ChartWatchers April 18, 2010 at 01:12 PM

For the past couple of months, I've been visiting with investments clubs around the country who have been gracious enough to invite me to talk. So far I've talked with clubs in Portland, Pheonix and Dallas... Read More

ChartWatchers April 17, 2010 at 11:29 PM

Financial stocks are considered to be leading indicators for the rest of the market. Over the last year, the group has led the market higher. Yesterday, they led it lower. The chart below shows the Financial SPDR (XLF) falling 3.6% on huge volume... Read More

ChartWatchers April 17, 2010 at 11:14 PM

In my first article of 2010, I indicated that financials would need to lead on a relative basis in order for us to see strength in overall equity prices this year. Until late last week, financials have performed very well on a relative basis... Read More

ChartWatchers April 17, 2010 at 11:04 PM

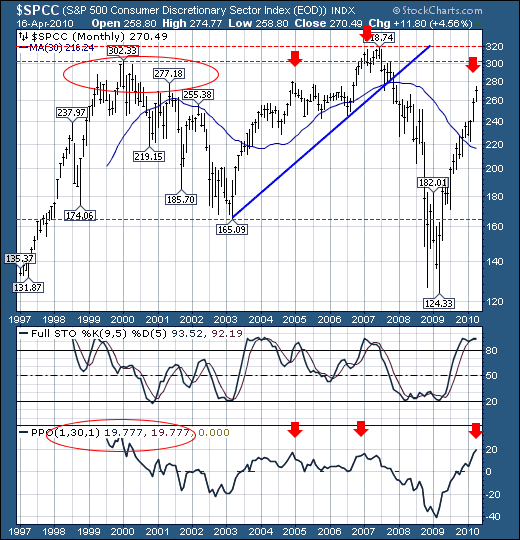

Since the beginning of the year, the market "Generals" if you will have been the S&P Consumer Discretionary, S&P Financial and S&P Industrial sectors given they are the only sectors to have out-performed the S&P 500... Read More

ChartWatchers April 17, 2010 at 11:00 PM

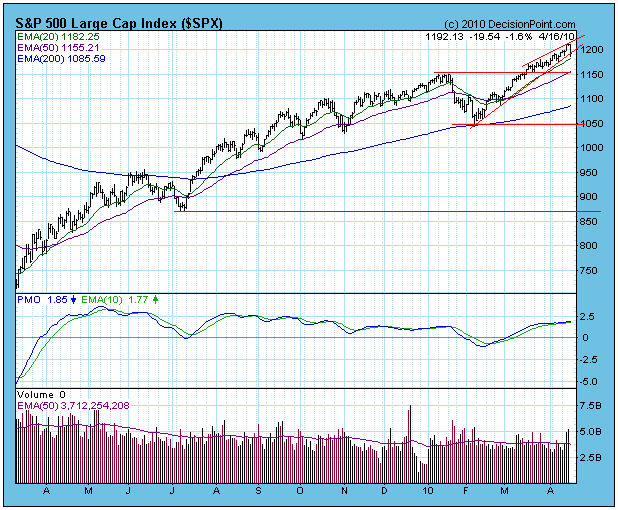

STOCKS: Based upon a 3/1/2010 Thrust/Trend Model buy signal, our current intermediate-term market posture for the S&P 500 is bullish. The long-term component of the Trend Model is on a buy signal as of 8/11/2009... Read More

ChartWatchers April 04, 2010 at 01:48 PM

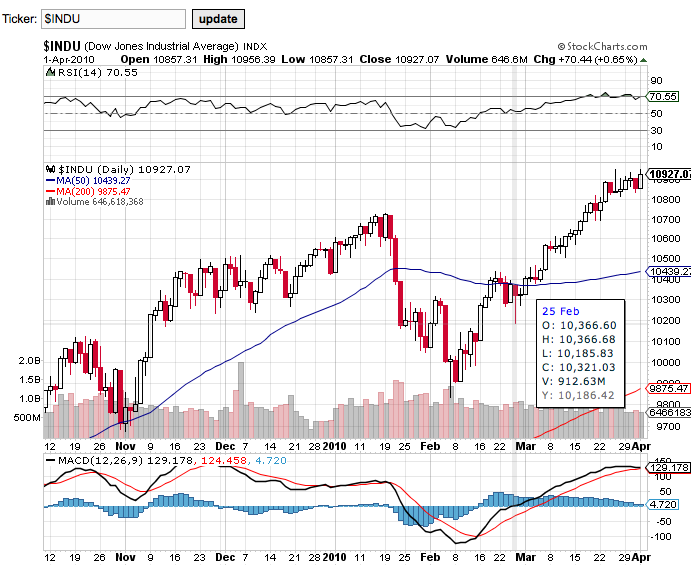

Hello Fellow ChartWatchers! Is the two-month old rally coming to a end now that April has arrived? The Dow's PPO is tantalizingly close to a bearish crossover right now. Arthur Hill sees weakness in the S&P 500 while Tom Bowley still sees opportunities... Read More

ChartWatchers April 03, 2010 at 09:36 PM

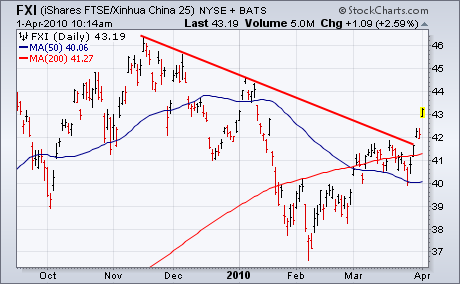

Stocks and commodity markets rallied on Thursday on news of an expansion in manufacturing in China, which is the world's biggest user of commodities... Read More

ChartWatchers April 03, 2010 at 09:29 PM

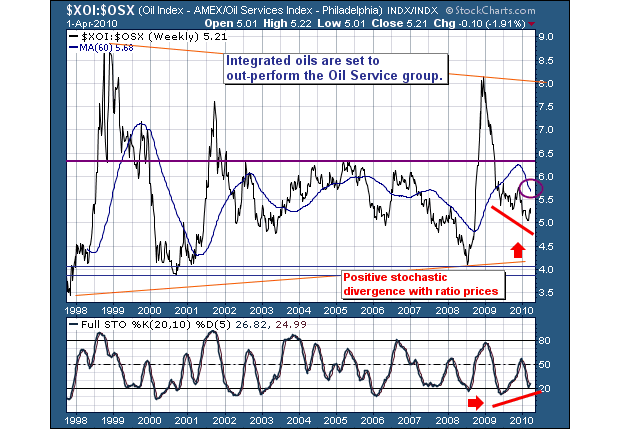

The market rally higher has taken quite a few stock groups along for the ride - most notably the Consumer Discretionary and Industrial sectors. However, we've begun to see some very small rotations out of this group, and into the Energy group... Read More

ChartWatchers April 03, 2010 at 09:26 PM

If you're looking for sector leadership in 2010, look no further than the industrials. While other sectors have performed admirably, especially financials and consumer discretionary, none top the 13.13% year-to-date gain that industrials are sporting... Read More

ChartWatchers April 03, 2010 at 03:10 PM

The S&P 500 ETF (SPY) and Nasdaq 100 ETF (QQQQ) are trading near the upper trendline of a rising price channel that extends back to August. I drew the lower trendlines first, created a second parallel trendline and then moved it up to match the reaction highs... Read More

ChartWatchers April 02, 2010 at 03:34 PM

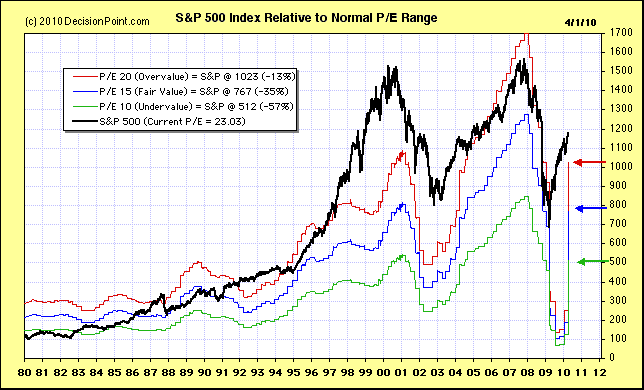

S&P has still not finalized 2009 Q4 earnings, but 99% of companies have reported, and I want to get the most current earnings picture out there, so I have updated our database to TMT earnings as of Q4 2009... Read More