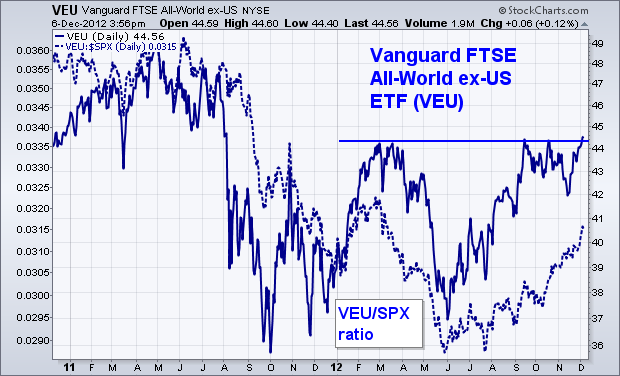

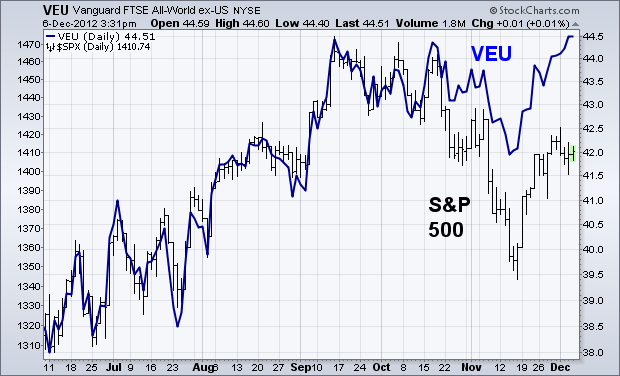

Foreign stocks look technically stronger than the U.S. at the moment. Tuesday's message showed EAFE iShares testing their spring high. Emerging markets are rising as well. A more comprehensive measure of foreign stocks that includes developed and emerging markets is shown below. Chart 1 shows the Vanguard FTSE All-World ex-US ETF (VEU) in the process of testing highs formed during the spring of this year. An upside breakout would give a boost to foreign stocks. The dotted line overlaid on the chart is a relative strength ratio of the VEU divided by the S&P 500. As I suggested on Tuesday, foreign stocks have been rising faster than the U.S. (rising ratio) since mid-year after lagging behind the U.S. during most of the past year (because of a falling dollar). After acting as a drag on the U.S. during the first half, foreign stocks are now leading the U.S. higher. Chart 2 shows foreign shares (VEU) in a stronger position than the S&P 500 (the VEU has risen 20% since June versus 10% for the S&P. Since global stocks are highly correlated, an upside breakout by foreign stocks would increase the odds for higher U.S. shares.