ChartWatchers October 21, 2012 at 03:50 PM

Hello Fellow ChartWatchers! Long-time ChartWatchers know that from the very beginning, StockCharts.com has been about the synergy of three things: Great online finanical analysis tools, Great educational content, and Great market commentary that brings it all together... Read More

ChartWatchers October 20, 2012 at 06:31 PM

Given the current chart for the Canadian Dollar, migrating snowbirds might want to exchange some loonies for some sawbucks very soon. The Canadian Dollar continues to hit resistance above the $1.02 level... Read More

ChartWatchers October 20, 2012 at 06:21 PM

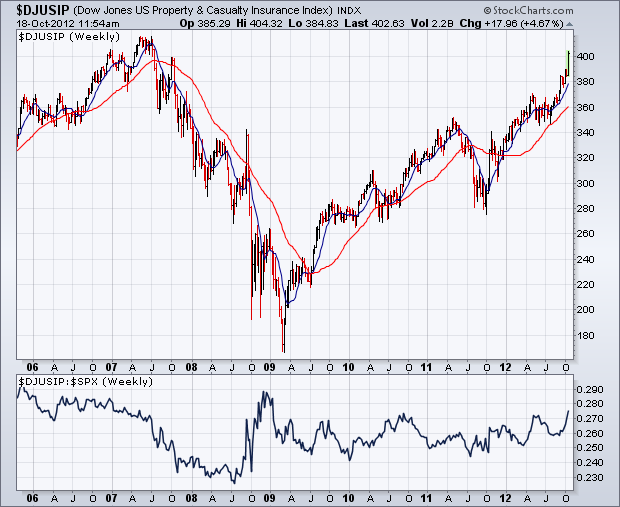

Insurance stocks are attracting a lot of new money into a reviving financial sector. Chart 1 shows the Dow Jones US Property & Casualty Insurance Index surging to the highest level in five years. Its relative strength line (below chart) is starting to break out to the upside... Read More

ChartWatchers October 20, 2012 at 06:12 PM

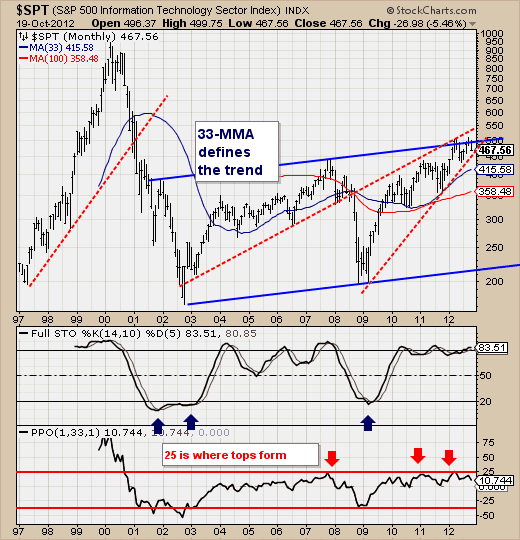

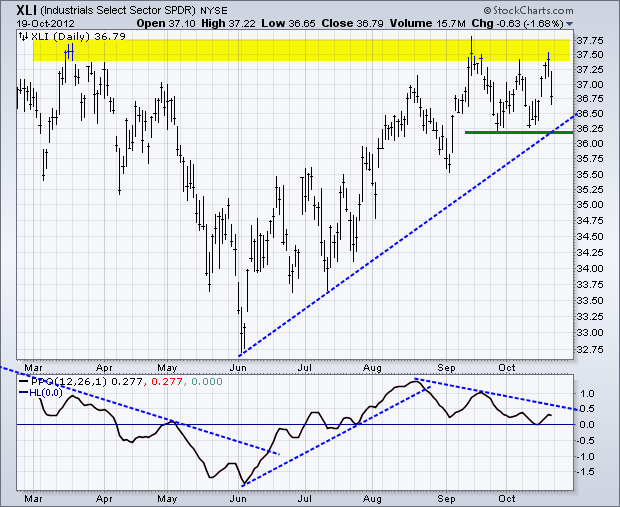

October has been a very strange month thus far. While most of our sectors are trading close to the flat line for the month, financials and technology are heading in opposite directions... Read More

ChartWatchers October 20, 2012 at 06:09 PM

It has been 25 years since the 1987 Crash, and I thought it would be a good time review a few things that probably won't be covered elsewhere in the media. I may have covered these issues in the past, but a refresher can't hurt... Read More

ChartWatchers October 20, 2012 at 06:07 PM

Last's week's early market rally seemingly disavowed all the bad news; which is of course what this market has been doing since the summer... Read More

ChartWatchers October 20, 2012 at 12:30 PM

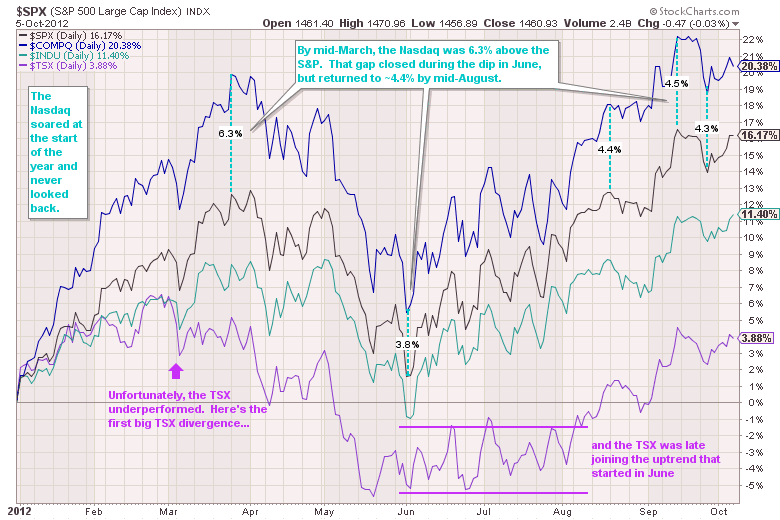

Weakness in the technology sector has been offset by strength in the finance sector since early September. This is why the S&P 500 is range bound the last five weeks and the Nasdaq is in a downtrend... Read More

ChartWatchers October 07, 2012 at 12:36 AM

Hello Fellow ChartWatchers! We've had interactive, Java-based PerfCharts going back to the very start of the website. And while those PerfCharts are very useful, they do have some limitations. For one, members cannot save them into their accounts... Read More

ChartWatchers October 07, 2012 at 12:35 AM

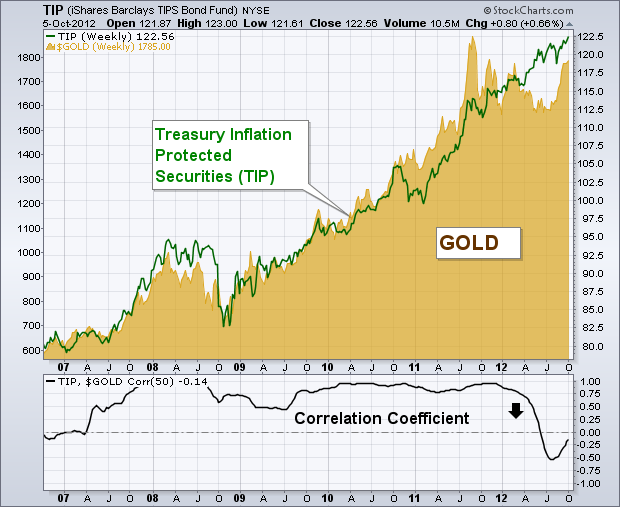

Two of the top performing assets since the September 13 launch of QE3 have been Treasury Inflation Protected Securites (TIPS) and gold. That makes sense considering that both are used as hedges against inflation... Read More

ChartWatchers October 07, 2012 at 12:29 AM

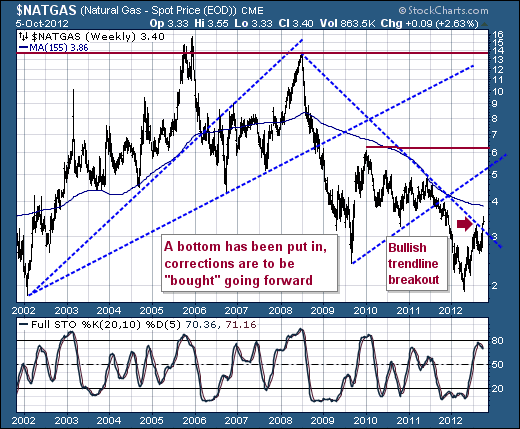

Quite simply, a bear market has ended, and a bull market has begun in the Natural Gas market. This has been quite some time in the making, for the relationship between natural gas and crude oil has been skewed for a number of years in favor of natural gas... Read More

ChartWatchers October 07, 2012 at 12:15 AM

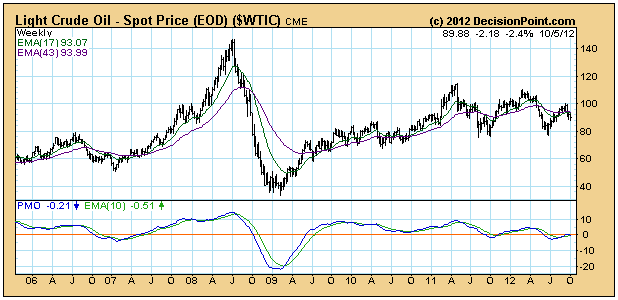

To be honest, I'm not a big fan of providing outlooks too far into the future because prices change continually. As a technician, I realize charts can change daily... Read More

ChartWatchers October 06, 2012 at 11:57 PM

According to a news clip I just saw, there is a gas station in the Los Angeles area currently selling regular gasoline for $5.58/gallon. Some gas stations are shutting down because the owners don't want to buy gas at these prices for fear that they won't be able to sell it... Read More

ChartWatchers October 06, 2012 at 01:07 PM

The Metals & Mining SPDR (XME) is battling to hold its resistance breakout. XME broke resistance with a big surge in early September and broken resistance turns into first support in the 43 area. This is a classic tenet of technical analysis: broken resistance turns support... Read More