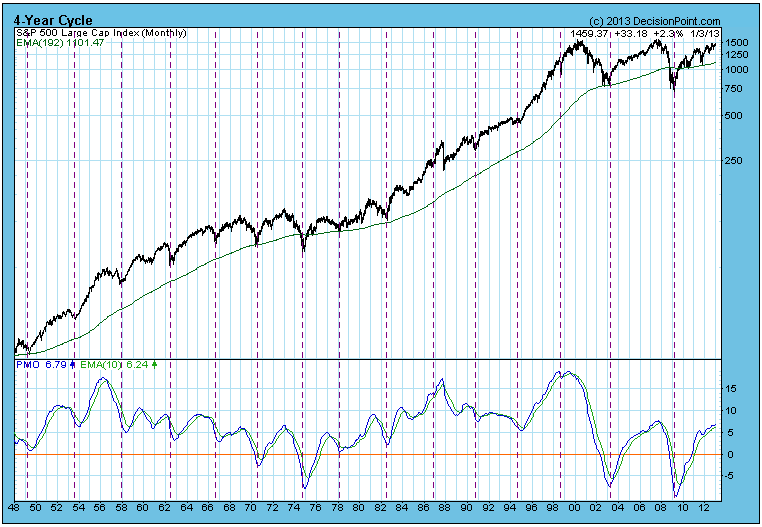

Calculating from the Four-Year Cycle low in 2009, the next cycle low is due in two months, but unless there is a major crash, that projection will not be realized... Read More

ChartWatchers January 05, 2013 at 05:34 PM

Happy New Year!!! Here's to good health and good fortune in 2013! Now is the time when market pundits give their predictions for the stock market for the upcoming year... Read More

ChartWatchers January 05, 2013 at 11:03 AM

It was a volatile week for gold and gold miners, but the Gold Miners ETF (GDX) remains at an interesting juncture that warrants attention. After surging above 47 to start the New Year, the Fed minutes on Wednesday put some doubts on the future of quantitative easing... Read More