Market Recap for Tuesday, February 5, 2019

Tuesday was Groundhog Day for those that have seen the movie starring Bill Murray. It was a repeat of what we've seen throughout earnings season. We heard a somewhat disappointing outlook from a market leader, in this case Alphabet (GOOGL, +0.92%), several companies lowering their forecasts for FY19, and yet the U.S. stock market was incredibly resilient, gaining across all of our major indices. Leadership once again came in the form of the NASDAQ, which rose 0.74%. The Dow Jones, S&P 500 and Russell 2000 all participated too, however, with gains of 0.68%, 0.47%, and 0.18%, respectively. 9 of 11 sectors advanced, led by four aggressive groups - communication services (XLC, +1.10%), consumer discretionary (XLY, +0.94%), industrials (XLI, +0.87%), and technology (XLK, +0.84%).

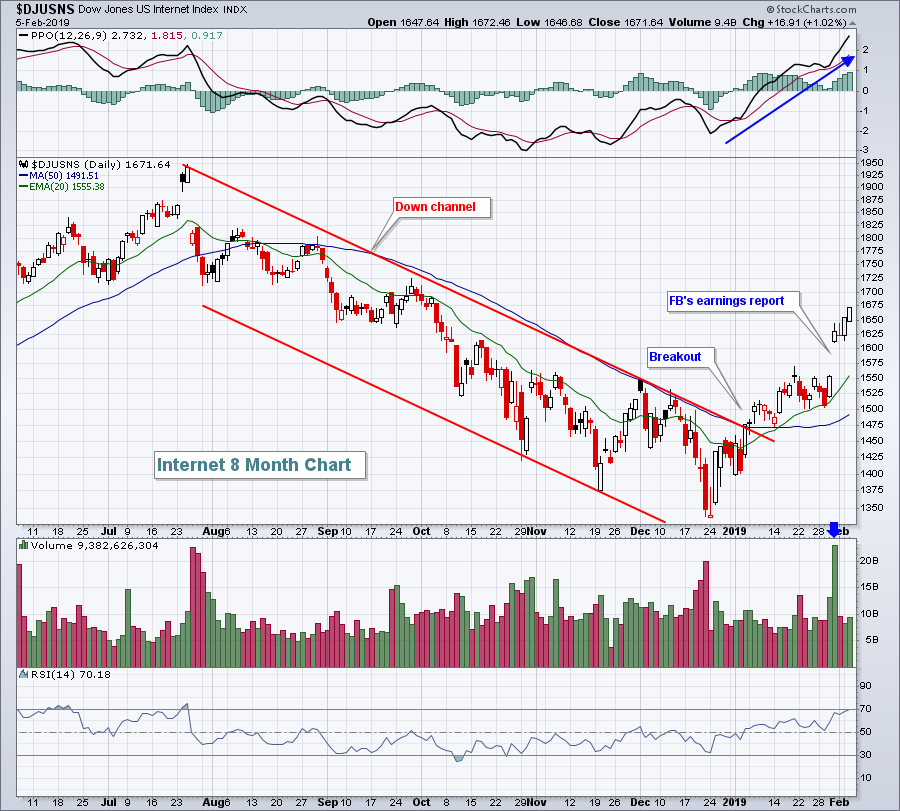

Internet stocks ($DJUSNS, +1.02%) have been quite strong since the beginning of 2019, especially since Facebook's (FB, +1.13%) quarterly results, and most definitely appear to have begun another uptrend:

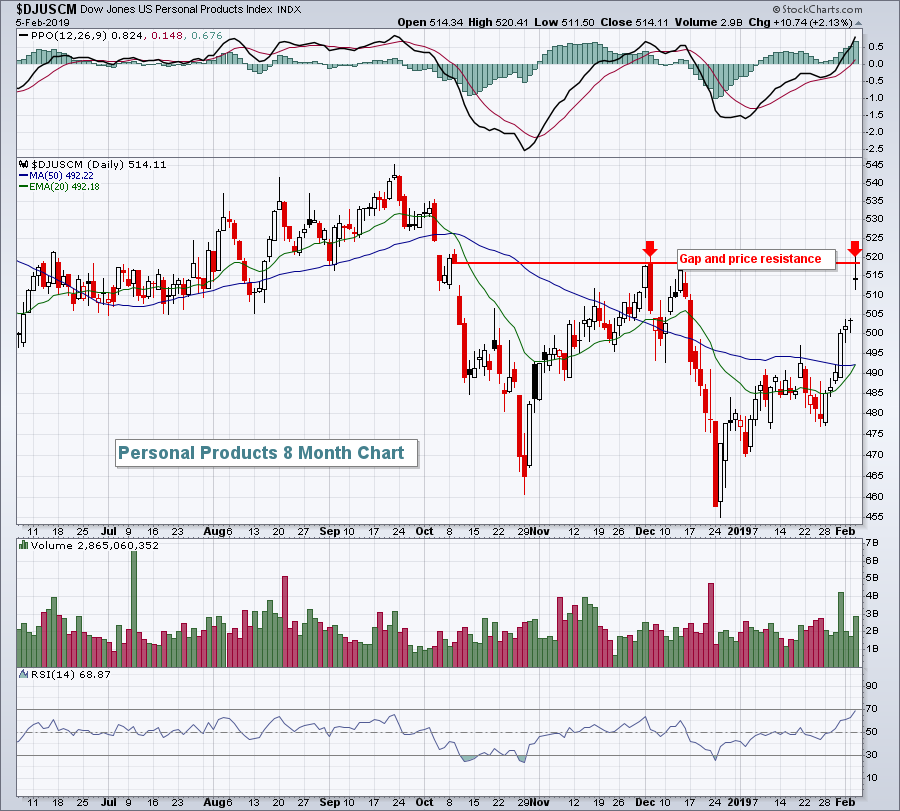

Personal products ($DJUSCM, +2.13%) got a nice lift from Estee Lauder (EL, +11.64%) after EL delivered quarterly results well ahead of Wall Street consensus estimates. That's the good news. The bad news is that the DJUSCM was stymied when it touched overhead price resistance:

Personal products ($DJUSCM, +2.13%) got a nice lift from Estee Lauder (EL, +11.64%) after EL delivered quarterly results well ahead of Wall Street consensus estimates. That's the good news. The bad news is that the DJUSCM was stymied when it touched overhead price resistance:

I would eventually expect to see a breakout here, but yesterday's failure could provide a short-term obstacle for the bulls.

I would eventually expect to see a breakout here, but yesterday's failure could provide a short-term obstacle for the bulls.

Financials (XLF, -0.27%) and healthcare (XLV, -0.14%) were the two sectors that failed to participate in Tuesday's advance.

Pre-Market Action

If there's one thing to worry about currently, it's the statement being made by the treasury market. This morning, we're again seeing treasury yields lower as the 10 year treasury yield ($TNX) has dropped two basis points to 2.68%. Crude oil ($WTIC) and gold ($GOLD) are flat.

Global stocks are mixed. Asian markets were mostly higher overnight, but in Europe, we're seeing fractional losses nearly across the board.

Dow Jones futures were red earlier, but have improved. Currently, it looks like we could see a flat open.

Current Outlook

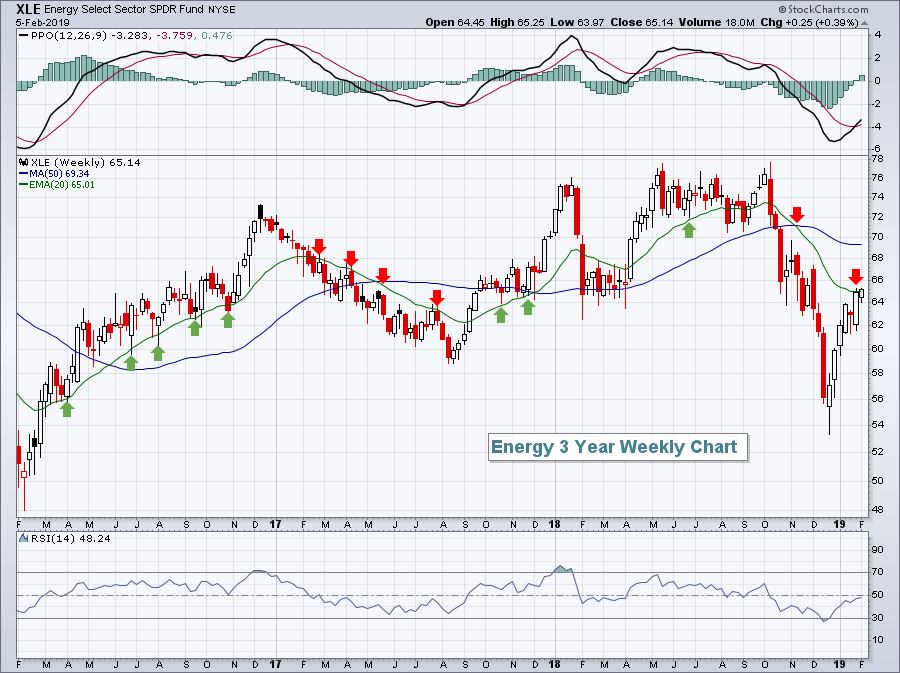

Over the past month, the energy ETF (XLE) has gained nearly 9%, ranking it beneath the leaders - industrials (XLI, +12.72%), real estate (XLRE, +12.39%) and technology (XLK, +11.07%) - but well ahead of several other sectors like utilities (XLU, +3.75%) and consumer staples (XLP, +4.51%). Nonetheless, the XLE is the lowest ranked sector ETF in terms of SCTR (StockCharts Technical Rank). In order for a new bull market to emerge, we want to see all sectors participating. Therefore, technical improvement on the weekly chart of the lowest ranked sector ETF would be advantageous for the bulls. Here's what that weekly chart looks like:

Check out all of those red and green arrows marking resistance and support, respectively, over the past three years. The XLE is attempting to break above its 20 week EMA and such a breakout would be very bullish for the stock market as a whole.

Check out all of those red and green arrows marking resistance and support, respectively, over the past three years. The XLE is attempting to break above its 20 week EMA and such a breakout would be very bullish for the stock market as a whole.

Sector/Industry Watch

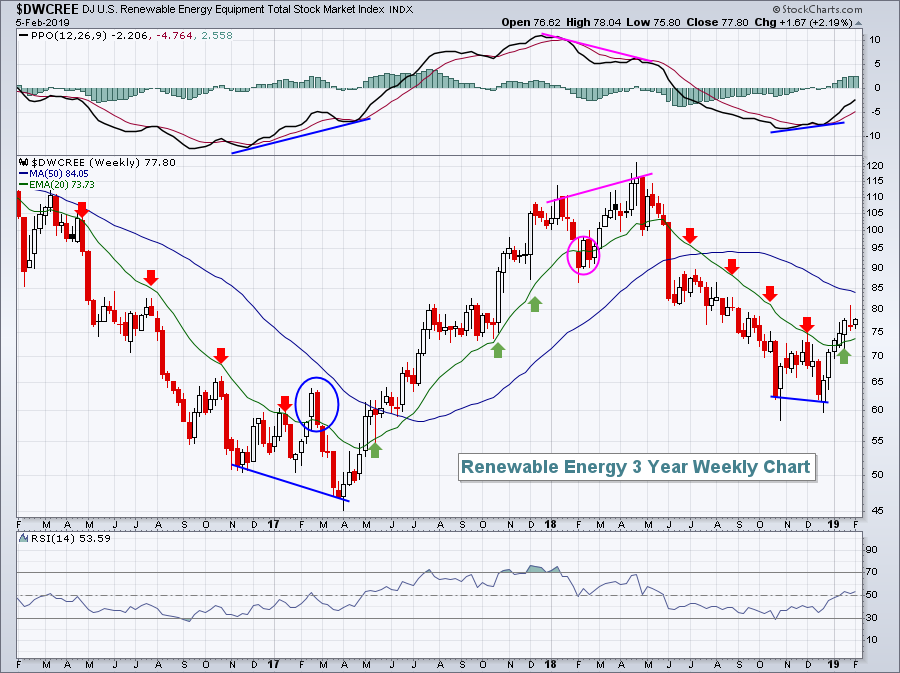

The Dow Jones U.S. Renewable Energy Index ($DWCREE, +0.83%) had another solid day on Tuesday and continues trending higher and above its rising 20 day EMA. So long as that continues, I like the group. The 2018 downtrend was broken in January and the technical outlook is now quite bullish:

The 20 week EMA has proven to be tremendous support during uptrends and resistance during downtrends the past three years. As the weekly PPO strengthens, look to the now-rising 20 week EMA as a solid reward to risk entry point into this area of the market.

The 20 week EMA has proven to be tremendous support during uptrends and resistance during downtrends the past three years. As the weekly PPO strengthens, look to the now-rising 20 week EMA as a solid reward to risk entry point into this area of the market.

Historical Tendencies

As you can see in the Sector/Industry Watch section above, renewable energy ($DWCREE) stocks are back in favor. It won't hurt that the group really likes the period from February through April, where the DWCREE has produced an average return of +10% over the last 8 years.

Key Earnings Reports

(actual vs. estimate):

BIP: .82 vs .81

BSX: .39 vs .37

CMI: 3.48 vs 3.82

CTSH: 1.13 vs 1.05

DASTY: 1.21 vs 1.15

ELAN: .29 vs .26

EQNR: .46 vs .52

FDC: .38 vs .37

GM: 1.21 - estimate, awaiting results

GSK: .70 - estimate, awaiting results

HUM: 2.65 vs 2.53

JEC: .78 vs 1.05

LLY: 1.33 vs 1.36

REGN: 6.84 vs 5.69

SPOT: (.24) - estimate, awaiting results

TTWO: 4.05 vs 2.75

(reports after close, estimate provided):

BAP: 3.95

CINF: .80

CMG: 1.38

FLT: 2.71

FTNT: .51

LNC: 2.13

MET: 1.30

MTCH: .39

NOV: .08

NTR: .54

NXPI: 2.09

ORLY: 3.76

PRU: 2.88

TRMB: .46

Key Economic Reports

Q4 productivity released at 8:30am EST: 1.6% (estimate) - actual data not available due to recent shutdown

Happy trading!

Tom