Just stop.

Listen, the two key drivers to the long-term direction of the stock market are (1) earnings growth and (2) monetary policy. That's it. The rest is completely noise that you need to tune out.

Most humans are innately pessimistic. It's how we're wired. And it shows every single time I look at an article headline. We love bad news. We love the train wreck. We can't get enough of it. Well, don't let that faulty human characteristic drive your stock market thinking. Hey, it's your financial future, so do what you think is right.

But here are the facts.

The Fed Could Not Be More Dovish

Did you hear Fed Chair Powell this week after the latest FOMC meeting? This is what I heard in summary form. The Fed believes growth could slow. Do you understand what that means in terms of future Fed policy? They will do whatever is necessary to support future growth. That means interest rates, which are already near historic lows, will remain that way for the foreseeable future. This is the only time in my lifetime that I've seen interest rates at these levels, which is incredibly bullish for U.S. equities. We're a debt-driven society and borrowing costs have NEVER been cheaper. STOP FIGHTING THIS.

We're also in line for more government spending. Say what you want about it, but it increases economic activity, thereby increasing profits for U.S. companies. Janet Yellen, former Fed Chair and now U.S. Treasury Secretary, is calling for more stimulus, as is Congress. Think about what more stimulus, a potential infrastructure package and a dovish Fed willing to do almost anything to re-inflate our economy will mean to future earnings growth of U.S. companies. Fed Chair Powell is on record saying that interest rates will remain low into 2023. That's at least two more years of the open candy jar! But even higher rates, when they emerge, from these ridiculously low levels won't disrupt the growth over the next several years.

And Then There's Earnings...

Many naysayers constantly point to the high PE ratio in the market today and continue to compare it to other major market tops. Again, it's our pessimistic nature. There are a couple things that must be understood here:

- During a historically-low interest rate environment, there are few investing alternatives to equities, triggering higher PE ratios (trust me, it's okay). Investors will be pay up for earnings.

- Rapidly-rising earnings forecasts will lower those current "scary" PE calculations.

I spent two decades in public accounting, mostly on the audit side. But I was involved in business valuations for clients - and nothing sends valuations higher than the combination of strong earnings growth and low interest rates. High growth rates rapidly expand future profit scenarios, and low interest rates exponentially increases the value of that future earnings growth when you discount it back to the present day. It's fairly simple math that Wall Street understands, while many other market pundits simply do not. The perma-bears most definitely don't understand it.

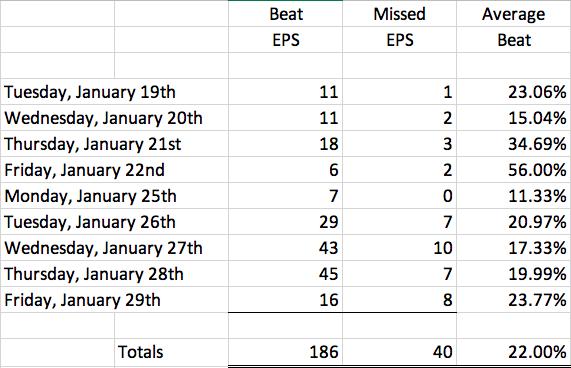

So where is this earnings growth going to come from? Well, do your research. It's right in front of us. Here's a quick little snapshot of the earnings summary the past two weeks:

The above analysis was based on free information that I summarized from zacks.com. Among companies with market caps greater than $5 billion, 186 out of 226 have beaten consensus estimates and the average beat has been by 22%!!! It's also worth noting that the "misses" include companies that simply matched expectations. The average beat has been in double digits every single day the past two weeks. Companies aren't just skating by estimates, they're blowing them out of the water! We haven't even seen the effect of the pent-up demand that's about to be unleashed across the globe when this pandemic is behind us. Growth will be explosive and future earnings forecasts will be raised - all while the Fed sits on its hands and interest rates remain extremely low.

Last week, Q4 GDP's initial reading came in at 4%. Folks, we still have restrictions in place across the country (across the globe for that matter). We have not seen ANNUAL GDP above 4% in any year this century. It's going to happen in 2021. I believe we'll see 5% or more. That kind of economic expansion, coupled with an accommodating Fed, is going to result in accelerating earnings across the board.

Go ahead and short this market if you want. I'll pass.

We're in a Secular Bull Market

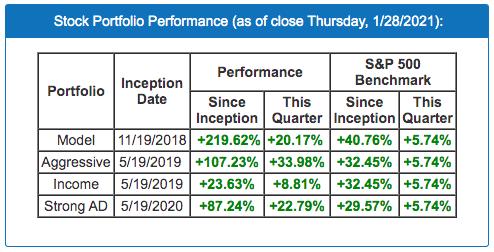

Stop fighting it and join one of the best stock markets of our lifetime. We're embracing it at EarningsBeats.com and that's the primary reason we can boast the following results in our portfolios (through Thursday's close):

The rally off the 2009 lows is nowhere near complete. This secular bull market actually began in April 2013, when we cleared the double top on the S&P 500 from 2000 and 2007. It's always good to take a step back and look at the Big Picture, and I see nothing but long-term strength:

Think about this for a second. We've endured a lengthy trade war and a 100-year pandemic in the past two years and we're sitting at an all-time high. You need to see the significance of that. The market is shaking this off just as it shook off the 1987 market crash. It's how secular bull markets work. Weakness doesn't last. Instead, it presents MASSIVE opportunities.

The Biggest Event of 2021

I'm hosting an event this morning (starting at 11:00am ET), Saturday, January 30, 2021, "A Day in the Life of EarningsBeats.com". I'll be providing an in-depth analysis of every facet of our business. It's being held for two reasons:

- A refresher for current EarningsBeats.com members to better utilize our research and educational platform.

- To introduce the StockCharts.com community to our vast number of products and services.

This is a FREE event, but you'll need to be an EB Digest newsletter subscriber (also free) to receive the room instructions this morning. I'll also be highlighting the significance of January performance relative to the balance of the year (the "January Effect"). I believe you'll find this information quite interesting. CLICK HERE for more information on the event and to sign up for our EB Digest. There is no credit card required and you may unsubscribe at any time.

A second way to join us is to enter the event directly from the room link below. We'll add you to our free EB Digest newsletter upon entering. Here's the room link (room will open by 10:30am ET at the latest):

https://us02web.zoom.us/j/88224156362

Happy trading!

Tom