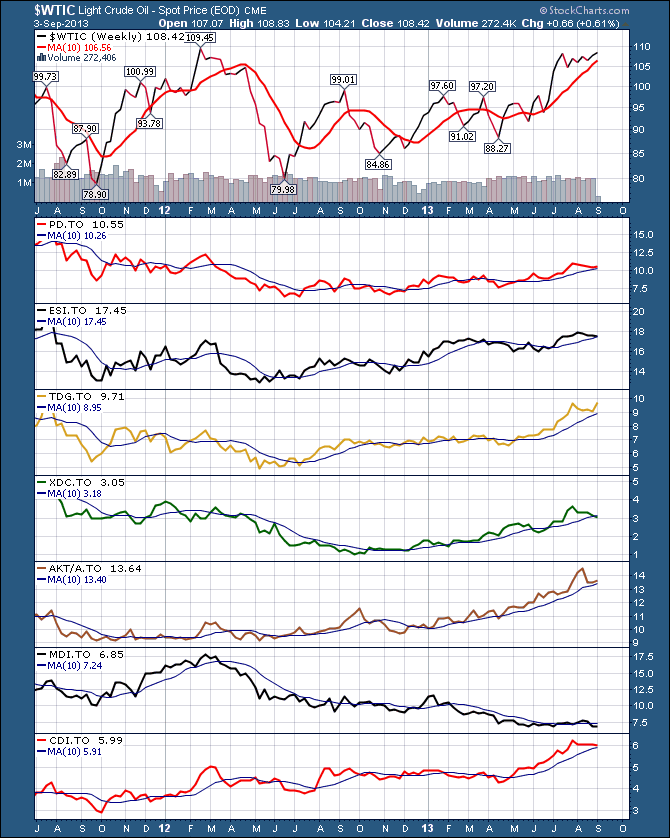

This is a pretty simple story. Higher oil prices mean more drilling.

Only one is missing the love of the market towards these drillers.

All of them are currently trying to bounce off the 10 week line. Usually a good entry in an uptrend where stops can be placed close by. As Crude retests the highs of Feb 2012, a break above would probably launch the industry group higher.

Looks like most of them have been sideways for a month. They can do a lot of drilling over winter if budgets for new wells start to improve. But the first retest of the 10 week line is usually bullish.

Good trading,

Greg Schnell, CMT

About the author:

Greg Schnell, CMT, MFTA is Chief Technical Analyst at Osprey Strategic specializing in intermarket and commodities analysis. He is also the co-author of Stock Charts For Dummies (Wiley, 2018). Based in Calgary, Greg is a board member of the Canadian Society of Technical Analysts (CSTA) and the chairman of the CSTA Calgary chapter. He is an active member of both the CMT Association and the International Federation of Technical Analysts (IFTA).

Learn More