Market Recap for Monday, June 18, 2018

Trade war fears are picking up again this morning and it's rattling equities worldwide. It created a bit of a stir on Monday morning as futures were weak, signaling a rough start for U.S. equities. That's exactly what we saw as the Dow Jones opened down well over 200 points. The good news is that buyers stepped up throughout the session. The bad news is that the short-term downtrend in this index remained in play despite the recovery:

Large multinational companies have been under pressure on a relative basis the past few months. It's partly attributable to trade issues, but dollar strength is also pointing traders to domestic, small cap companies. Check out the same chart for the Russell 2000:

Large multinational companies have been under pressure on a relative basis the past few months. It's partly attributable to trade issues, but dollar strength is also pointing traders to domestic, small cap companies. Check out the same chart for the Russell 2000:

The outperformance of smaller stocks is fairly evident as the Russell 2000 closed at an all-time high yesterday.

The outperformance of smaller stocks is fairly evident as the Russell 2000 closed at an all-time high yesterday.

Energy (XLE, +1.00%) bounced back beautifully at its 50 day SMA, helping to reduce the early losses on Wall Street. Utilities (XLU, +0.32%) also performed well as the 10 year treasury yield ($TNX) has once again come under pressure as defensive money rotates into treasuries. While I do not expect this to last, the current trade environment definitely is adding an element of risk that many traders are looking to avoid. Treasuries are viewed as a safe haven and higher prices there are temporarily resulting in falling yields. As trade wars intensify this morning, the TNX has dropped another 6 basis points to 2.87%. This will likely keep utilities atop the sector leaderboard while other sectors like financials (XLF, -0.18%) and industrials (XLI, -0.41%) suffer in the near-term.

Pre-Market Action

Asian markets tumbled overnight on increasing trade tensions between China and the United States. President Trump has vowed to step up tariffs with China promising retaliation. Equity markets don't like it as China's Shanghai Composite ($SSEC) dropped 115 points, or nearly 4%, to close at its lowest level since June 2017. Hong Kong's Hang Seng Index ($HSI) fell 841 points, or just under 3%, to close just 9 points above its lowest close of 2018. Trade fears are causing serious technical damage to the Asian markets.

In Europe, the negative reaction is a bit more subdued, but bad nonetheless. I watch the German DAX closely because there's a very strong long-term positive correlation to our benchmark S&P 500. This morning, the DAX is lower by 176 points, or 1.37%.

Dow Jones futures are currently down 350 points with a little more than 30 minutes left to the opening bell. While this drop will produce some technical heartache, the significant intermediate-term support, in my view, resides at the 2018 low, so approximately 23500. The Dow appears that it will open at least 1000 points above this level. Also, keep in mind that these trade fears have a much more impactful effect on the Dow Jones and other multinational companies found mostly on the S&P 500. It'll be interesting to see how the market weakness affects small cap stocks as the Russell 2000 closed yesterday at an all-time high.

Crude oil ($WTIC) has come under pressure as well, dropping 1.5% and beneath $65 per barrel. Gold ($GOLD) is fractionally lower as well.

Current Outlook

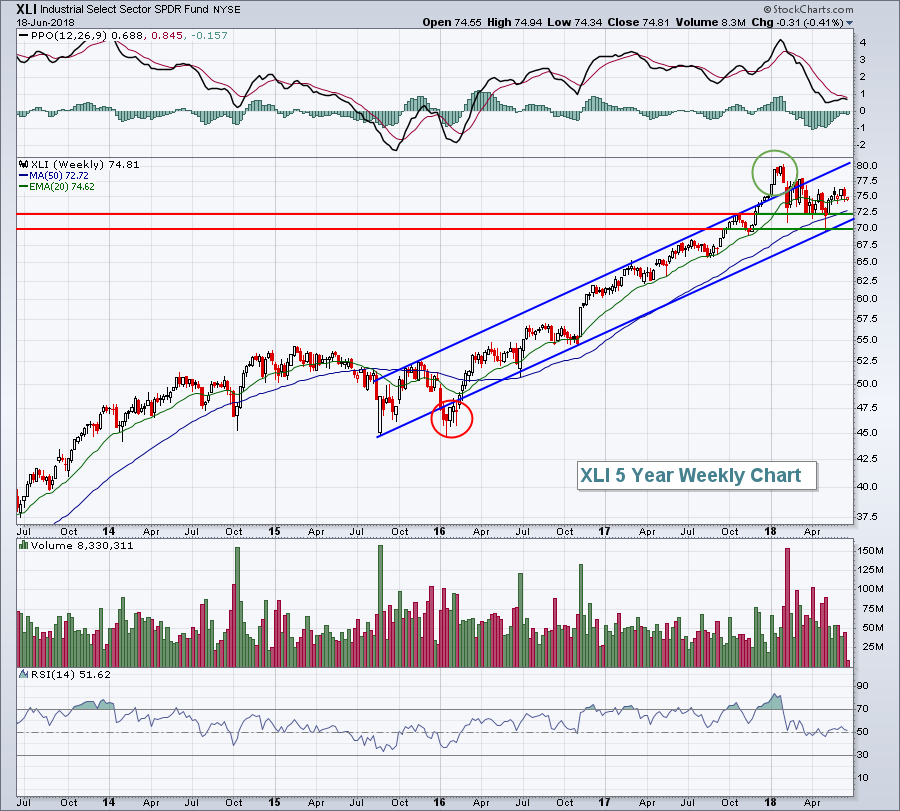

Industrials (XLI) have been relatively weak since January, in part due to the rising dollar, but also due to trade fears. Technically, the group looks fine to me in the short- to intermediate-term so long as key price support holds. Take a look:

The XLI has been in an up channel for the better part of three years, straying to the downside in early January 2016 (red circle) and breaking out in parabolic fashion to the upside in January 2018. Other than that, this has been a very steady, rising industry. Also note that the weekly PPO has remained in positive territory since breaking above centerline resistance in Q1 2016.

The XLI has been in an up channel for the better part of three years, straying to the downside in early January 2016 (red circle) and breaking out in parabolic fashion to the upside in January 2018. Other than that, this has been a very steady, rising industry. Also note that the weekly PPO has remained in positive territory since breaking above centerline resistance in Q1 2016.

Keep an eye on the 70-72 support level. A break beneath that would violate all key moving averages, both price support levels identified above, and channel support. Also, the weekly PPO breaking below its centerline, together with the price breakdown, would suggest increasing caution with this space. Until then, however, I'd be a buyer of the XLI.

Sector/Industry Watch

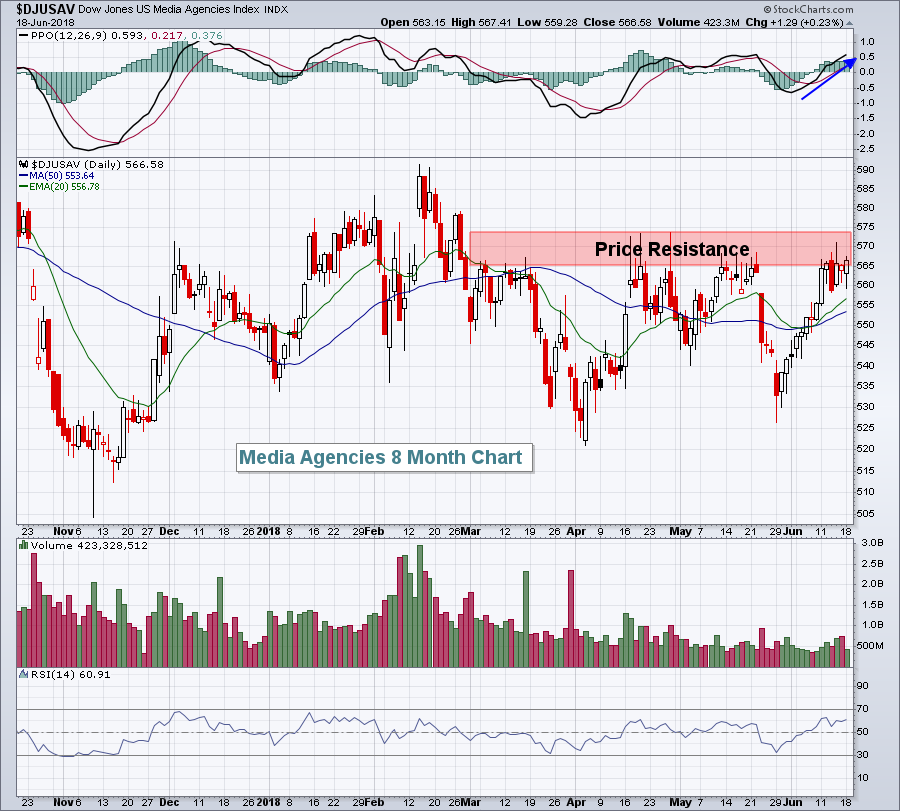

The Dow Jones U.S. Media Agencies Index ($DJUSAV) has pierced the 565 level 22 times over the past few months, but has yet to close a single time above 570. The group closed at 566.58 on Monday and could be poised for a serious rally IF it can close above resistance:

Will the 23rd time be a charm?

Will the 23rd time be a charm?

Historical Tendencies

Media agencies ($DJUSAV) have struggled historically during June, dropping an average of 3.3% over the past two decades. This industry group has just hit a very significant price resistance level. A breakout would be bullish, but failure would be quite bearish given the group's tendency to fall.

Key Earnings Reports

(reports after close, estimate provided):

FDX: 5.72

ORCL: .94

Key Economic Reports

May housing starts released at 8:30am EST: 1,350,000 (actual) vs. 1,310,000 (estimate)

May building permits released at 8:30am EST: 1,301,000 (actual) vs. 1,350,000 (estimate)

Happy trading!

Tom