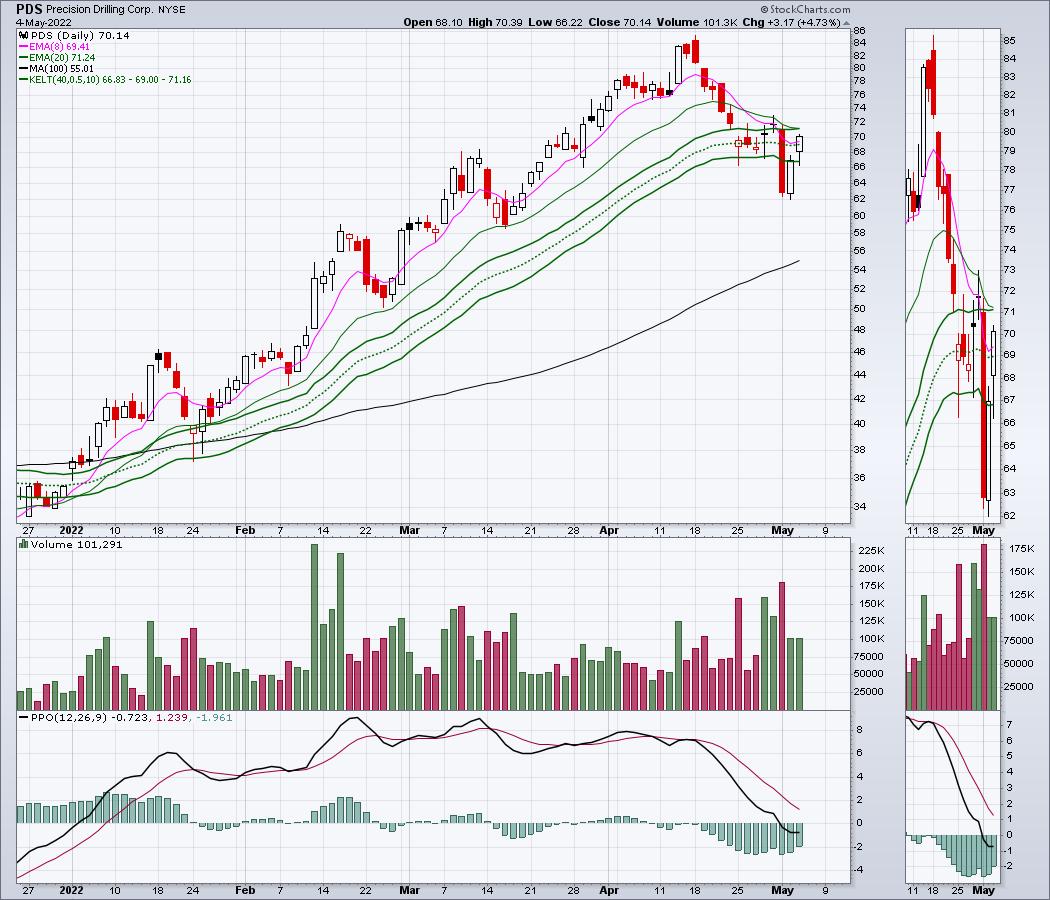

It has been the oddest of circumstances. The pressure on the oil supply has been immense, but the oil stocks just couldn't break out. In what has been the most bullish of backdrops, it seemed unfathomable that the oil names weren't going higher. The recent 25% drop in oil stocks was vicious, with drillers like PDS, PD.TO falling 12% in one day.

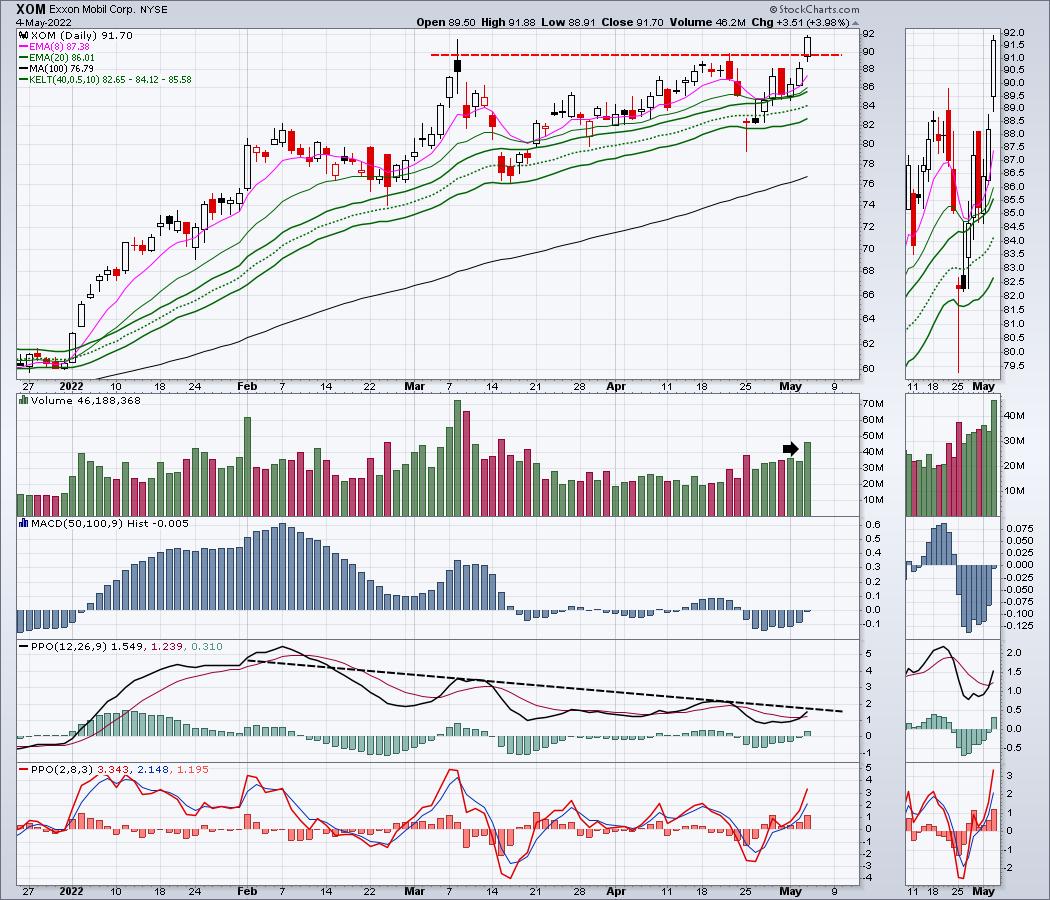

But as the market formed a hammer candle on Monday, the last two days showed some tremendous enthusiasm to move back into the oil trade. Breakouts galore came in after the Fed announcement. Check out this example of Exxon Mobil (XOM) breaking out:

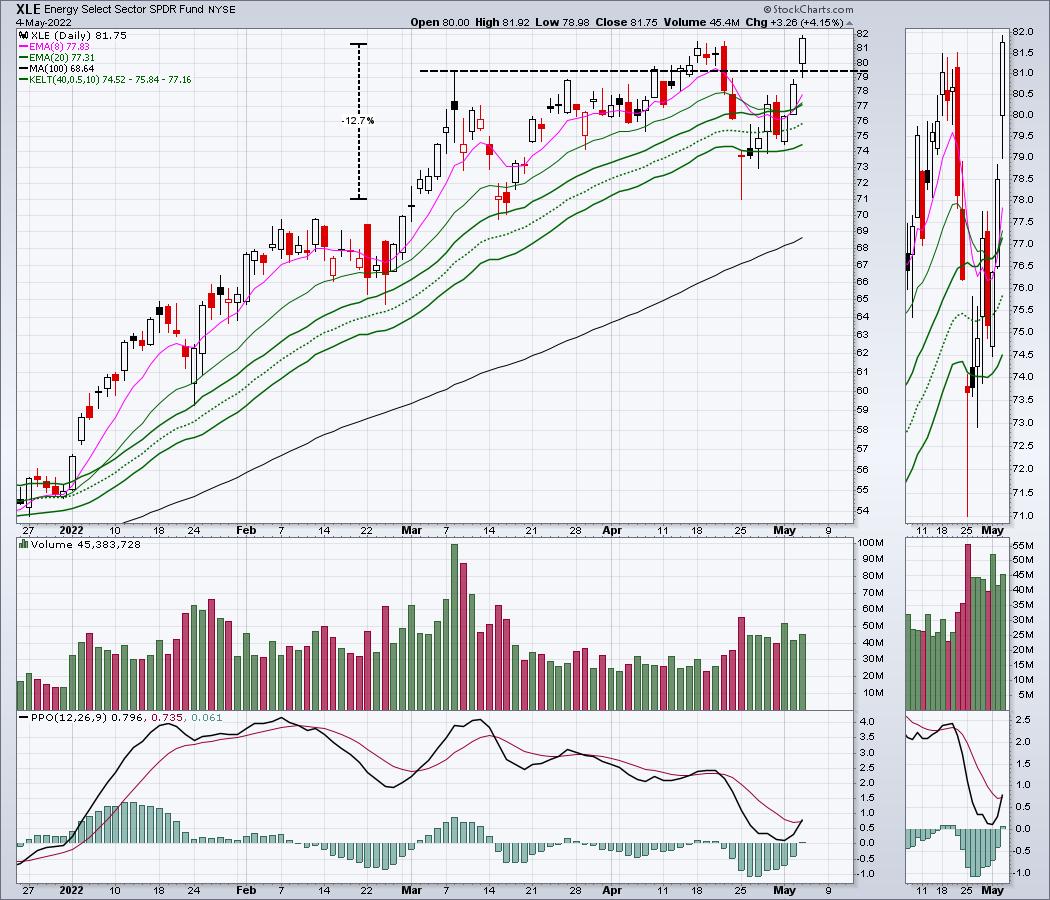

The XLE is a broad group of energy stocks. Exxon Mobil and Chevron are the big boys in the ETF, at almost 1/2 of the holdings, it is still representative of the broader sector.

One of the keys to buying near the lows is to identify the sectors and industries breaking out. This looks like a great place to start.

Good trading,

Greg Schnell, CMT, MFTA

Senior Technical Analyst, StockCharts.com

Author, Stock Charts For Dummies

Want to stay on top of the market's latest intermarket signals?

– Follow @SchnellInvestor on Twitter

– Connect with Greg on LinkedIn

– Subscribe to The Canadian Technician

– Email at info@gregschnell.com