Market Recap for Tuesday, May 16, 2017

Technology (XLK, +0.47%) and financials (XLF, +0.29%) were the two best performing sectors on Tuesday and the former was the primary reason that the NASDAQ was able to outperform on a day when the U.S. market was bifurcated. The Dow Jones and S&P 500 both started the day with very strong gains before reversing and finishing slightly lower on the session.

Technology was once again led by semiconductors ($DJUSSC), which gained 1.18% for the day. Over the past year, the DJUSSC has gained 52.48%, easily one of the best performing industry groups and that strength continues.

On the other end of the spectrum, retail stocks weighed on consumer discretionary as the XRT (retail ETF) lost the right shoulder support that I had featured recently. It appeared we could be in a bottoming phase in retail but Tuesday's action started painting a different picture. Also, consumer staples were held back by tires ($DJUSTR), which fell 1.82%. The good news is that the DJUSTR hit price support. Check it out:

Look for support at the current level here.

Look for support at the current level here.

Pre-Market Action

Dow Jones futures are extremely weak this morning, down 121 points with 30 minutes left to the opening bell. The 10 year treasury yield ($TNX) has also fallen back to the 2.25% area, down 7 basis points as money clearly is rotating back towards bonds this morning.

Current Outlook

Transportation stocks ($TRAN) are looking quite bearish in the near-term. I'm fairly bullish on the truckers ($DJUSTK) as they've just hit price support on their longer-term weekly chart at 575 as you can see:

Truckers look like the best area of transports. The overall transportation index, however, has printed a long-term negative divergence and is ripe for short- to intermediate-term weakness. That slowing momentum is evident on the following chart:

Truckers look like the best area of transports. The overall transportation index, however, has printed a long-term negative divergence and is ripe for short- to intermediate-term weakness. That slowing momentum is evident on the following chart:

The negative divergence is slight, but railroads ($DJUSRR) are highlighted below in the Sector/Industry Watch section and their negative divergence is quite obvious. Furthermore, airlines ($DJUSAR) are attempting to break out above 280 with an incredibly weak MACD, evidence of slowing momentum in that area of transports.

The negative divergence is slight, but railroads ($DJUSRR) are highlighted below in the Sector/Industry Watch section and their negative divergence is quite obvious. Furthermore, airlines ($DJUSAR) are attempting to break out above 280 with an incredibly weak MACD, evidence of slowing momentum in that area of transports.

Sector/Industry Watch

It's time to ring the register on railroads ($DJUSRR). If the group goes higher, it'll be a shocker to me. A weekly negative divergence could stifle the industry just as it hits major overhead price resistance. Check out the visual:

Negative divergences on weekly charts can take months of consolidation or selling in order to reset the weekly MACD so I'd completely avoid railroads unless we see a heavy volume breakout above the price resistance shown.

Negative divergences on weekly charts can take months of consolidation or selling in order to reset the weekly MACD so I'd completely avoid railroads unless we see a heavy volume breakout above the price resistance shown.

Historical Tendencies

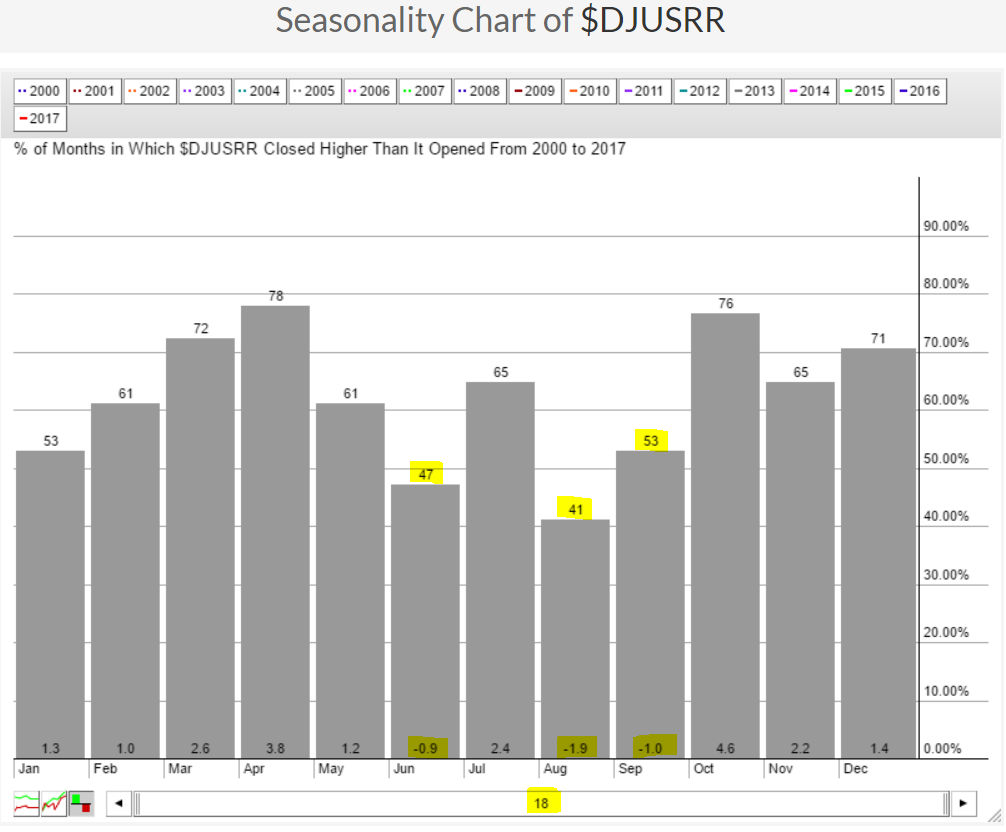

In addition to the technical issues that railroads face in the weeks ahead, below are the bearish historical ramifications for the group as we head into the summer months:

While the first five months of the year carry historical tailwinds - railroads performed extremely well in the first five months of 2017 - the summer time generally produces a slump, additional evidence to consider taking profits.

While the first five months of the year carry historical tailwinds - railroads performed extremely well in the first five months of 2017 - the summer time generally produces a slump, additional evidence to consider taking profits.

Key Earnings Reports

(actual vs. estimate):

TGT: 1.21 vs .89

(reports after close, estimate provided):

CSCO: .53

LB: .29

SNPS: .56

Key Economic Reports

None

Happy trading!

Tom