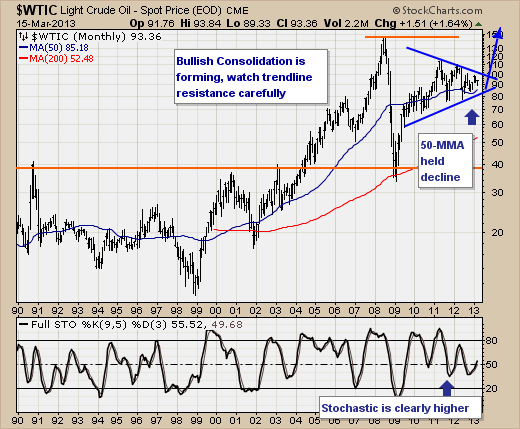

The stock market's uninterrupted gains in recent months is giving rise to talk of a bubble, and perhaps this is the case within the scope of time. It is still far too soon to determine this, although further gains will cause us to consider sharply higher prices within the context of anemic economic growth. With this said, we are watching the Crude Oil futures market rather closely, for on a monthly basis - a bullish pennant pattern is forming that projects sharply higher prices...to new highs above the $150/barrel level. This would come as a surprise to many, but the fact of the matter is that there is likely to be a series of rolling euphoric moves across all asset classed stocks, commodities and bonds. Right now, it is simply stocks. But we are starting to see signs of more interest in the commodity groups than we have previously.

Therefore, we are interested in various energy stocks to participate in this rally, which by-the-way can occur within the context of a lower stock market just as occurred in 2007-2008. Our choices are several of the "laggards" such as Apache (APA), National Oilwell-Varco (NOV) and others. If there is risk in the long energy trade, then we would look for a monthly close below the 50-month moving average at $85/barrel level. In effect, this would suggest a mean reversion exercise towards the 200-month moving average that occurs roughly every 7-years. In this environment, we hate to think of what the world economy looks like, but suffice to say there will likely be very few long hiding places.

Good luck and good trading,

Richard