First, much continues to be made of the decline in crude oil prices, and the positive impact of lower energy prices upon the world consumer et al. This much is known; but oil service stocks have been "taken to the proverbial woodshed" and beaten to death, which creates a very interesting and perhaps very profitable opportunity to buy these stocks as crude oil continues to move lower.

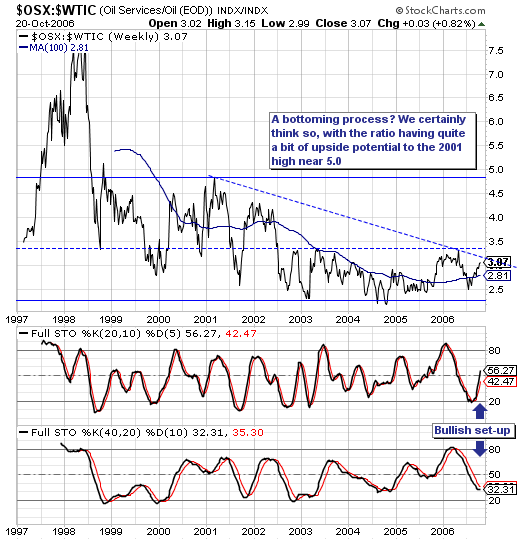

Our interest stems from the technical perspective of the Oil Service Index vs. Crude Oil Ratio ($OSX:$WTIC). We think it is rather clear on a historical basis, the ratio is trading now too far off its lows of the past several years, which gives rise to the emerging "rounding bottom". Thi is confirmed with the now rising 100-week moving average. Too, we find trendline resistance above it coming into play; a clear breakout above this level would serve to push prices sharply higher towards 5.0.

So, in the end, no matter how crude oil trades...oil service is likely to trade better and outperform. Our favorite individual plays in the sector for the months and years ahead are: Nabors Industries (NBR), Transocean Offshore (RIG) and Weatherford International (WFT).