Question: When can “overbought” be a good thing?

Question: When can “overbought” be a good thing?

Answer: When something becomes really overbought.

Allow me to explain. The Relative Strength Index (RSI) is one of the most common ways to measure price momentum, ranging from 0 to 100. When the RSI becomes overbought, the price has risen too high too quickly, generally leading to a downside correction. When the RSI becomes oversold, the price has dropped too low too quickly and you’d expect an upside rally to compensate.

That’s the simple interpretation, anyway. A deeper look into RSI shows that it is a rich measure of relative momentum that can put any price move into proper context.

First off, it’s worth remembering that the “relative” in the name is a bit of a misnomer, as the RSI compares the current price relative not to other assets but to the security's own price data, measuring the average up day vs. the average down day over a certain period of time. That is to say, when a certain stock closes higher on the day, how much higher has it gone? On down days, how much lower does the stock tend to go? In this manner, the RSI shows the most recent price movements relative to the “average” price movements for that specific security.

This is why RSI makes for a fantastic screening mechanism. It allows you to focus in on stocks or ETFs that are moving in a more extreme fashion than what is normal for them.

One of the worst “rookie mistakes” of technical analysts is to think of overbought as bad and oversold as good. When a stock is overbought with an RSI above 70, all that means is that the price has gone up a lot - that’s it. On its own, this doesn’t suggest negativity, but tells you the uptrend has been strong. The real signal is when the RSI exits the overbought region, which suggests that the upside momentum has been alleviated and that we’re now in a corrective pattern.

To put it another way, a security's RSI becoming overbought is a leading indicator and should put that chart on your watchlist of extreme moves worth monitoring. The RSI exiting the overbought region is more of a lagging indicator, suggesting that a downside correction has likely begun.

So can an RSI overbought condition ever be a good thing? Absolutely. When the RSI is “extremely overbought” with a value above 80, the upside momentum has become so great that the price will likely continue in the direction of the primary trend, following a brief corrective pattern.

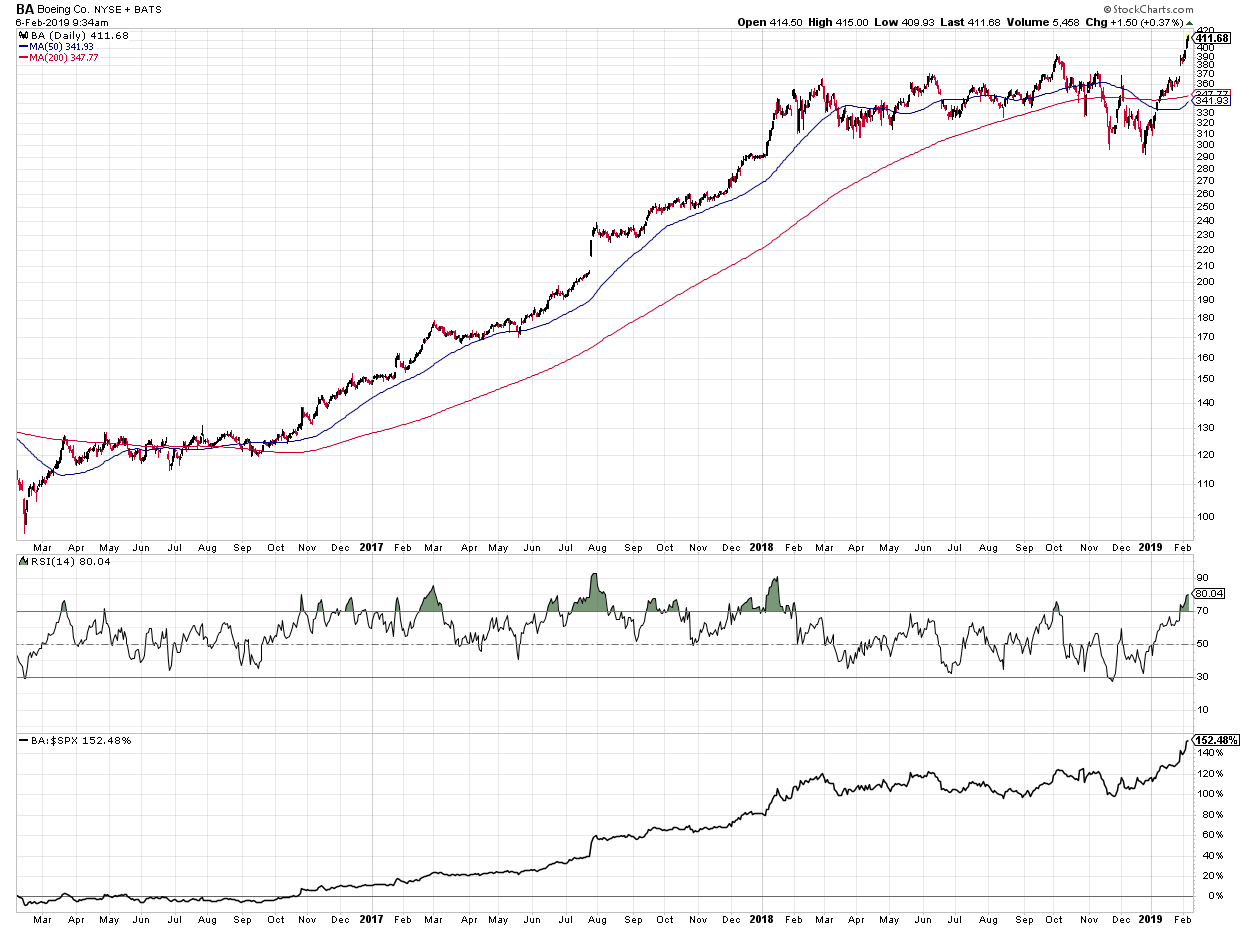

Let’s take a look at Boeing (BA) for an example of how this “good overbought” can play out.

For much of 2016, BA was in a sideways range, fluctuating between 115 and 130. Then, in October, the price broke to new highs as the RSI became overbought and then proceeded to hit the key 80 level. While we saw a brief pullback soon after, this ended up being the beginning of a 16-month stretch of significant price gains and relative outperformance.

For much of 2016, BA was in a sideways range, fluctuating between 115 and 130. Then, in October, the price broke to new highs as the RSI became overbought and then proceeded to hit the key 80 level. While we saw a brief pullback soon after, this ended up being the beginning of a 16-month stretch of significant price gains and relative outperformance.

Also notice how, during the course of the uptrend, the RSI became overbought many times and never reached below the 40 level on pullbacks. This is a crucial theme for extended uptrends.

You'll also notice that BA has had a similar structure in early 2019, wherein a long basing pattern has now been resolved to the upside. Notably, the RSI has just reached 80, much like in late 2016. This tells me to expect a short-term pullback within a long-term uptrend.

What would tell me that this pattern is incorrect? I'll need to watch the RSI on any correction. As long as the RSI remains above 40, then the long-term uptrend is in good shape.

With indicators like RSI, there is often a “surface level” interpretation based on simplistic signals. But a deeper dive into many technical indicators can illuminate patterns in crowd behavior, which can be quite profitable for the savvy technician.

RR#6,

Dave

David Keller, CMT

President, Sierra Alpha Research LLC

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.