ChartWatchers January 29, 2021 at 10:00 PM

Stock indexes remain under pressure again today and are pressuring moving average lines. Chart 1 shows the Dow Industrials falling below its 50-day moving average for the first time since early November... Read More

ChartWatchers January 29, 2021 at 09:59 PM

This week's 3.2% decline in the S&P 500 has this Index closing at a very important area of support, as investor confidence has been shaken amid discouraging Fed comments and weak economic data... Read More

ChartWatchers January 29, 2021 at 09:23 PM

I've spoken recently of the bearish divergences emerging from breadth indicators, including the anemic new 52-week highs list, as well as a breakdown in the percent of stocks trading above their 50-day moving averages... Read More

ChartWatchers January 29, 2021 at 04:09 PM

Just stop. Listen, the two key drivers to the long-term direction of the stock market are (1) earnings growth and (2) monetary policy. That's it. The rest is completely noise that you need to tune out. Most humans are innately pessimistic. It's how we're wired... Read More

ChartWatchers January 29, 2021 at 03:17 PM

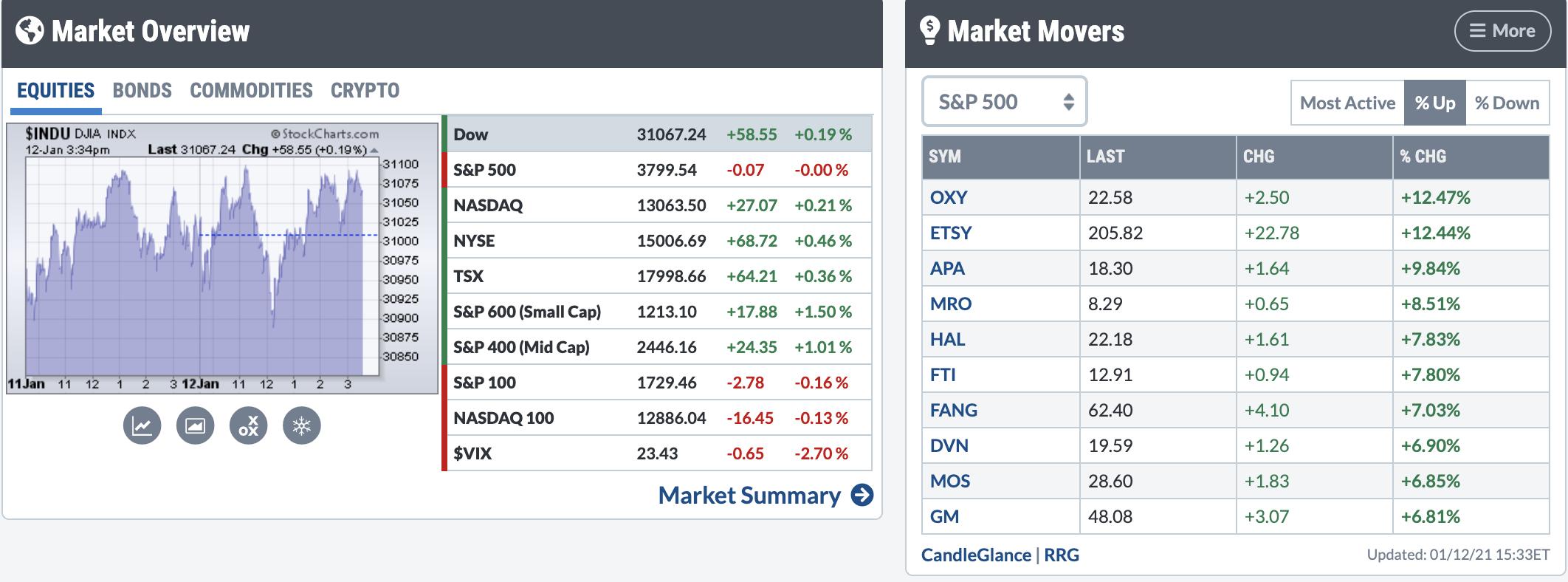

At the start of this week in my weekly StockCharts TV show Sector Spotlight, I discussed the re-emerging strength of Consumer Discretionary and Technology stocks... Read More

ChartWatchers January 22, 2021 at 08:00 PM

Last week, I recorded a 40-minute presentation with my friend Bruce Fraser on the 2021 outlook. It's currently being featured on StockCharts TV and calls for a significant extension to the bull market... Read More

ChartWatchers January 22, 2021 at 07:16 PM

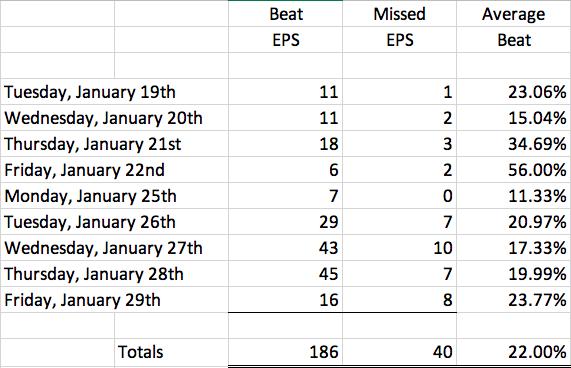

Earnings season is off to the races, with Netflix (NFLX) flexing its muscles last week as it beat expectations all the way around, rising 18% at its peak the day after its numbers were released. Netflix isn't the only company to report strong earnings... Read More

ChartWatchers January 22, 2021 at 07:08 PM

I believe it is time to revisit the Rydex Ratio sentiment chart. A few DecisionPoint.com subscribers have noticed how overbought it has become; I wrote about it in last week's DP Weekly Wrap for subscribers of the DP Alert... Read More

ChartWatchers January 22, 2021 at 05:07 PM

The Semiconductor ETF (SOXX) and several other ETFs are on a serious roll in 2021. For the fourth time since 2009, 14-day RSI was above 70 for ten or more days. This is an exceptional streak, but SOXX is not alone and there are even longer streaks... Read More

ChartWatchers January 22, 2021 at 04:42 PM

Some online retailers are all lined up to explode higher. This is a good weekend to take a look at them before they report earnings and decide how you want to position. Amazon (AMZN) has been consolidating sideways, and this is seasonally a nice time for this chart... Read More

ChartWatchers January 16, 2021 at 12:51 AM

It was another winning week for most of the stocks from my bi-weekly MEM Edge Report. In fact, over 74% of the Suggested Holdings from this report outperformed the broader markets, some doing so by a very wide margin... Read More

ChartWatchers January 15, 2021 at 07:00 PM

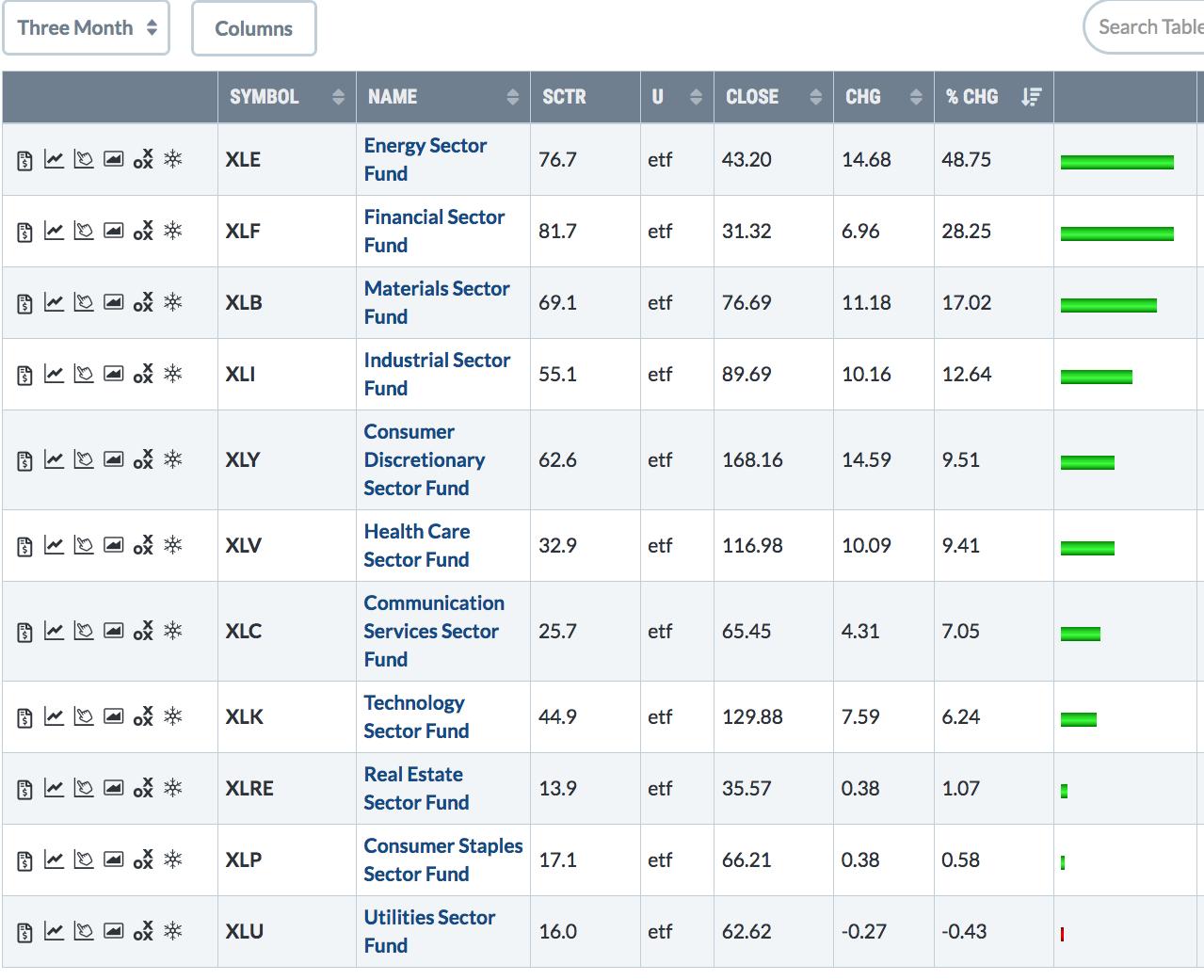

The last three months have seen rising stock prices. What's especially encouraging is which sectors have led the market higher. Chart 1 plots the sector performance over those three months... Read More

ChartWatchers January 15, 2021 at 06:56 PM

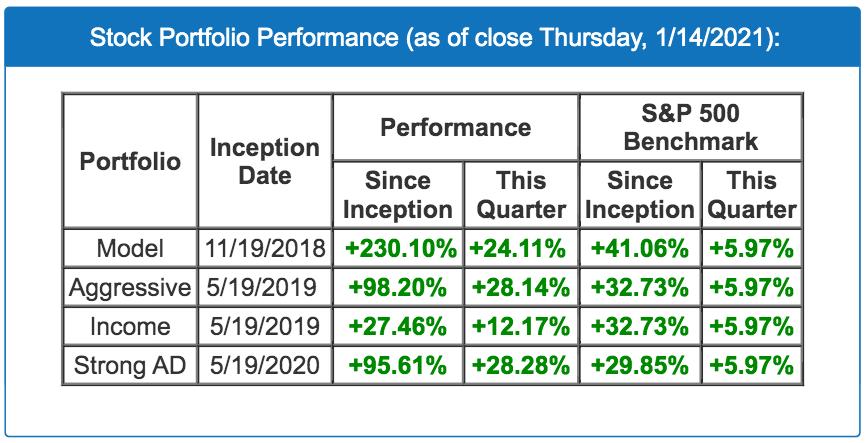

All of the stocks and ETFs in our 5 current portfolios are "drafted" in real time during our members-only events that we hold quarterly. I don't Monday Morning quarterback; I listen to what Wall Street is saying and stick with the themes that are driving big money... Read More

ChartWatchers January 15, 2021 at 03:53 PM

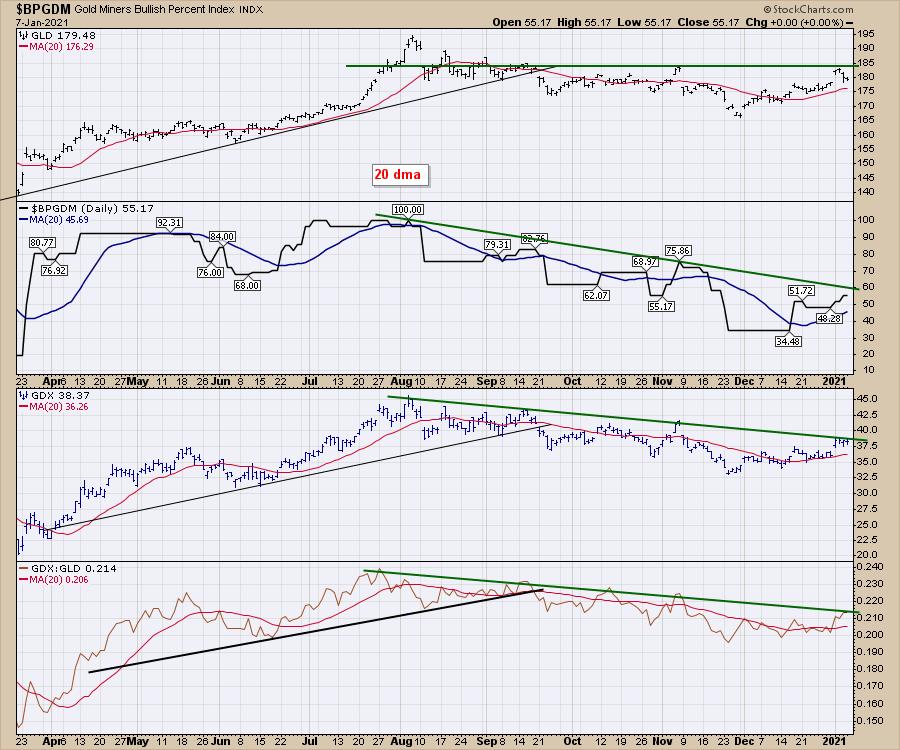

Back in early December, we discussed the three signals we would need to see to turn bullish on gold and gold stocks... Read More

ChartWatchers January 15, 2021 at 02:00 PM

Relative Rotation Graphs, or RRGs, can help you get a better view of the big picture... Read More

ChartWatchers January 08, 2021 at 08:33 PM

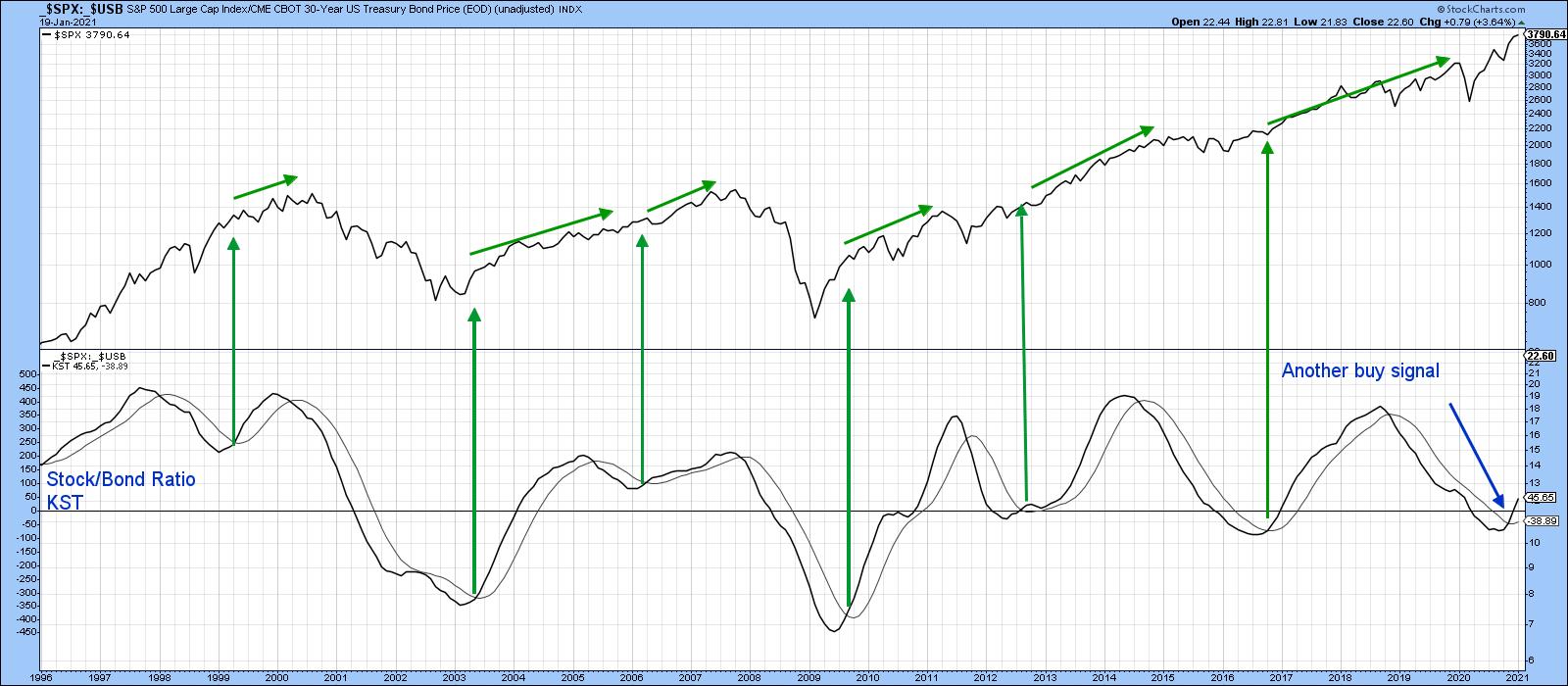

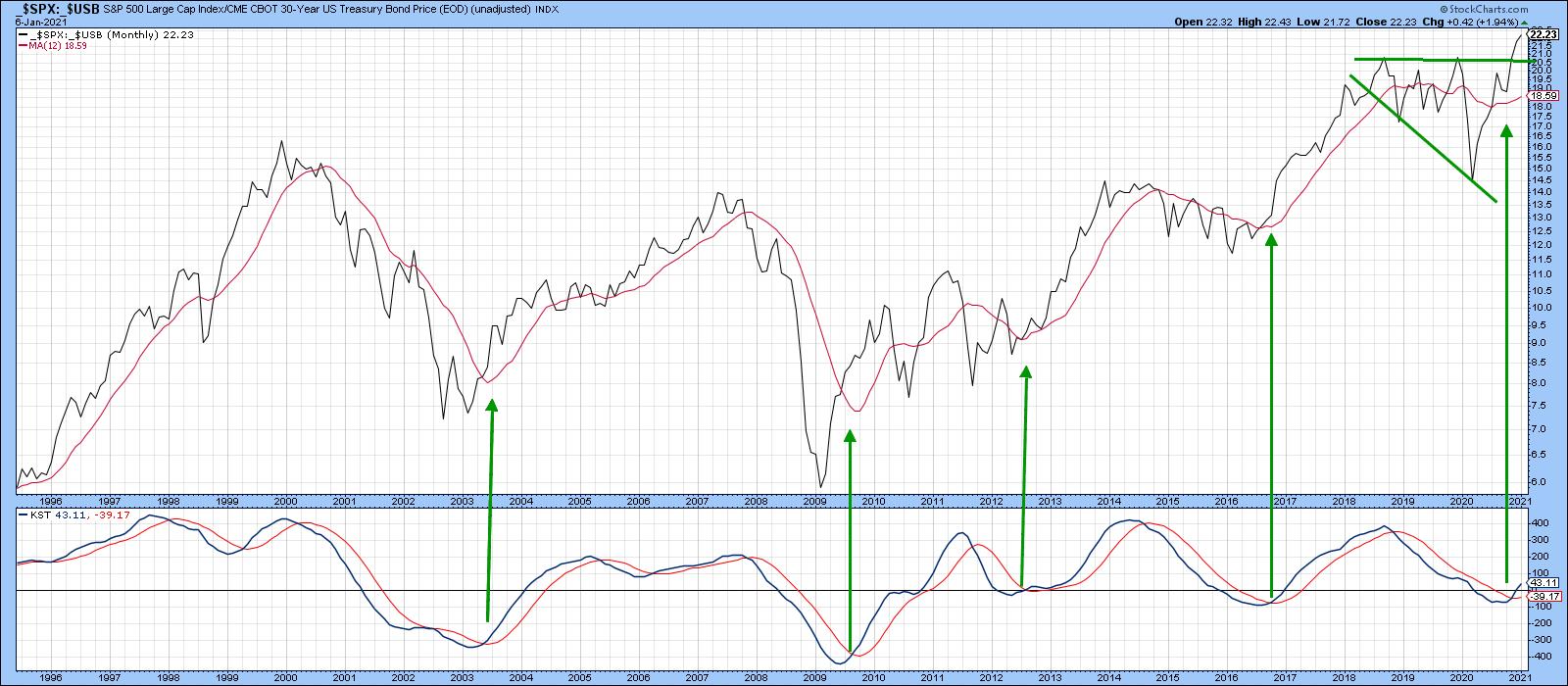

Prices are determined by the attitude of market participants to the emerging fundamentals. Fortunately for us technicians, these attitudes move in trends, and once a trend gets underway it tends to perpetuate... Read More

ChartWatchers January 08, 2021 at 07:44 PM

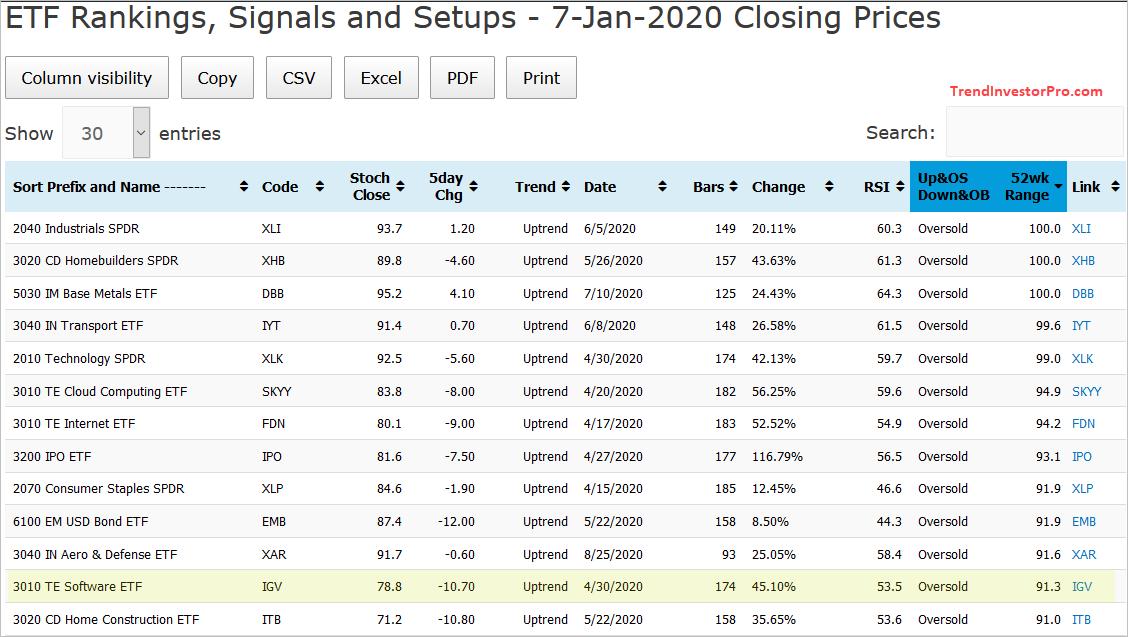

In my last ChartWatchers article, I mentioned that we had started a new ETF feature of the EarningsBeats.com service. This new feature is meant for those individuals who are interested in putting capital to work in ETFs as part of their trading strategy... Read More

ChartWatchers January 08, 2021 at 05:53 PM

It is hard to see any downside when you're making a lot of money, which is why people can't resist a bubble. From the Tulip Mania, to DotCom Fever, to the Real Estate Crisis, for many people the appeal of easy and fast money cannot be resisted... Read More

ChartWatchers January 08, 2021 at 04:25 PM

Tech-related ETFs are lagging over the last few weeks, but they are still in uptrends overall. This means bullish setups still matter so today we will look at a classic mean-reversion setup in the Software ETF (IGV)... Read More

ChartWatchers January 08, 2021 at 11:55 AM

The radical waves in the economic cycle in 2020 look set to continue into 2021. Elon Musk has outpaced Jeff Bezos as the richest man in the world, which I would have never mapped out as a possibility. The chart of Tesla (TSLA) continues to surge higher... Read More

ChartWatchers January 01, 2021 at 08:00 PM

This article is about using charts in different time spans to gain a better perspective on an individual stock or any other market. I'm using copper producer Freeport McMoran (FCX) to make that point... Read More

ChartWatchers January 01, 2021 at 07:49 PM

Happy New Year! The S&P 500 closed the year at a new high in price despite record new COVID-19 cases worldwide. A new, more contagious variant of the virus is also being ignored as investors are instead focused on an economic recovery buoyed by the rollout of vaccines... Read More

ChartWatchers January 01, 2021 at 04:24 PM

Happy New Year! Many market pundits view every year in the stock market exactly the same. I do not. I believe there are "big picture" headwinds and tailwinds that impact the stock market in much the same way as currents impact fish attempting to swim upstream vs. downstream... Read More

ChartWatchers January 01, 2021 at 08:00 AM

My first article for the Chartwatchers newsletter going into the new year... 2021!! First of all, I wish all readers and watchers of Sector Spotlight a very happy and, above all, healthy new year... Read More