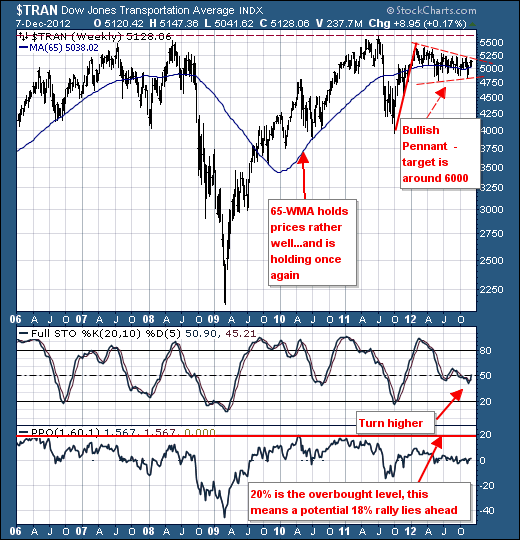

The Dow Jones Transportation Index ($DJT) is on the verge of a major breakout that could see prices rise by up to +20%. Quite simply, the developing bullish pennant pattern would suggest that once a breakout of trendline resistance materializes, then a measured towards the 6000 to 6200 zone becomes a reality. In further support of this viewpoint, note the 20-week stochastic has turned higher from near the 50-level, while the 65-week moving average continues to provide major support to declines. Collectively, the risk-reward of long $DJT positions is rather good given one can measure their risk at the recent lows.

The manner in which to play this trade is several fold. One could look at the Dow Transports ETF (IYT) to mimic the index. Or, one could look at the the risk-reward of the particular stocks that make up the index such as the rails, truckers, and air freighters in general. Our particular focus is upon all of these, with CSX Corp. (CSX); FedEx (FDX) in particular, with Arkansas Best (ABFS) having potentially the largest percentage gain...but it has its flees so to speak. As with all of these stocks; do your technical homework.

Good luck and good trading,

Richard