I’ve written several articles regarding seasonal trends in the markets, including the four-year Presidential Cycle, the “Sell in May” phenomenon, and even general thoughts on cyclical patterns in price.

This time of year, we’re faced with a very interesting anomaly known as the January Barometer.

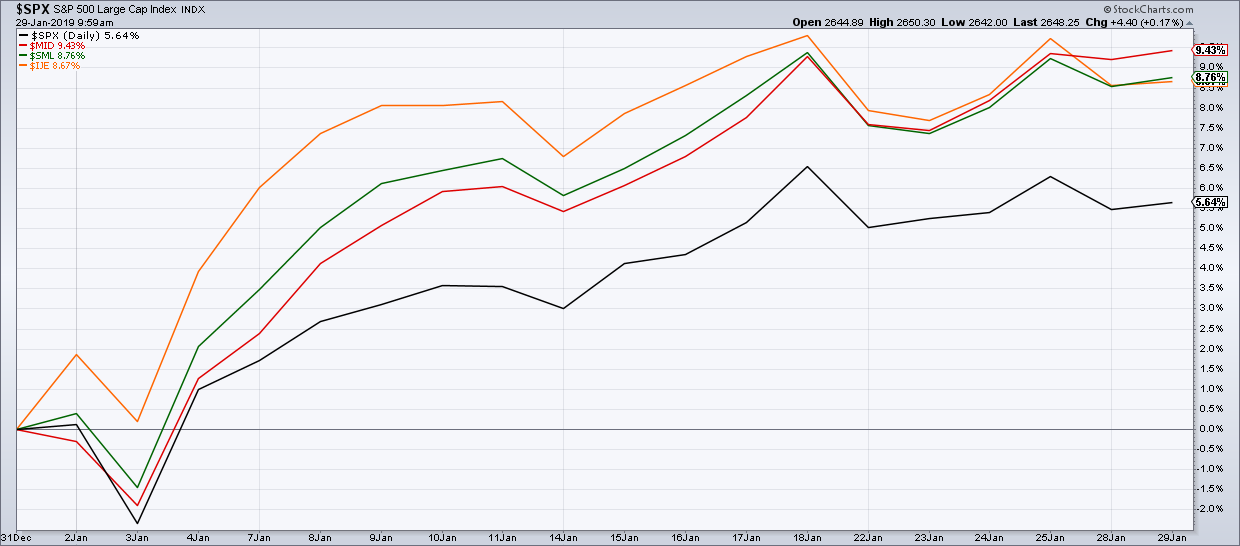

This is different from the January Effect, where January tends to start strong due to money managers going to back to “risk on” following end-of-year window dressing. You also tend to see small caps outperform large caps due to the same reason - that pattern has certainly played out this year.

The January Barometer, popularized by Yale Hirsch of the Stock Trader’s Almanac, suggests that “as goes January, so goes the year.” That is to say, an up January means a positive year for the market, while a down January means a likely down year for the overall market.

The January Barometer, popularized by Yale Hirsch of the Stock Trader’s Almanac, suggests that “as goes January, so goes the year.” That is to say, an up January means a positive year for the market, while a down January means a likely down year for the overall market.

So, based on this January’s 5% gain (and barring any major selloff in the next couple days), we should be feeling pretty good about the rest of 2019, right?

Not so fast.

As money manager John Dorfman points out, the January Barometer has been correct about 2/3 of the time since 1950. That doesn’t sound too bad! However, blindly predicting the market would always close higher would actually have been correct around 78% of the time!

Even last year, the S&P 500 had a positive January 2018, before finishing the year down over 6%. To be honest, I’m fairly certain that the January Barometer became a "thing” just because January tends to be a positive month. Coincidentally, the S&P 500 has tended to end each year higher than where it started. Post hoc ergo propter hoc.

Similar to the Super Bowl Indicator, which purports to predict the year’s returns by which conference champion wins the Super Bowl, the January Barometer belongs in the bucket of “high in entertainment value, low in predictive value” indicators.

So in the absence of prescient January predictions, what should we follow?

Price.

Follow the trends, follow the breakouts, follow the patterns. Then you’ll have a good sense of where the markets are headed over any given time frame.

At this point, I see the S&P 500 as being in a cyclical bear market within a secular bull market. Until I see enough evidence of a break of that pattern, I’m happy expecting it to persist.

RR#6,

Dave

![]()

David Keller, CMT

President, Sierra Alpha Research LLC

![]()

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.