While commodities still seem nestled in the doldrums, recently a few have started to move higher.

But more importantly, the global stock indices are making moves to higher ground looking like a global sustainable bull market is more likely.

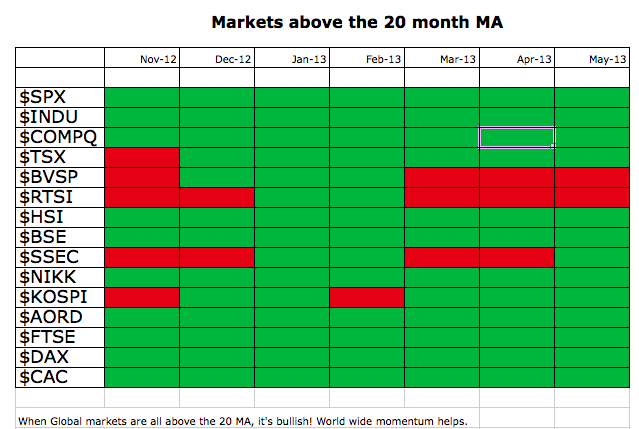

At one mid month view in April near the US lows, their were 7 global markets back under the 20 Month MA. Currently, only 2 are. What is more important is that a lot of commodities track the $SSEC (Shanghai) market. The $SSEC has now started to push higher again. This gives me more faith that a bull market is starting up.

As well, the $DAX and the $FTSE have joined America in breaking above the 2007 highs. The $BSE (India) is trying to break through some resistance up around the old highs as well. I thought it might wait until June for the next thrust higher, but it appears these foreign markets are starting to push up in May.

There are still a lot of major markets trapped below resistance but above the 20 Month MA like the $TSX, $AORD, $CAC, $KOSPI, $HSI. But more and more, it looks like this global inflation push could start working through. $WTIC is still trapped inside a range but the oil stocks on the US are moving up and above.

Without a doubt, the push in Europe sees even the Italian and Spanish markets above the 20 Month MA which are not listed above. So Europe is well underway, and now the emerging markets appear to be syncing with the USA. Maybe the commodity countries can get on the train. Currently, the strength of the $USD is holding them back.

Good Trading,

Greg Schnell, CMT.