(This is an excerpt from Thursday's (10/14) DecisionPoint Alert)

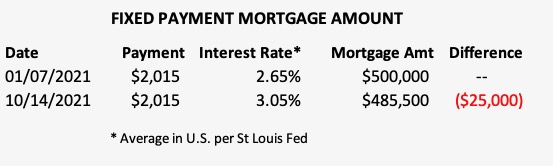

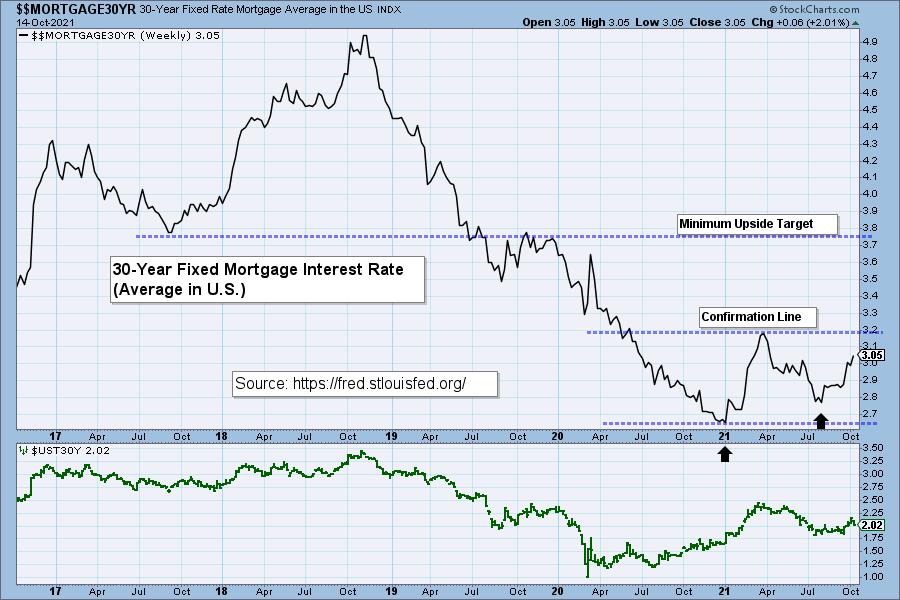

We want to watch the 30-Year Fixed Mortgage Interest Rate, because, for the most part, people buy homes based upon the maximum monthly payment they can afford. As rates rise, a fixed monthly payment will carry a smaller mortgage amount. (See table.) As mortgages are forced to shrink, real estate prices will have to fall, and many sellers will increasingly find that they are upside down with their mortgage. That, or we will now see inflated real estate prices begin to normalize.

Click here to register in advance for the recurring free DecisionPoint Trading Room! Recordings are available!

Right now, rates are rising quickly. Looking at the chart, we see a double-bottom forming. This tells us that rates could continue rising. If it moves above the confirmation line of the double-bottom (that confirms the pattern), the minimum upside target would take rates all the way to 3.75%. Add this to inflation, rising energy costs and other data points and life is about to get harder for home buyers and renters alike.

Technical Analysis is a windsock, not a crystal ball.

--Carl & Erin Swenlin

(c) Copyright 2021 DecisionPoint.com

Helpful DecisionPoint Links:

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.