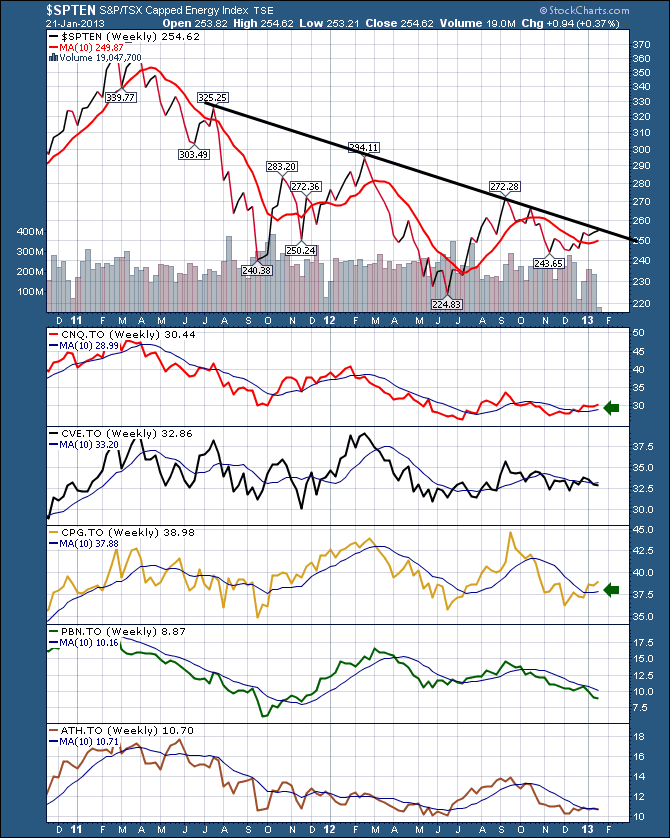

The Canadian Energy sector is still a mixed bag. That acceleration from Mid November is hardly exciting.

The markets are very interesting here. The Energy sector above broke down almost 2 full years ago and this trendline is still holding. Hopefully this week will tell us whats going to happen. Be ready both directions.

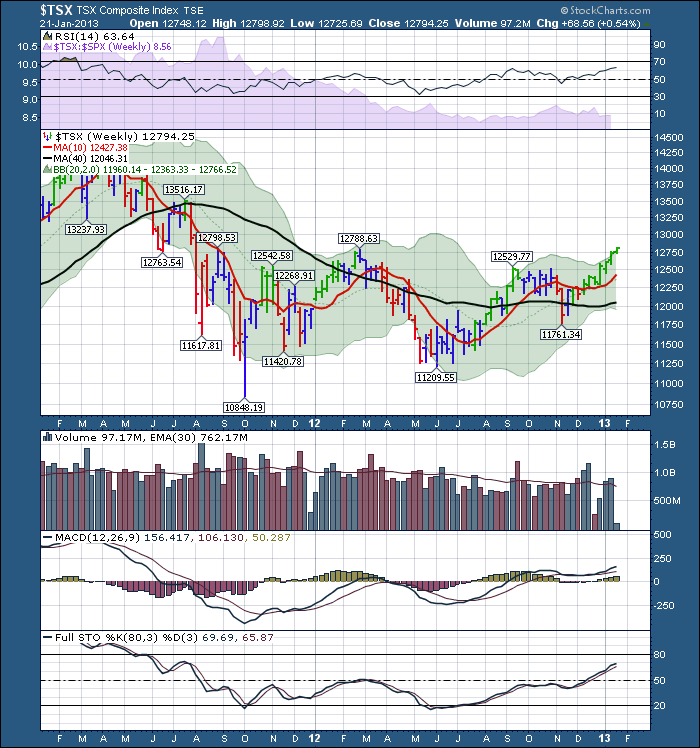

The market by my indicators is flashing all kinds of overbought signals and needs a rest.

Globally, the trend has been great. Almost every major market in the world is above the 20 Month MA.

But there are reasons to lighten up on the gas pedal if you want to find them.

1)The Gold trade is having trouble getting started and on Friday, the Gold Miners Bullish percent index turned down rather than up after a long sideways period. Hopefully we get a snap back early this week. I find Gold likes to rally off lows during the week including the 25th of the month.

2)Copper isn't moving up yet. It can't seem to break the pennant pattern on the weekly.

3) The currencies are starting to break down which worries me.

4) All major markets are screaming overbought world wide. It doesn't mean they can't go higher, but usually mutual funds like to enter on lows, not highs. So its tough getting new money without a pullback.

5) Its after Options Expiration during earnings month so the market may trade differently here. Its a specific line on my charts every quarter!

6) JPM is at the level it has topped out 8 times in the last 7 years. Someone suggested that there is resistance there! Wells Fargo has hit resistance 7 times in 7 years in the low 30's. Its at $34.93.

7) The $TSX is right at the resistance level that hit it in March 2012. It made a church spire top at 12788. You may remember this resistance area has 7 years of friction. Between 12500 and 12800 has been difficult.

8) The high volume of the last 2 days on the $SPX is alarming to me. If the last 15 minutes on Friday had not made a run, it would have been a stalling day. High volume with no gain. So the move above the consolidation area takes out all the stops above and then loses momentum. Just concerning.

I'm still bullish, but its getting more difficult. Lots of stocks are making new highs which should happen when the market is too. Transports and Dow Theory intact. But if the Dow reversed this week, we'd call it a failed breakout. So just a cautious time.

We need the move into commodities to start with a vengeance and instead its starting with a whimper.

I need to see the commodities have a run to believe the global bull market is going to take hold. Otherwise, it will be back to cash!!

I am the guest speaker for the MTA webinar this week. If you would like to attend at no charge, feel free to follow the link I'll send tomorrow in a separate blog and you should be good! I have done some very interesting research on the wedge pattern in the $SPX. I have some compelling data I am looking forward to sharing.

Time: 12 Noon EST.

Date: Wednesday January 23, 2013.

Location: I'll post a separate blog Tuesday that will have a working link!

Lastly, signups for the Calgary SCU 101 class close this week. Calgary. It is going to be great! Its so close to being sold out! I'm excited!!

All this makes for a very interesting week...

Good Trading,

Greg Schnell CMT