Some Canadian Retail stocks recently hit turbo mode!

Photo courtesy of Autoblog.com

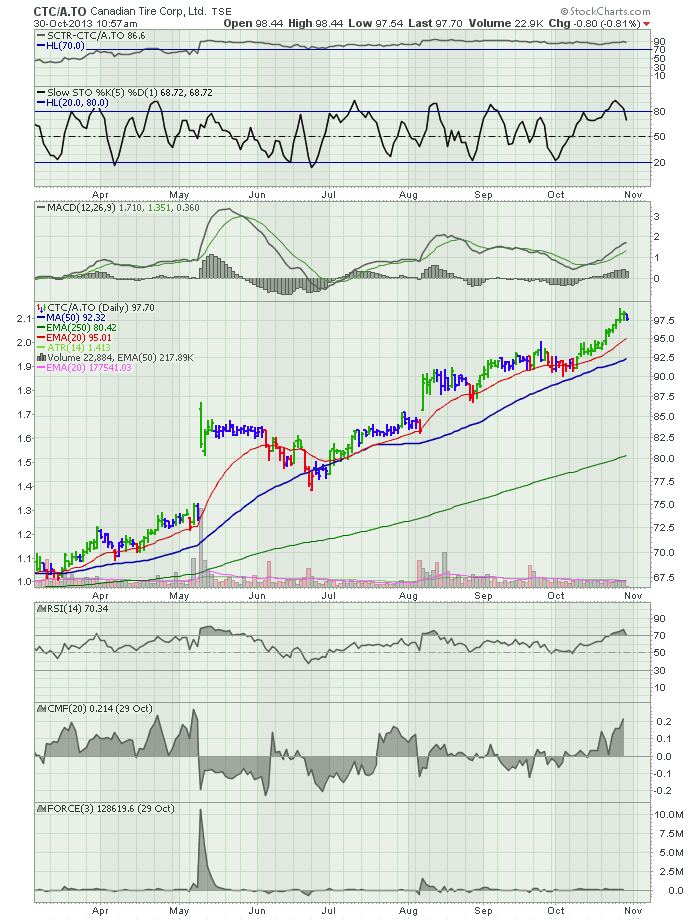

Here are the charts of three interesting Retailers that might have you driving one of these.

Canadian Tire recently bought the Forzani Group including SportCheck.

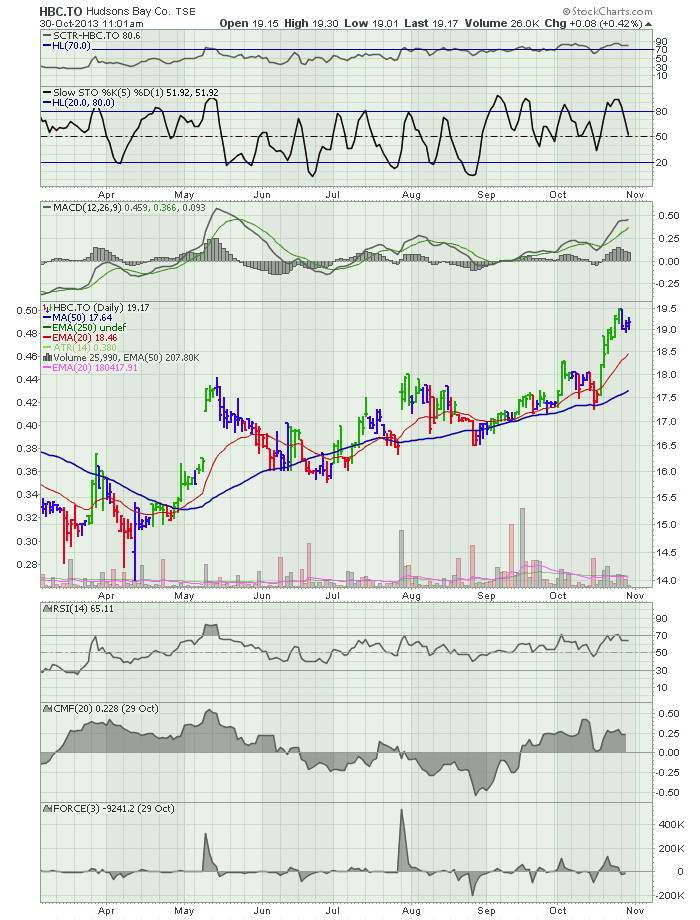

Here is Hudson Bay Company. They recently acquired Sak's Fifth Avenue.

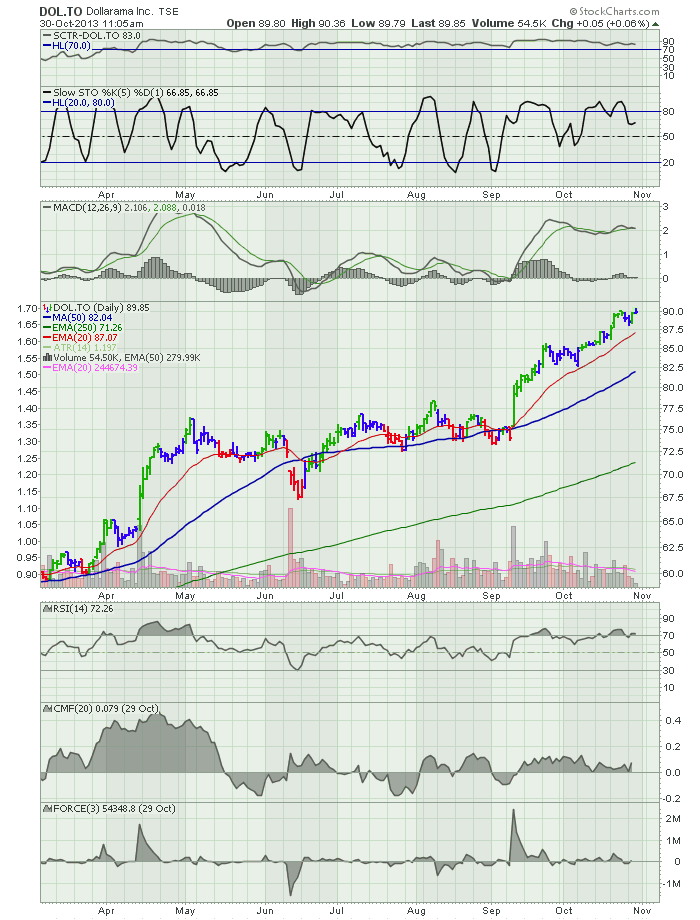

Here is Dollarama.

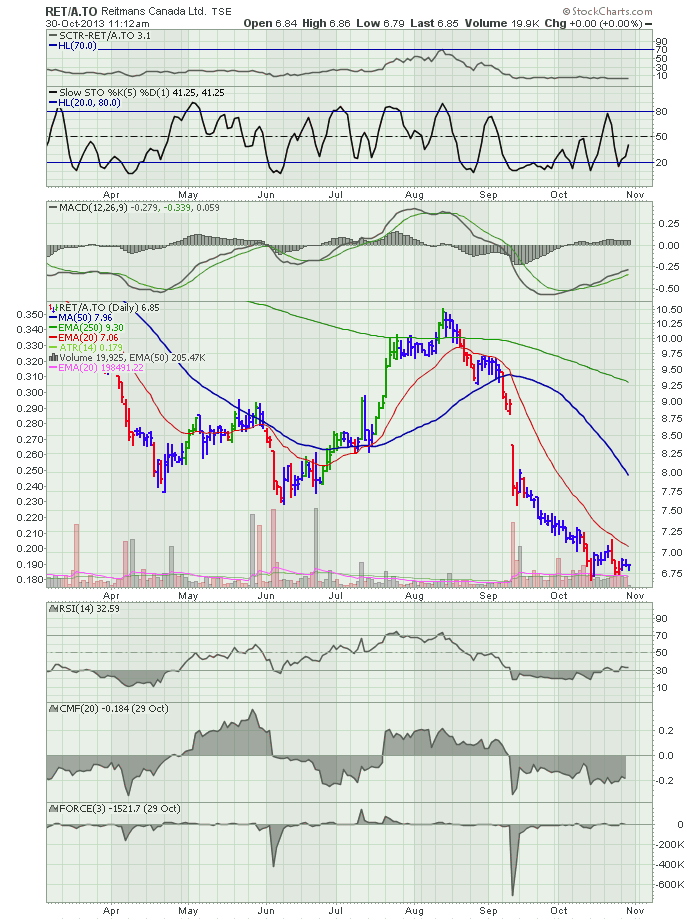

Not all the reatilers look this hot. Here is Reitmans.

There are many reasons technically not to buy Reitmans. The downward slide looks brutal. Hopefully it can base soon for investors. The important thing to note here is something as simple as the SCTR line on the charts. If it can't get above 75, the institutional investors are probably not adding to positions. They are probably selling their positions. Weak stocks can stay weak for a while.

If you are looking to buy the zoom shown above, you may find the SCTR ranking line a simple but helpful method of filtering stocks. On the SCTR indicator panel, HL means horizontal line. I have placed it at 70, just for a reference point.

Currently, I am writing a series of blogs explaining what the SCTR is, why it is important and trying to help readers set up chartlists and scans to find these attractive stocks as they break out. In early October HBC.TO showed up on the scan. New stocks are showing up every day. Let me know if you are following the SCTR articles to put it in your trading arsenal. Or feel free to jon the conversation and send in suggestions.

Lastly, vroom Vroom. The Porsche 918 gets over 75 US MPG. How sweet is that!

Good Trading,

Greg Schnell, CMT