ChartWatchers October 21, 2006 at 10:06 PM

Recall in my last article the "axis of normal returns" showing the potential move of the NASDAQ over the next 2-3 years to return to its "normal line"... Read More

ChartWatchers October 21, 2006 at 10:05 PM

The Consumer Staples SPDR (XLP) was a top performer from April to September, but went through a period of underperformance over the last 4-5 weeks. The Dow Industrials and S&P 500 kept right on trucking in September and October... Read More

ChartWatchers October 21, 2006 at 10:04 PM

For several months these articles have included a reminder that "Technical analysis is a windsock, not a crystal ball." To clarify, a windsock is used to ascertain the current wind direction and intensity. A crystal ball is used to predict the future... Read More

ChartWatchers October 21, 2006 at 10:03 PM

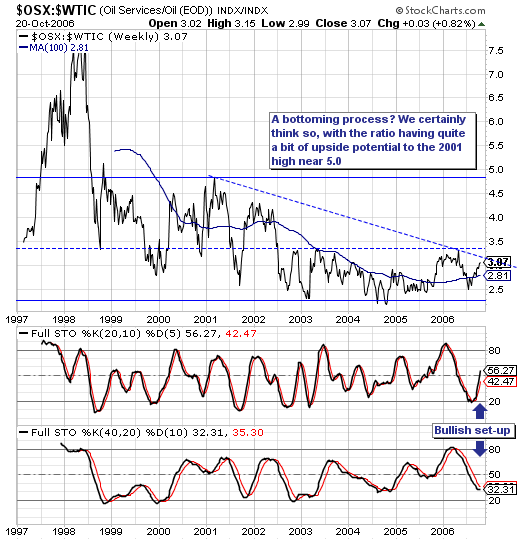

First, much continues to be made of the decline in crude oil prices, and the positive impact of lower energy prices upon the world consumer et al... Read More

ChartWatchers October 21, 2006 at 10:02 PM

JOHN MURPHY TRAVELLING THIS WEEK - John will be presenting at the IFTA Conference in Switzerland this week and will not be online after Monday. We've arranged for Arthur Hill (you can read he column below) to contribute commentary while John is away... Read More

ChartWatchers October 21, 2006 at 10:01 PM

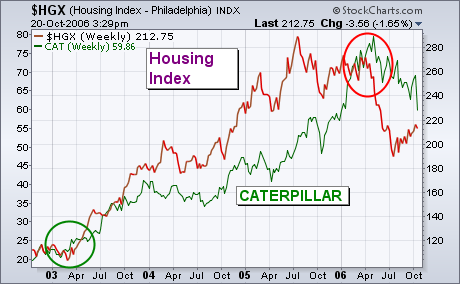

CATERPILLAR HURT BY WEAK HOUSING ... A plunge in Caterpillar on Friday, Oct 20th, unsettled the market. And for good reason. The bad news from the stock was blamed on a weak housing sector... Read More

ChartWatchers October 21, 2006 at 10:00 PM

The Dow Industrials continued to set new highs last week and several interesting sectors led the way - but I'm not going to talk about that. (Our expert columnists have it covered below anyways.) I'm going to share some interested statistics with you about how StockCharts... Read More

ChartWatchers October 07, 2006 at 10:06 PM

After a decent run up in stock prices, one of the questions always heard is "is it too late to buy?" Well, there's never a guaranteed right answer and a lot of analysts would say the bull market is long in the teeth and has run its course. I am not in that camp - far from it... Read More

ChartWatchers October 07, 2006 at 10:05 PM

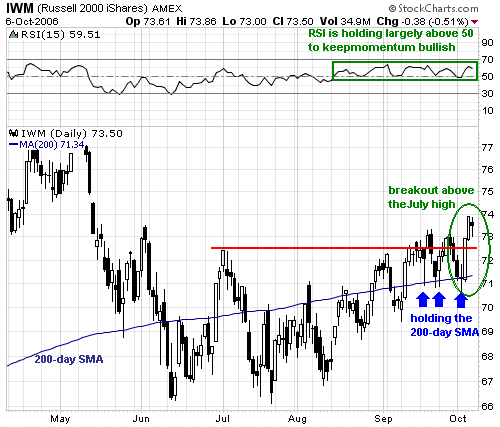

After lagging QQQQ and SPY throughout September, the Russell 2000 iShares (IWM) got into the action last week with a surge from 71 to 74 (4.2%) on Wednesday and Thursday... Read More

ChartWatchers October 07, 2006 at 10:04 PM

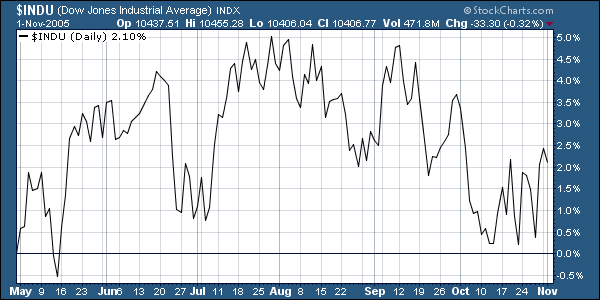

The structure that has dominated the price pattern for nearly three years is a rising trend channel, which I have drawn on the S&P 500 chart below... Read More

ChartWatchers October 07, 2006 at 10:03 PM

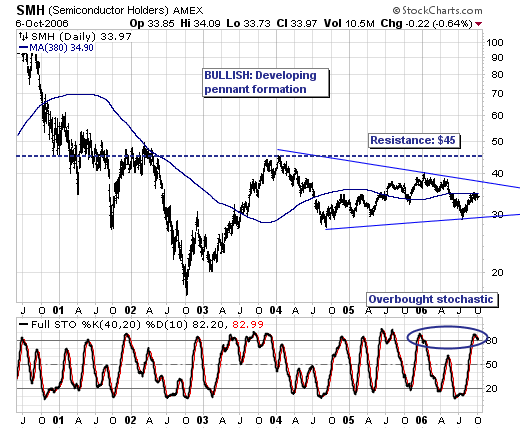

The sharp technology share rally has caught many "off-sides" to be sure. Take for example the NASDAQ 100 "Q's" +13.4% rise off their June low; this is quite impressive indeed...but not as impressive as the +19.7% gain in the Semiconductor Index (SMH)... Read More

ChartWatchers October 07, 2006 at 10:02 PM

JOHN MURPHY ON THE RADIO - In case you missed it, John Murphy was on Invested Central's radio broadcast during last Friday's afternoon show. He discussed the current direction of the market and what was driving its current direction... Read More

ChartWatchers October 07, 2006 at 10:01 PM

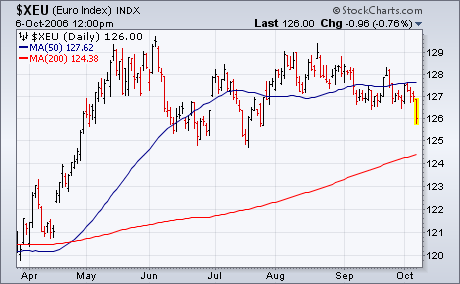

The dollar is having one of its strongest days in months. Part of the reason is the drop in the U.S. September unemployment rate and some upward revisions in recent job creation. The report diminished hopes for rate reductions by the Fed in the near future... Read More

ChartWatchers October 07, 2006 at 10:00 PM

Hello Fellow ChartWatchers! Did you know that this is the most important time of the year for ChartWatchers that are looking to invest for the mid- to long-term? It is. Mention the month October to many investors and you will see them grow pale... Read More