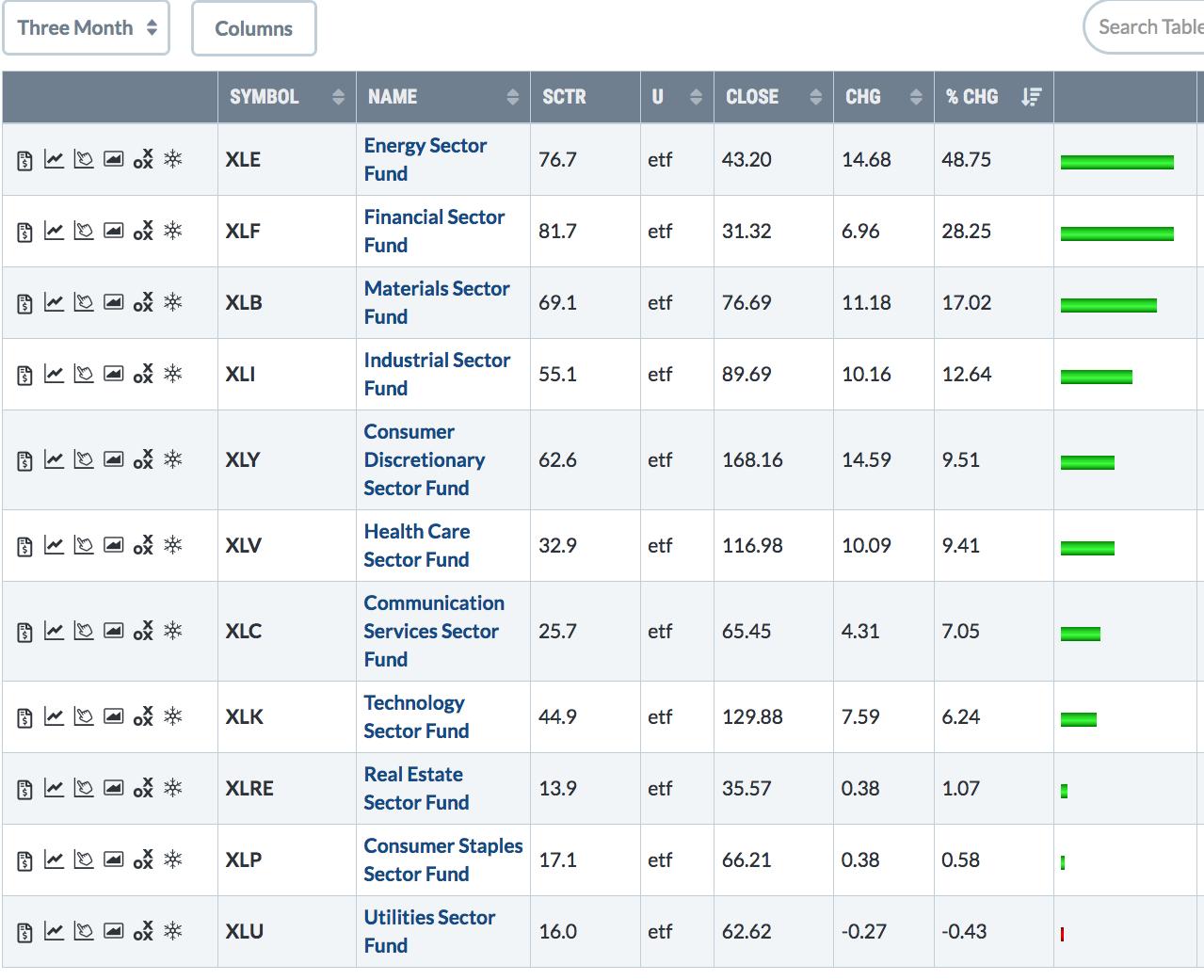

The last three months have seen rising stock prices. What's especially encouraging is which sectors have led the market higher. Chart 1 plots the sector performance over those three months. The top five sectors have been energy, financials, materials, industrials, and consumer cyclicals. All five are economically-sensitive stock groups that do better in a stronger economy. At the same time, the three weakest sectors have been utilities, staples, and real estate. All three are defensive in nature.

Rising commodity prices and rising bond yields may also explain some of that sector performance. Energy and materials, for example, are benefiting from rising commodity prices as part of the reflation trade. Rising bond yields have helped financials become market leaders. That may also explain the relatively weak performance by bond proxies like utilities and REITs. Rising bond yields may have also contributed to a rotation out of large technology growth stocks and into more value-oriented cyclical stocks. That rotation has helped to broaden out the market rally which is another encouraging sign. But it has pushed technology to the lower end of the leader board. And may explain why the largest tech stocks have spent the last three months trading sideways while the rest of the market has been rallying.

Chart 1

Chart 1

Editor's Note: This is an article that was originally published in John Murphy's Market Message on Thursday, January 14th at 2:28pm ET.