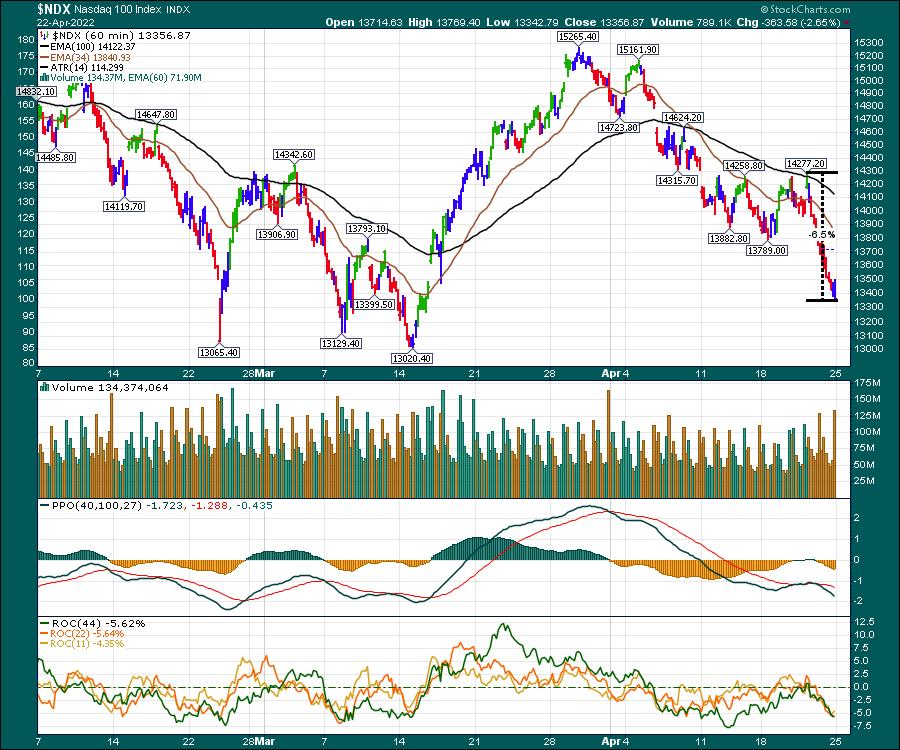

It's a twisting market, but, typically, the bears don't leave any berries untouched. Within two trading days, the Nasdaq has dropped 6.5%. By any measure, that is a fast move down in an index of some of the largest companies in the world. It's been a grind lower for three weeks since the late March top.

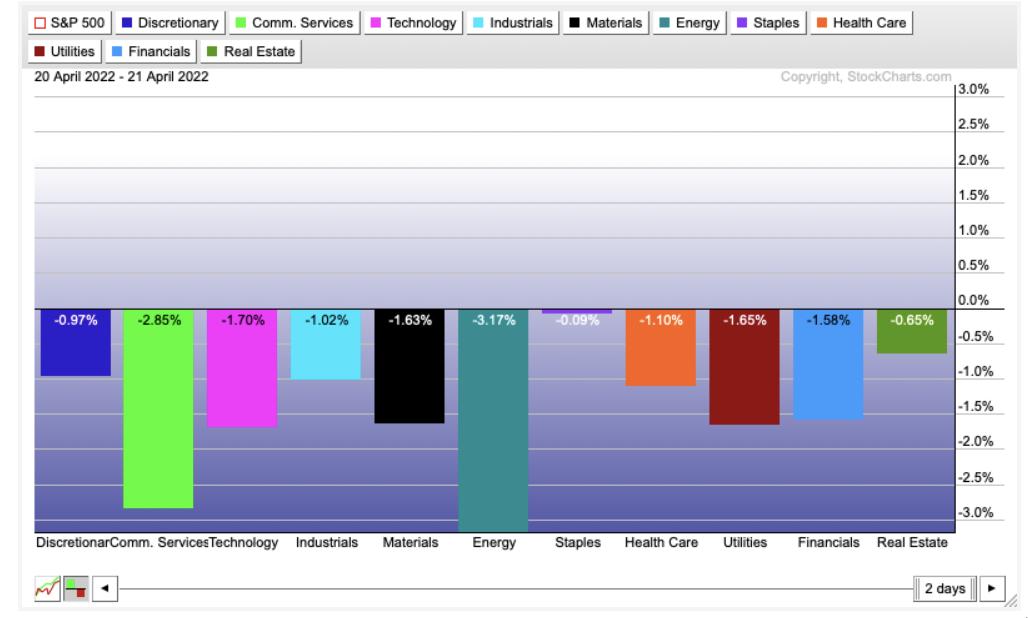

However, all the sectors were down over the last two days. Energy was clearly the worst, but the Materials sector also took a drubbing. Communication Services has really been hit hard with the drop in FB and NFLX.

While we continue in this bear market mode, there are very few places to hide. Even hiding in Staples, Healthcare, Utilities or Real Estate was hard. Staples held up okay, but that was still only the best of a bad experience.

I do want to point out that the XOP went on a sell signal for me this week, and it is a cautious environment here. If the high price of commodities slows down the economy, it will eventually slow down commodities as well.

Without reviewing them all, commodities could be subject to a quick move down with all the weakness elsewhere.

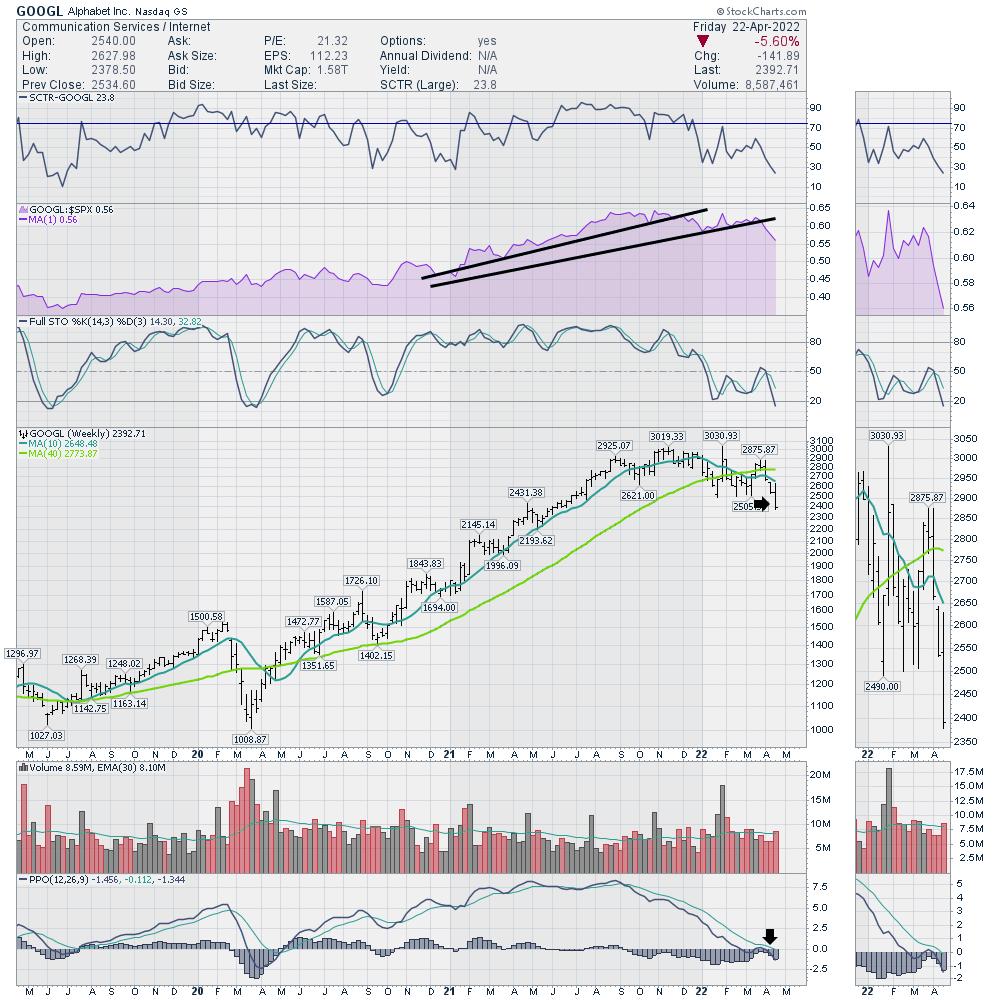

I do want to highlight the mood change on GOOGL as it is joining the Meta party and NFLX. Alphabet is starting to underperform the $SPX, as shown in purple, as it makes new 52-week lows. The PPO is accelerating lower after wobbling just below zero. This is a very weak chart setup. Use caution.

One chart that held up better than my expectations this week was the SMH ETF. There is still not a lot to cheer about, as it made a negative outside bar and closed on the lows. However, on the week, it was only down 1.47% compared to the extreme moves in the indexes. It's still negative and the PPO is a terrible position, but the fact that it didn't drop 5% this week is potentially a sign that the selling is done in the industry group. That's a long shot, but one worth watching for the week ahead.

I remember Tesla reported blowout earnings to start Thursday, but the stock lost most of that gain to finish up just 2% on the week. It's hard to pick winners when even the big obvious companies can't hold their gains. I plan to stay cautious here.

Good trading,

Greg Schnell, CMT, MFTA

Senior Technical Analyst, StockCharts.com

Author, Stock Charts For Dummies

Want to stay on top of the market's latest intermarket signals?

– Follow @SchnellInvestor on Twitter

– Connect with Greg on LinkedIn

– Subscribe to The Canadian Technician

– Email at info@gregschnell.com