Well, here we sit with $COPPER testing the trendline. The price action late last week was not encouraging and we have a little negative divergence on the daily. You can see when copper fails at the zero line on the MACD it's a big deal.

It looks to me like the major miners need a rest before continuing their assault to higher prices. To offset that, I have some other ideas.

I also have wedge formations that look identical to this on $WTIC and $XOI. See the chart here.

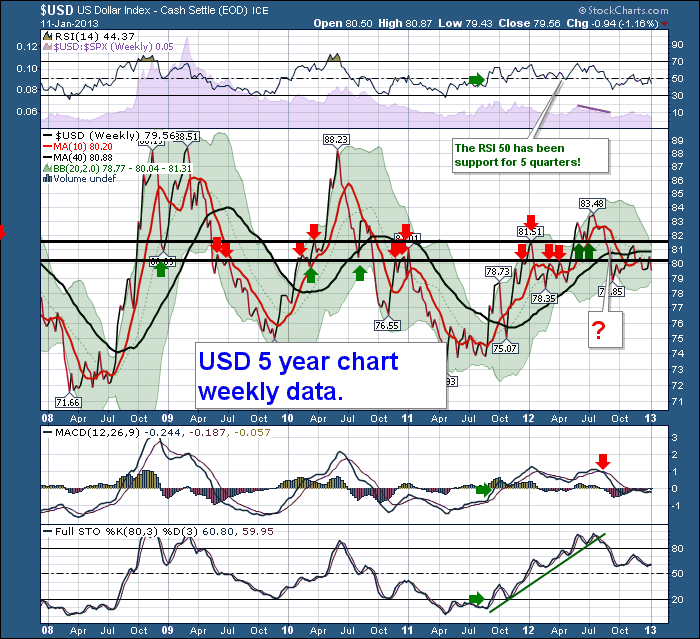

Another chart that shows indecision is the $USD. ITs not time to go to sleep on any of these charts. A meaningful breakout any time soon could talk a lot about the longevity for the market overall.

I could have piled 4 more arrows on the right side for you to check out, but I left it clear. You can see in July we were wondering. Here we are wondering again. I mentioned the European currencies the other day. They all got support and rose.

The gold miners performed very well on Friday with the big $20 move down. The 3X gold etf - NUGT was almost unchanged on the day. You would have expected major pain. So someone wasn't selling their miners.

A breakout this week in Commodities could be very bullish. Lets see which way $COPPER goes. It's probably the smartest of the three commodities here. I'll be watching, not predicting this one!

Good Trading,

Greg Schnell, CMT