Market Recap for Tuesday, June 19, 2018

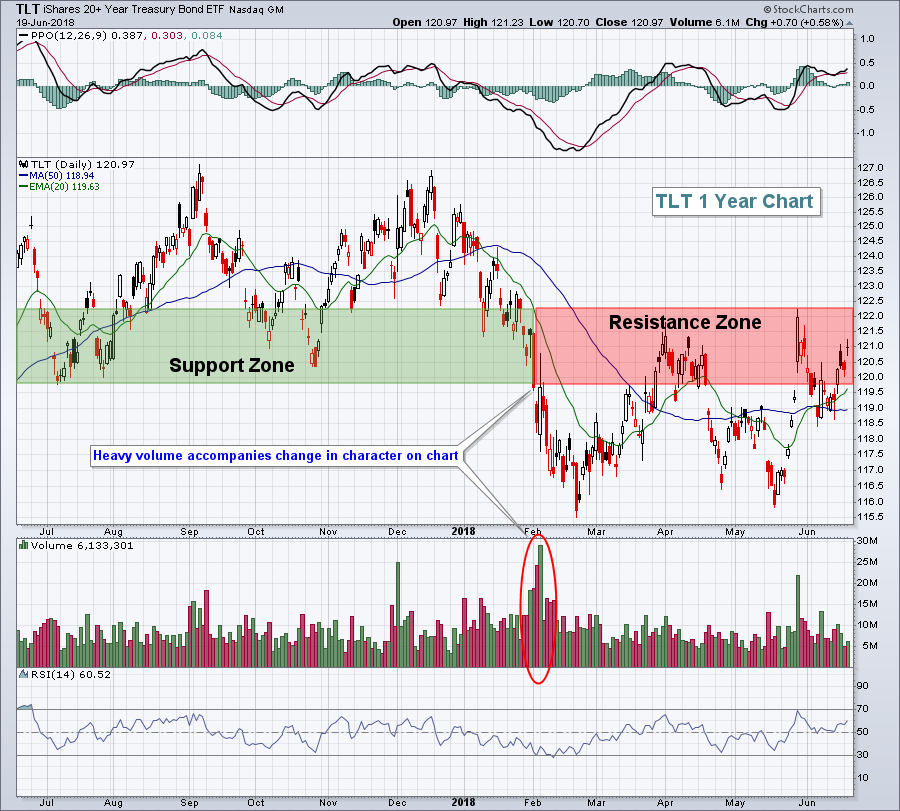

Treasuries (TLT, +0.58%), utilities (XLU, +0.99%), consumer staples (XLP, +0.53%) and healthcare (XLV, +0.26%) highlighted the strength on Tuesday. Wall Street suffered painful losses at the opening bell for a second straight day, but also rallied off those early losses for a second day in a row. Money rotating toward defensive areas is not a great thing, but it's much worse in my opinion when defense leads rallies. It's typical for defense to lead during declines as scared money pours into those areas on a relative basis. That's not what is happening currently. Instead, the market is digesting scary headline news about trade wars, blah, blah, blah, and reacting as we should expect. The TLT has been on the rise, but is in a key resistance zone where I expect it to turn lower again:

The Fed continually conveys to us an expanding economy and higher interest rates ahead. That's a signal to SELL treasuries, not buy them. So either the Fed has this completely wrong or selling treasuries here makes sense.

The Fed continually conveys to us an expanding economy and higher interest rates ahead. That's a signal to SELL treasuries, not buy them. So either the Fed has this completely wrong or selling treasuries here makes sense.

As for the XLU, XLP and XLV, they've been losing ground to the S&P 500 for a long time. Current conditions, in my view, point to a continuing bull market for U.S. equities. Historically, the XLU, XLP and XLV lag during such periods, so again I'd use strength in these sectors to reallocate:

Since the lows in early 2016, the S&P 500 has risen steadily with relative weakness in each of the three defensive sectors. I'd expect this relative weakness to continue.

Since the lows in early 2016, the S&P 500 has risen steadily with relative weakness in each of the three defensive sectors. I'd expect this relative weakness to continue.

Industrials (XLI, -2.11%) was the weakest sector, followed by materials (XLB, -1.83%) as these two groups were hardest hit by the potential trade war with China.

Pre-Market Action

Global equities have rebounded overnight and this morning and that's helping to lift U.S. stock futures. With less than 30 minutes left to the opening bell, Dow Jones futures are higher by 119 points.

Micron Technology (MU), a large cap semiconductor, reports its latest quarterly results after the bell today. At Tuesday's low, the Dow Jones U.S. Semiconductor Index ($DJUSSC) had fallen roughly 6% in just the past 8 trading sessions. So MU's report could help to stabilize the group or provide further ammunition for the bears to take the group lower.

Current Outlook

I know it seems as though specialty retailers ($DJUSRS) have been going up forever, but that's not the case. In fact, it was a very frustrating group for more than two years as it consolidated in a bullish ascending triangle pattern. Check out the pattern and the huge returns since the pattern breakout:

After a serious uptrend, stocks and/or indices can go into lengthy "continuation" patterns. While the patterns themselves are very bullish, trading stocks in that space during a consolidation phase is a losing proposition. From the summer of 2015 through late-2017, the DJUSRS consolidated in a very bullish ascending triangle pattern, but its relative strength suffered. It finally broke out above 1100 in Q4 2017 and THAT is when relative strength returned.

After a serious uptrend, stocks and/or indices can go into lengthy "continuation" patterns. While the patterns themselves are very bullish, trading stocks in that space during a consolidation phase is a losing proposition. From the summer of 2015 through late-2017, the DJUSRS consolidated in a very bullish ascending triangle pattern, but its relative strength suffered. It finally broke out above 1100 in Q4 2017 and THAT is when relative strength returned.

Why bring this up? Well, home construction ($DJUSHB) has weakened after a lengthy period of relative outperformance and this relative weakness could last awhile, even though the overall longer-term uptrend remains in play. It's difficult to say what pattern the current period of consolidation will take on, but I wouldn't expect too much out of homebuilders until, at a minimum, the declining 20 week EMA is cleared:

The red arrows highlight the failures at that key moving average. Breaking above it could signal an extended short-term rally to establish another key top in what will likely become a continuation pattern of some sort. As money continues to pour into consumer discretionary stocks, it's clear that the stock market currently favors specialty retailers and is unforgiving relating to home construction.

The red arrows highlight the failures at that key moving average. Breaking above it could signal an extended short-term rally to establish another key top in what will likely become a continuation pattern of some sort. As money continues to pour into consumer discretionary stocks, it's clear that the stock market currently favors specialty retailers and is unforgiving relating to home construction.

Sector/Industry Watch

The Dow Jones U.S. Specialty Retailers ($DJUSRS) is up more than 65% since its July 2017 low and much of those gains are directly attributable to the stellar move by Netflix (NFLX), which has risen approximately 180% over that same period. NFLX rose another 3.73% on Tuesday to close above 400 for the first time in its history. But there are plenty of other specialty retailers doing quite well. The latest to make a noteworthy move is Williams Sonoma (WSM). On May 23rd, WSM posted revenues and EPS that exceeded Wall Street's estimates and raised its sales forecast. The stock has subsequently climbed to break above key price resistance and appears poised for further technical strength:

WSM has quickly climbed into overbought territory so the best reward to risk entry would be on a pullback. I'd consider 56-59 to be a solid accumulation zone.

WSM has quickly climbed into overbought territory so the best reward to risk entry would be on a pullback. I'd consider 56-59 to be a solid accumulation zone.

Historical Tendencies

Micron Technology (MU) reports its earnings after the close tonight. Over the past 15 years, MU has risen during July just three times and has averaged losing 2.2% in July. June's average loss over that same 15 year period has been 3.2%. MU can be extremely volatile after its earnings reports so protecting current gains in some fashion makes good sense.

Key Earnings Reports

(reports after close, estimate provided):

MU: 3.14

Key Economic Reports

May existing home sales to be released at 10:00am EST: 5,500,000 (estimate)

Happy trading!

Tom