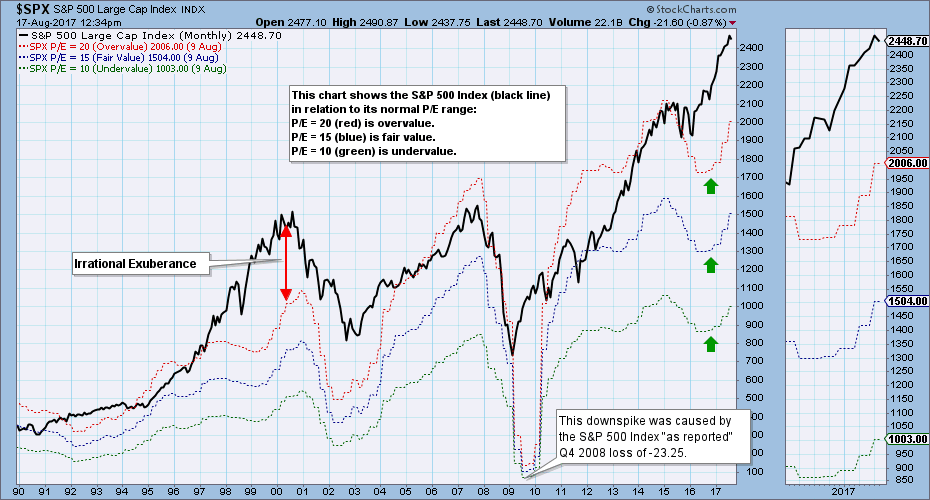

The market has been rising ahead of earnings for over two years, and it is very overvalued. Nevertheless, bullish investors seem unconcerned. The chart below shows the S&P 500 Index (black line) in relation to where it would be if it were undervalued (P/E 10 - green line), fair value (P/E 15 - blue line), or overvalued (P/E 20 - red line). The current price is far above the overvalue side of the range, because the S&P 500 has a P/E of 24.

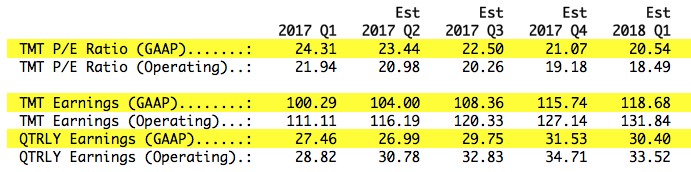

Earnings growth through 2018 Q1 will bring the P/E down to 21, but only if price goes no higher. If the bull market advance continues, overvaluation will continue to be a problem. The table below shows twelve-month trailing (TMT) earnings estimates through 2018 Q1. The P/E estimates are calculated based upon the current value of the S&P 500.

Source: http://us.spindices.com

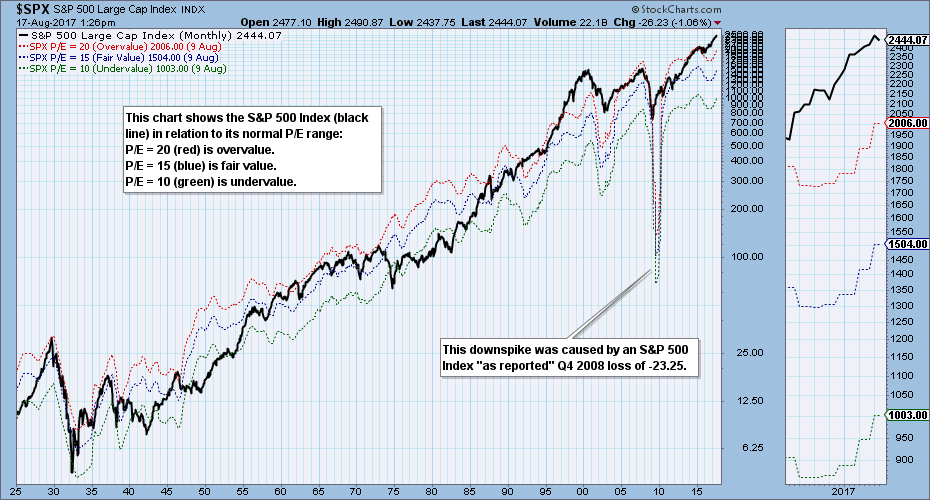

The chart below presents a long-term view of price relative to the normal valuation range. Since the late-1990s there has been a persistent tendency toward overvaluation, and it has been 35 years since the market was at or below the undervalued side of the range.

The market can stay overvalued for years, so market valuation is not a timing tool; however, it should be a consideration when making investment decisions. Currently, valuation is unfavorable.

Happy Charting!

- Carl

Technical Analysis is a windsock, not a crystal ball.

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)