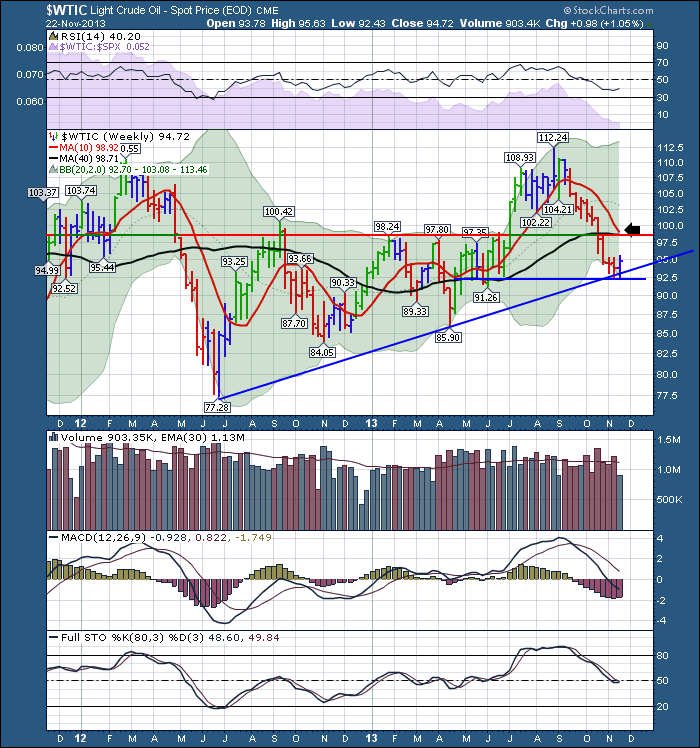

Crude oil has had a huge setback. It has fallen below all of the common moving averages.

Is it ready for a bounce? Here is why I think it will retest the $100 level soon.

For the live link to the chart. $WTIC

Notice the uptrend line on crude oil off the 2012 lows. This blue line sloping upwards has been a support for the last year and a half and we would look for crude to get a bounce. The 92.5 level is also significant as the May June and July 2013 lows continually tested there. $WTIC was supported there for three months in a row. If you look up to the 98.5 dollar level you will notice the firm resistance at that level all the way through 2012 and 2013 before finally breaking out in the summer of 2013. That resistance level will probably be retested as the 40 Week moving average and the 10 week moving average look ready to meet there as crude retests this from the bottom side. That decision point will be a major decision for technicians. If crude oil fails at the 40 WMA, I would expect a significant move down to the $85 level next. This would create a downtrending 40 WMA which is not good news. Should crude bounce off this 92.5 level and push back through the moving averages, that should be a bull train getting on board for. So I would expect crude to get a bounce here and watch closely up above for resistance.

Good Trading,

Greg Schnell, CMT