ChartWatchers August 19, 2017 at 12:55 PM

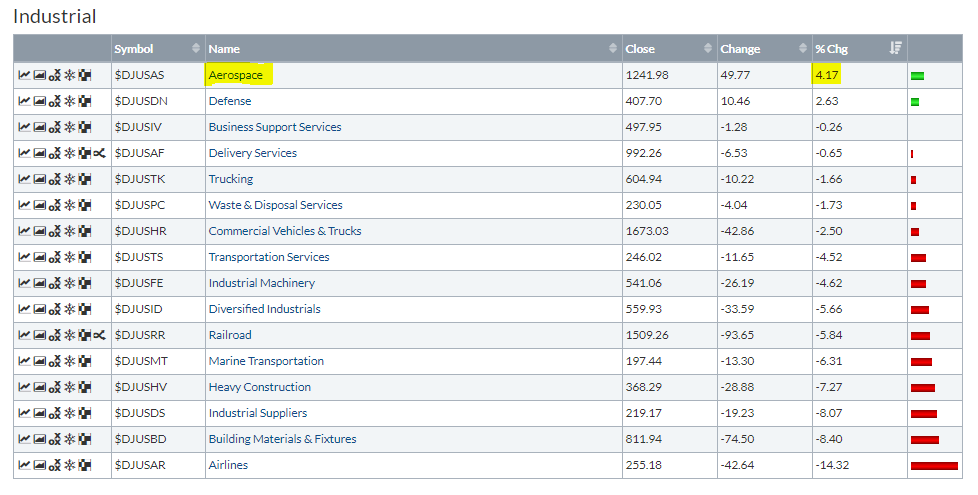

Bull markets are fueled by sector and industry group rotation. Throughout the bull market since 2009, we've seen each of the key aggressive sectors take their turn leading on a relative basis. Within each sector, we also see relative leadership and weakness among industry groups... Read More

ChartWatchers August 19, 2017 at 11:11 AM

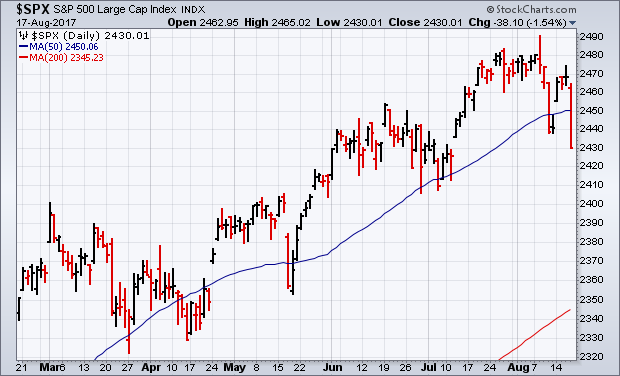

S&P 500 FALLS TO SIX-WEEK LOW... Selling pressure resumed with a vengeance today. And a lot of support levels have been broken. Chart 1 shows the S&P 500 falling back below its 50-day average to the lowest level in more than a month. Volume was higher... Read More

ChartWatchers August 19, 2017 at 11:08 AM

As earnings season winds down traders are going to be looking for new reasons to be long the market. So far, according to Thompson's Reuters, 460 of the companies represented in the S&P 500 have reported earnings with almost 74% beating expectations... Read More

ChartWatchers August 19, 2017 at 07:06 AM

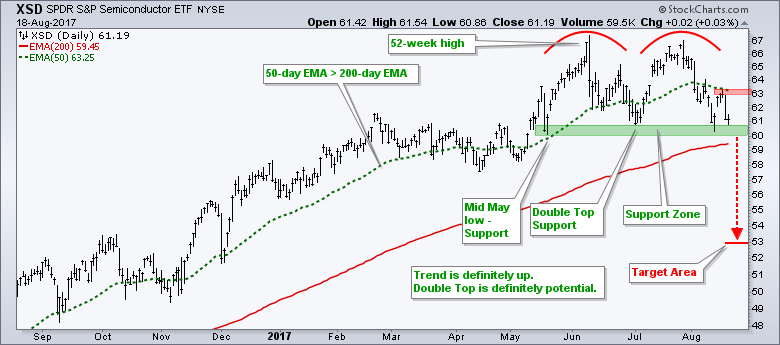

Doubles Tops are forming in two key ETFs, the Semiconductor SPDR (XSD) and the Consumer Discretionary SPDR (XLY), and chartists should watch these important groups for clues on broad market direction in the coming week or two. First, let's talk about the Double Top... Read More

ChartWatchers August 19, 2017 at 01:12 AM

The Transportation indexes look like they are struggling here. That's not usually a good thing. There are three components: Railroads - $DJUSRR, Airlines - $DJUSAR, and Trucking - $DJUSTK. Starting with the railroads, this has all the making of a derailment... Read More

ChartWatchers August 18, 2017 at 12:18 PM

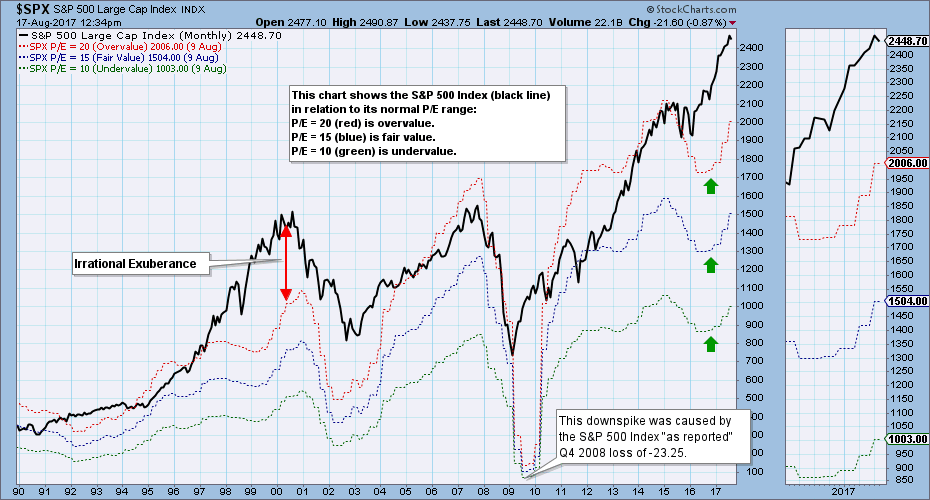

The market has been rising ahead of earnings for over two years, and it is very overvalued. Nevertheless, bullish investors seem unconcerned... Read More

ChartWatchers August 05, 2017 at 03:17 PM

Everyone likes a good meal, especially an all you can eat buffet. And if you are a trader, you've just been served up an earnings smorgasboard. So far, per Thomson Reuters, over 400 companies in the S&P have reported for Q2, 2017, with almost 73% beating earnings expectations... Read More

ChartWatchers August 05, 2017 at 03:14 PM

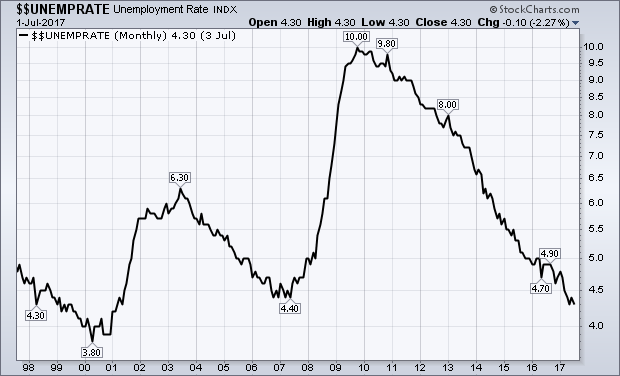

IS THIS THE REAL UNEMPLOYMENT RATE? ... Friday's job report saw 209,000 new jobs added during July which was well above expectations. Hourly earnings also saw a July again of 0.3% which attracted the most attention... Read More

ChartWatchers August 05, 2017 at 12:42 PM

A month ago, I posted an article looking at 3 NASDAQ 100 stocks that were looking to make technically significant breakouts. Sirius XM Holdings (SIRI) had a cup in play that, if broken, would measure to 5.90, or nearly 8%. It broke out on heavy volume and hit a high of 5... Read More

ChartWatchers August 05, 2017 at 08:56 AM

The price relative, or ratio chart, is handy for measuring relative performance, but it does not always reflect the trend for the underlying securities... Read More

ChartWatchers August 05, 2017 at 01:02 AM

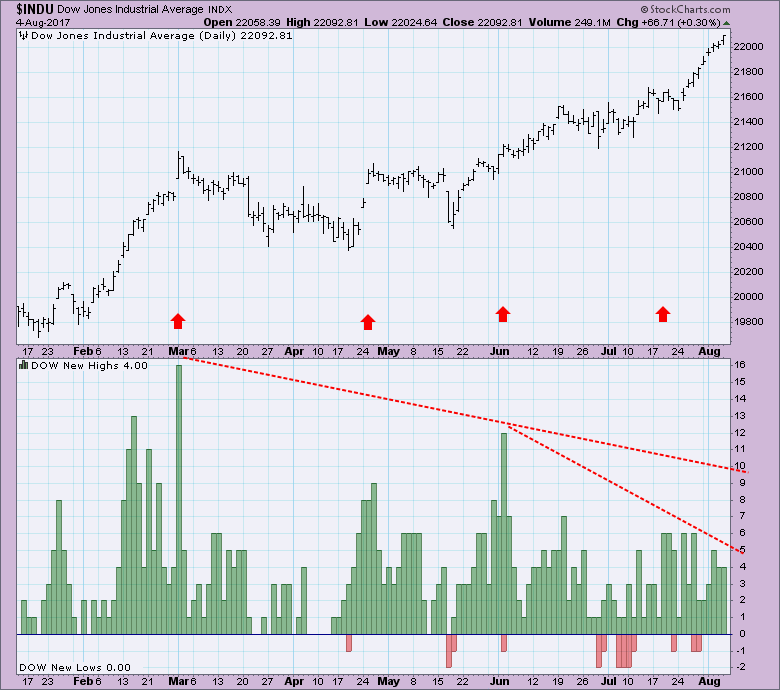

As the Dow Jones Industrial Average (DJIA) has been moving steadily to record highs, I have observed a persistent erosion of underlying support as expressed by 52-Week New Highs for the DJIA component stocks... Read More

ChartWatchers August 04, 2017 at 09:17 PM

One of the hardest parts about investing, is staying with the constant rotation of sectors. Amazon is already down more than $100 since the high last week. Gulp! While it's only 10%, $100 a share is an ouch... Read More