CNQ exists as a bright spot in Canadian Exploration. A massive company built by investing when everyone was scared and trying to do things differently. Their Fort MacMurray Oilsands project called Horizon was trying to be one of the lowest cost construction projects in the region. Costs still escalated but they are one of the few at the bottom of the construction pricing range.

I emphasize that because building each one of these facilities is like building 2 or 3 entire automotive factories. The number of associated jobs for construction and for long term employment is massive. They can not be moved or reshuffled to a lower tax haven. They are massive investments for the company, for the province and for the country. They need political certainty and will go through periods of underperformance.

They also did a major Natural Gas acquisition when Natural Gas was relatively low. Unfortunately, Natural Gas spiralled down to under $2.00.

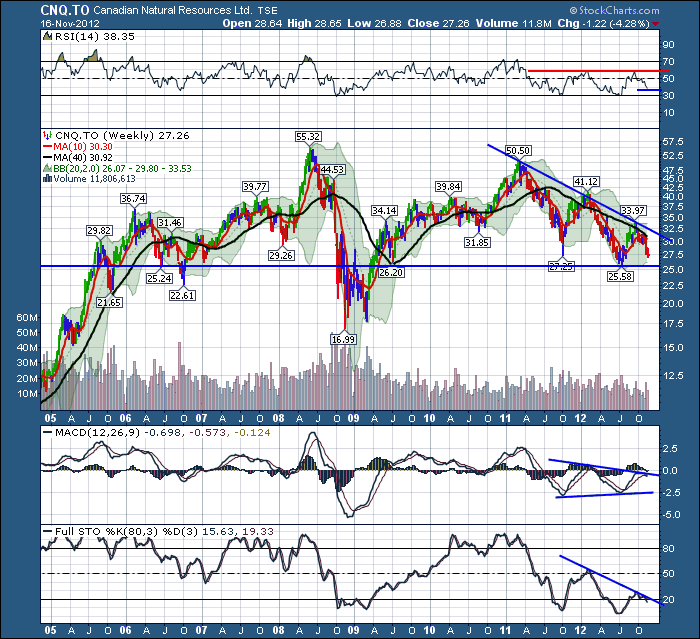

Today, with Pipeline capacity issues, Oil $28 off it's post crash high, relatively low Natural Gas prices, and provincial revenues missing budgets which creates uncertainty, CNQ has become unloved. The stock sits at a floor level where it has found support for the last 7 years with the exception of the financial crisis blowout low in 2009.

We can see on the RSI the stock has been stuck in a bear market since the Highs in Spring of 2011. Notice how the RSI can't get about 65 when in a bear market. Well, even a permabear would expect a great company like this to reemerge at some point. We are within 10% of the long term support level I have drawn on the price chart. We also have a bear market structure of lower highs and lower lows. The MACD appears to be rolling over while below zero. and forming a narrowing pattern. This pattern usually resolves itself with an aggressive move one way or the other. The full stochastics were coming out of oversold only to roundtrip right back under the 20 level. This chart looks UGLY.

So can CNQ find some love? Great Question. Oil is up a $1.50 this morning. Sometimes the macro trend is the most important. So let me briefly discuss that.

All of Europe and Asia rallied big this morning. Major US stocks made a hammer candle on Friday. My blog about Apple turned out as planned, with Apple reversing the downside move and closing near the highs. I did have one reader find a mistake and point out the candle was a hammer, not a harami! I was writing quickly and somehow wrote the wrong word there. It looks like a hammer so it is a hammer! Good catch!

All of my internal indicators show me we are ready for a sustained bounce here. I put some money to work on Friday and we'll see how that plays out. FB is breaking out, AAPL is turning, and the global markets seem to want to party for US thanksgiving. As a bear, its hard to bet against the most bullish week of the year.

The price action on Apple Friday was a classic technical move. I would encourage anyone learning technicals to study that reversal. It was classic! Write me if you have any questions about it at all. It's one to watch. You'll also notice that it can change the mood of the overall market too. We'll see what unfolds but bears will probably hibernate all week.

Lastly, regarding the Fiscal Cliff. I have a Schnellism I wrote on my chart a while back. 'The market does not wait for the politicians to find a solution. The market starts to rally when they know they have the politicians full focus on the problem. ' How the market reacts to the ultimate solution may be different, but a market can rally with unsolved problems.

Lastly, Canada's 100th Grey Cup plays out this weekend. Should be tremendous in the Skydome! The Cvalgary Stampeders and the Toronto Argonauts. I watched the Toronto Semi final in the Skydome. Great Venue, Great Players. Should make for a great game.

Good Trading,

Greg Schnell, CMT