ChartWatchers October 29, 2021 at 11:14 PM

Where should you invest your hard-earned money? That's a question that we ask ourselves quite frequently. And I don't know that there's an easy answer to this question. I like to see where Wall Street is investing its money and then make a decision to follow relative strength... Read More

ChartWatchers October 29, 2021 at 08:04 PM

Hertz and Tesla signed an order for 100,000 vehicles this week. The Tesla stock chart (TSLA) migrated from $800 to $1100 in October and the rental car order was just adding throttle for the chart! However, the announcement also lit the fuse on the entire electric vehicle space... Read More

ChartWatchers October 29, 2021 at 07:45 PM

Like many traders, I have a few "go to" technical indicators I rely on when making trading decisions. One that I have found to be extremely useful over the years is the Relative Strength Index, better known as the "RSI"... Read More

ChartWatchers October 29, 2021 at 07:36 PM

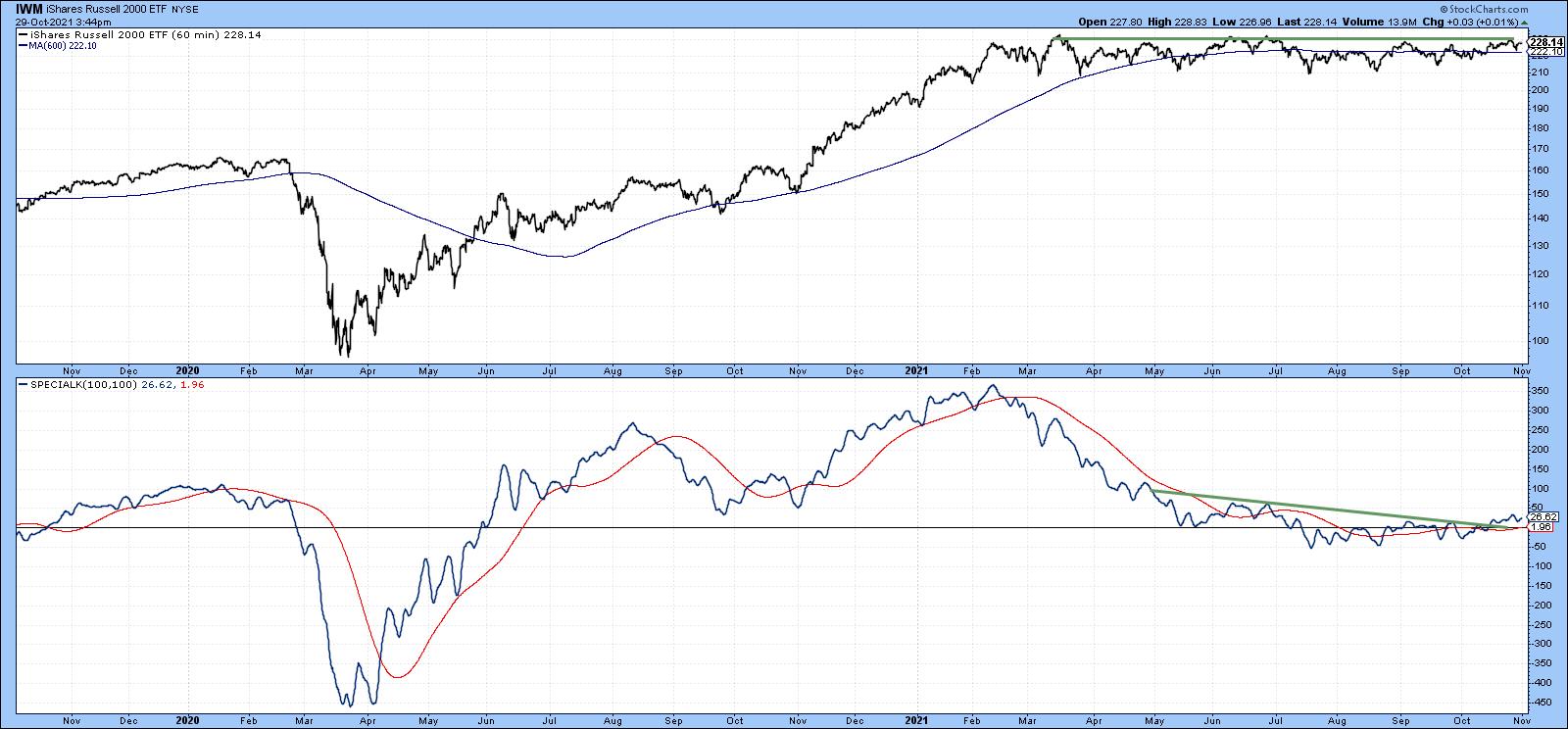

Sometimes, when I mess around with the charts, I discover an entirely new approach that I had not thought of before. Last week saw one of those breakthrough moments when, for the first time ever, I applied the Special K to hourly charts and came up with some interesting results... Read More

ChartWatchers October 29, 2021 at 07:06 PM

Moving averages are classic trend-following indicators and the 200-day SMA is perhaps the most widely used long-term moving average. This article will put the 200-day to the test using the Russell 2000 ETF (IWM)... Read More

ChartWatchers October 22, 2021 at 10:01 PM

Tesla (TSLA) reported its earnings last week with the stock getting a nice boost in spite of a steady move higher since its mid May low. In fact, the company notched an all-time high on Friday as it exceeded $900 for the first time... Read More

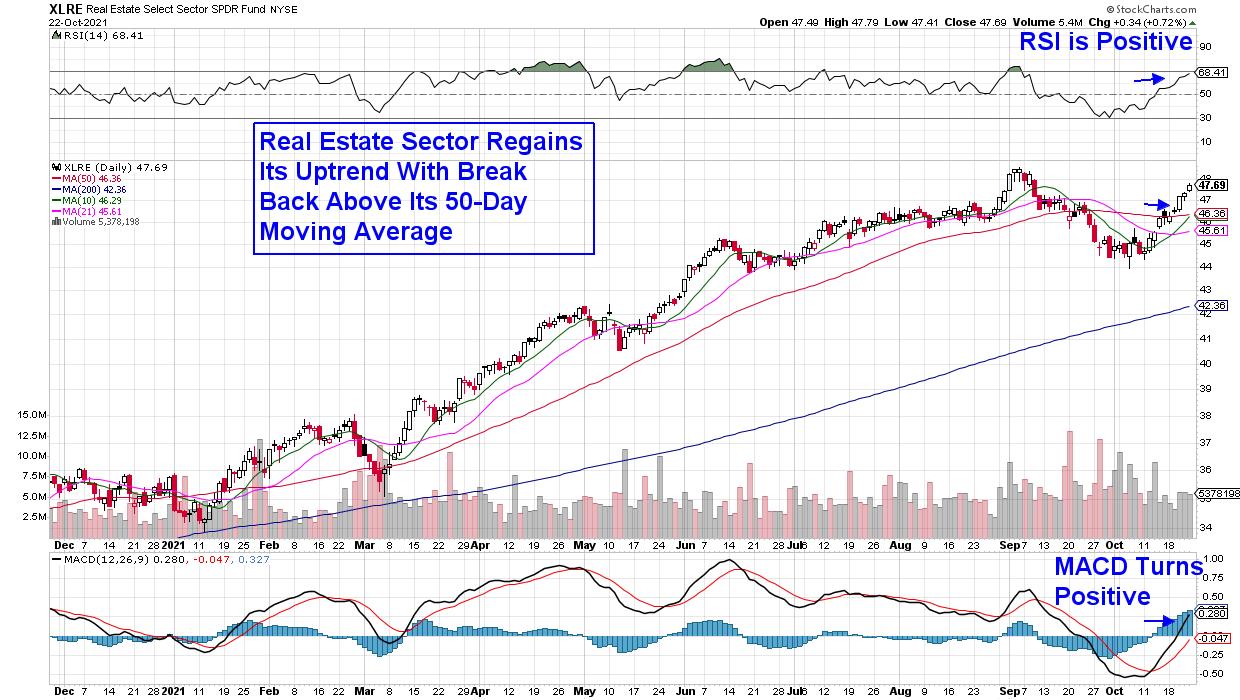

ChartWatchers October 22, 2021 at 09:49 PM

Fed Chair Powell signaled new concerns about inflation today after remarking that global supply-chain constraints and shortages that have led to elevated inflation "are likely to last longer than previously expected"... Read More

ChartWatchers October 22, 2021 at 01:46 PM

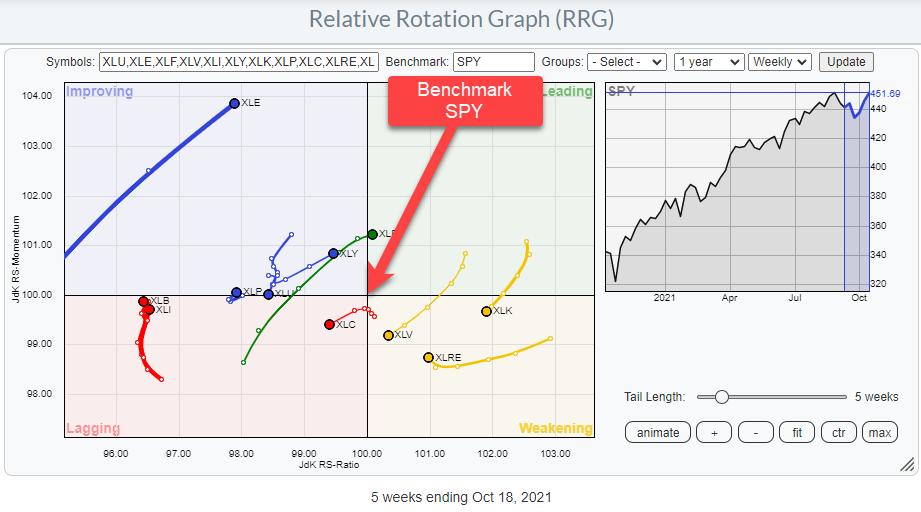

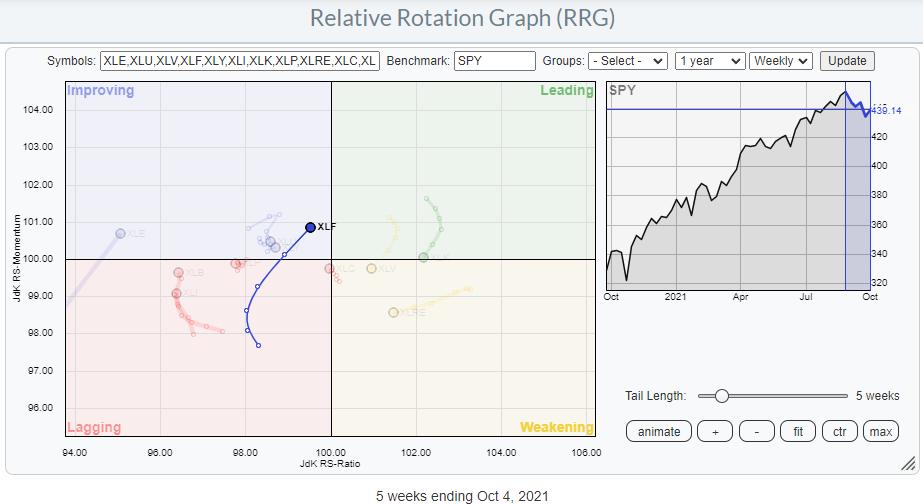

The two crucial elements of a Relative Rotation Graph (RRG) are the "universe" and the "benchmark". The Benchmark The benchmark for a Relative Rotation Graph is the common denominator for all securities that are present in the universe... Read More

ChartWatchers October 15, 2021 at 06:52 PM

(This is an excerpt from Thursday's (10/14) DecisionPoint Alert) We want to watch the 30-Year Fixed Mortgage Interest Rate, because, for the most part, people buy homes based upon the maximum monthly payment they can afford... Read More

ChartWatchers October 15, 2021 at 05:42 PM

Stocks surged for the second Thursday in as many weeks, but this Thursday's surge was a lot different than the previous week. This week's surge featured a strong open and strong close as well as the strongest breadth in four months... Read More

ChartWatchers October 15, 2021 at 03:00 PM

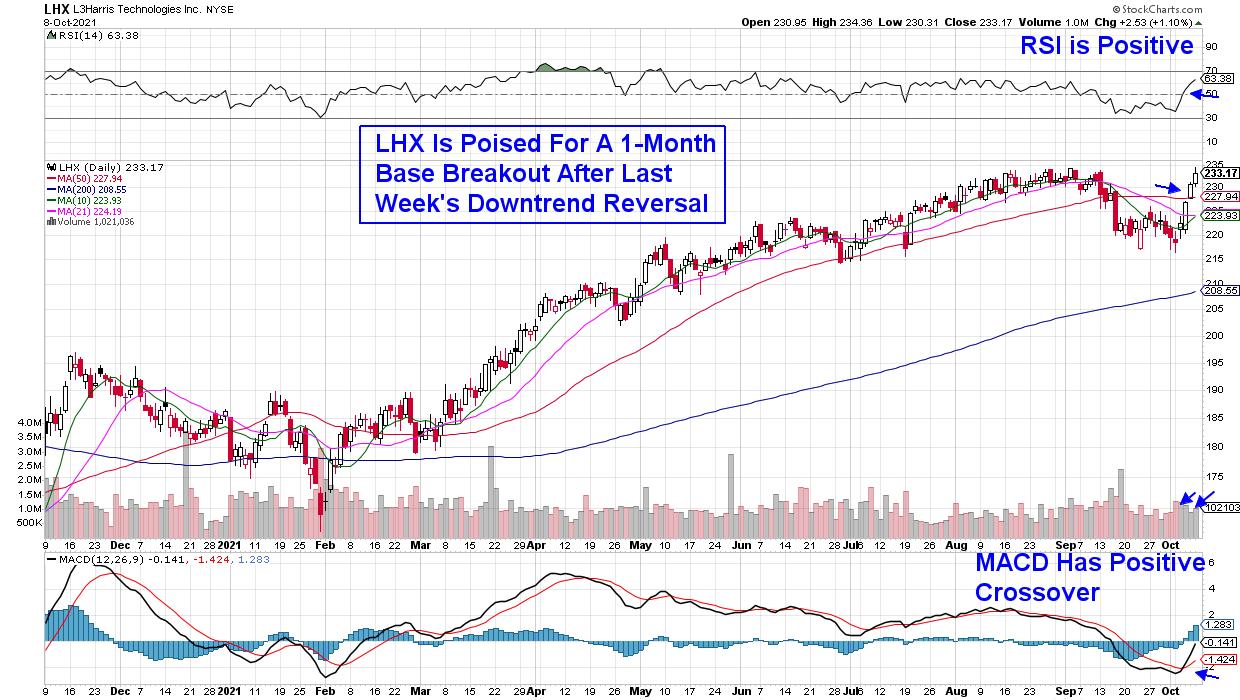

On September 28th, I wrote a "Trading Places" blog article titled "Rising Yields Have A History of Favoring These Stocks; One Such Stock is Being Heavily Accumulated"... Read More

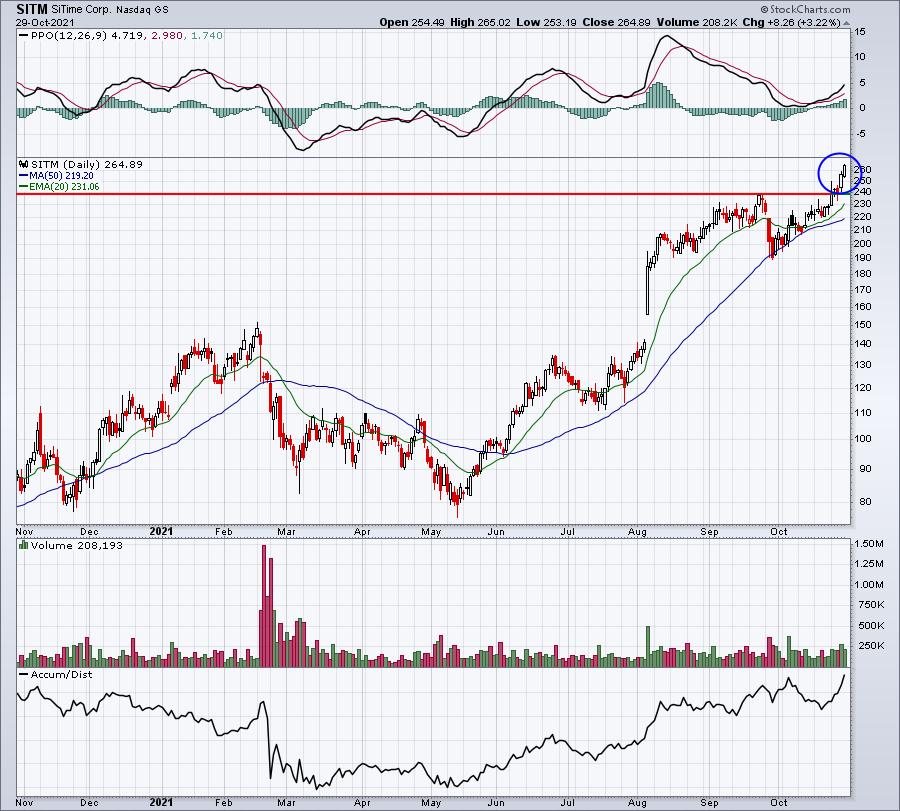

ChartWatchers October 15, 2021 at 01:41 PM

After a month of wandering sideways, the market seems to be finding its legs as we enter prime time for earnings season. We have a PPO buy signal showing up, just as the market returns to the 50-DMA moving average... Read More

ChartWatchers October 08, 2021 at 10:52 PM

The broader markets have been struggling amid inflation and interest rate fears that have collided with a global energy crisis. After peaking in price in early September, the S&P 500 has been in a downtrend that it's been struggling to reverse... Read More

ChartWatchers October 08, 2021 at 04:08 PM

On the Relative Rotation Graph for sectors, the tail on XLF is showing one of the most promising rotations, being inside the improving sector and traveling at a strong RRG-Heading towards leading... Read More

ChartWatchers October 08, 2021 at 02:30 PM

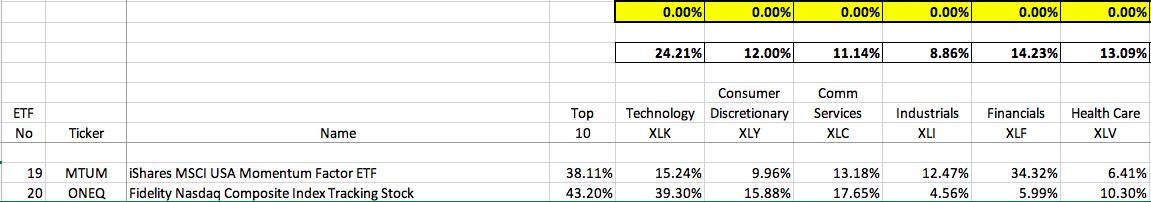

I have two reasons for writing this article. First, I'm hosting a FREE webinar relating to ETF selection on Saturday morning that I'll discuss later... Read More

ChartWatchers October 01, 2021 at 10:04 PM

Last week, the Fed announced that tapering is likely to begin later in the year, to be later followed by a leisurely hike in rates. As usual, those pesky impatient markets have decided to raise rates now rather than wait for the clobbering they know they will get later... Read More

ChartWatchers October 01, 2021 at 06:49 PM

In last week's ChartWatchers newsletter, I wrote about the climax days that occurred the previous week. We saw two more last week and I'll give you the heads up that today we saw an upside initiation climax... Read More

ChartWatchers October 01, 2021 at 06:44 PM

With Q3 earnings season kicking off over the next few weeks, it's important to try to identify those companies that might shine and those that might suffer once they release their earnings... Read More

ChartWatchers October 01, 2021 at 04:26 PM

Chartists looking to trade in the direction of the bigger trend have two options. First, take trend signals and act when the trend turns up... Read More

ChartWatchers October 01, 2021 at 03:33 PM

I rode the rails through western Canada last week on the Rocky Mountaineer. This particular tour uses the freight railway lines that run through the Rockies; I traveled on the CP Rail line as well as the CN Rail line. Railways are a great clue to the health of the economy... Read More