In Perry Kaufman's book, Trading Systems and Methods, he discusses a relationship between small-caps and large-caps:

"Investors shift from small-cap stocks to the S&P 500 and then to the Dow when they are looking for safety."

A quick comparison of the daily charts of the SPX, Dow and IWM yield some interesting analysis. Let's start with the Dow. The picture is not particularly bullish, but we can see that support is holding and the Price Momentum Oscillator (PMO) is rising and on a BUY signal.

The S&P 500 has not broken down yet either, but the PMO has turned down below its signal line which is a sign of negative momentum. This makes sense if it is true that investors prefer first the S&P 500 and next the Dow during periods of uneasiness.

Now we see IWM's spectacular breakdown from its bearish descending triangle. This formation is on the S&P 500 and Dow above and you'll see it on many of the other large- and small-cap indexes. IWM could be leading the way to a market breakdown. Small-caps are typically the first place we will see weakness and in many cases, the first place to see recovery.

Now we see IWM's spectacular breakdown from its bearish descending triangle. This formation is on the S&P 500 and Dow above and you'll see it on many of the other large- and small-cap indexes. IWM could be leading the way to a market breakdown. Small-caps are typically the first place we will see weakness and in many cases, the first place to see recovery.

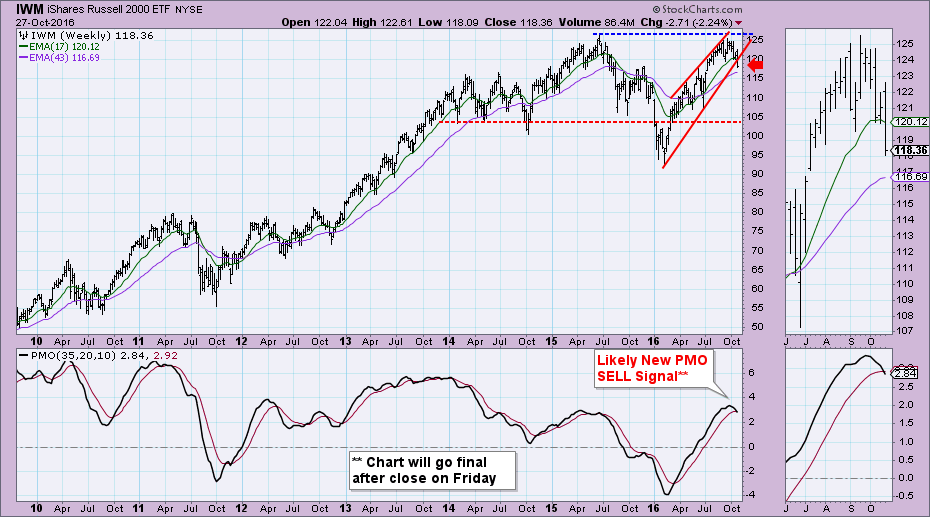

The picture does not brighten for IWM when you look at the weekly and monthly charts. The rising wedge is executing. You can see a wedge on most of the large-cap index weekly charts. (Go to the DecisionPoint LIVE free public ChartList to review) and a new IT PMO SELL signal is on tap. This signal will not go "final" until the close tomorrow.

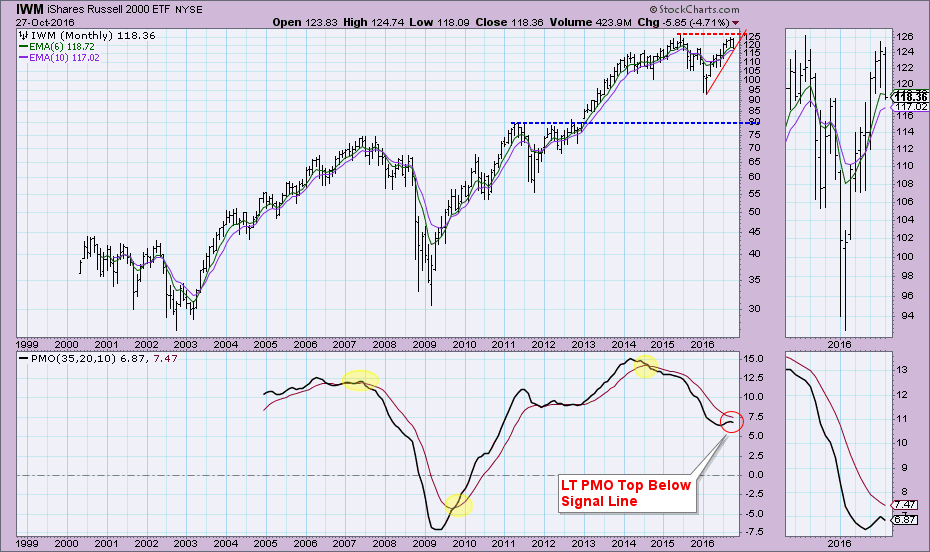

The chart pattern on the monthly chart is bullish (ascending triangle), but the PMO just topped below its signal line which implies that a breakout isn't likely.

Conclusion: It is said that money moves from small-caps to large-caps when investors are unsure. In addition, it is said that investors will use Gold as a safe haven. Gold has managed to hold its own during the Dollar's recent explosive rally which suggests market uneasiness. There is a high likelihood that IWM is a harbinger of a breakdown in the major market. We'll watch the Dow closely in the DecisionPoint Report webinars and the DecisionPoint blog for a follow-through breakdown.

The NEW DecisionPoint LIVE public ChartList has launched! Click on the link and you'll find webinar charts annotated just before the program. Additional "chart spotlights" will be included at the top of the list. Be sure and bookmark it!

Come check out the DecisionPoint Report with Erin Heim on Wednesdays and Fridays at 7:00p EST, a fast-paced 30-minute review of the current markets mid-week and week-end. The archives and registration links are on the Homepage under “Webinars”.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin