The Canadian Technician March 30, 2012 at 04:10 AM

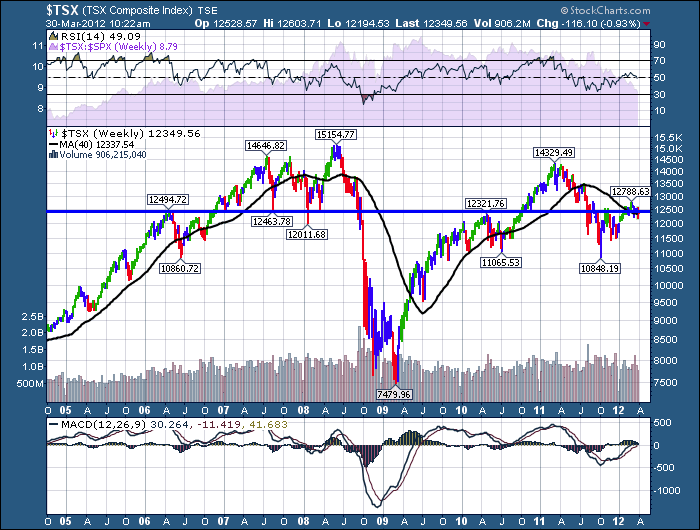

Very interesting quarter, let's do a review. While watching the US markets powering higher to the tune of 12%, the $TSX is up 1%. If you were in the strong stocks the pullbacks have been jarring like 20% in a week in WPT.TO... Read More

The Canadian Technician March 28, 2012 at 03:08 PM

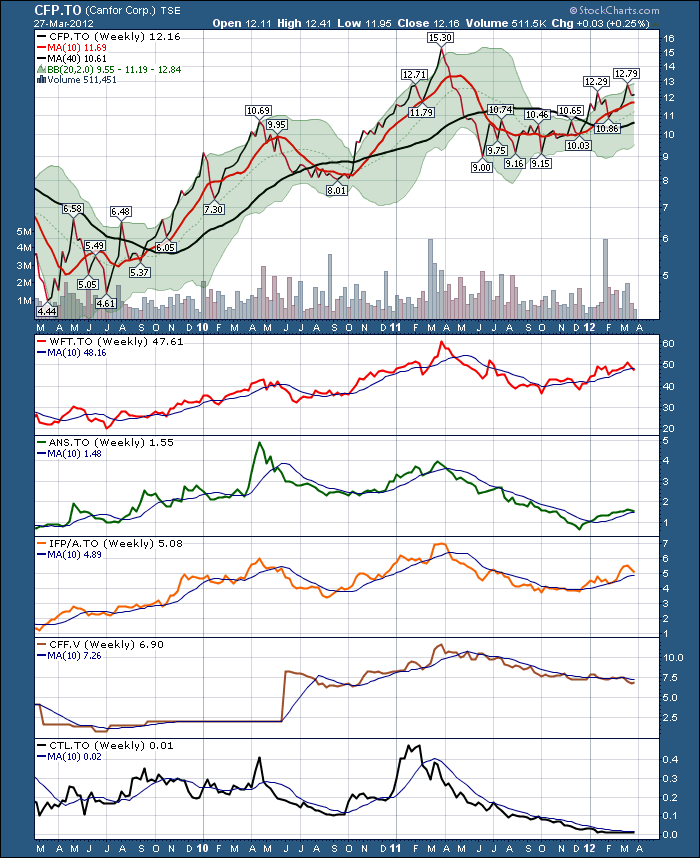

Here are two lumber/paper stock dashboards. Pretty mixed bag. You can see there are sharp contrasts between the leaders and laggards. Home Depot and Lowes in the US are doing pretty good. Look at RONA at the bottom here...No momentum higher at all... Read More

The Canadian Technician March 24, 2012 at 02:04 PM

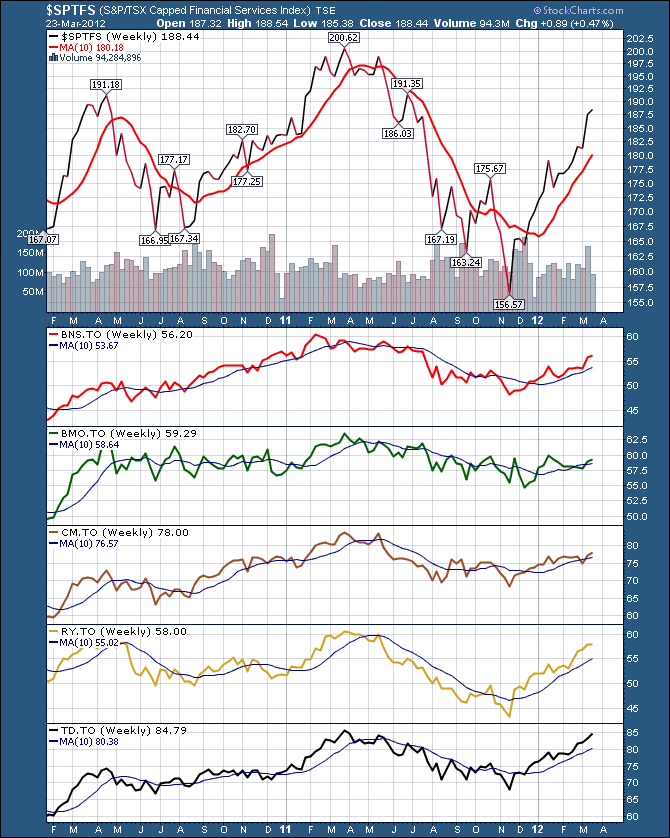

The Canadian banks are very interesting here. Well, here is the dashboard. Lets start at the top. The Financial services sector has been rising nicely... Read More

The Canadian Technician March 22, 2012 at 04:16 AM

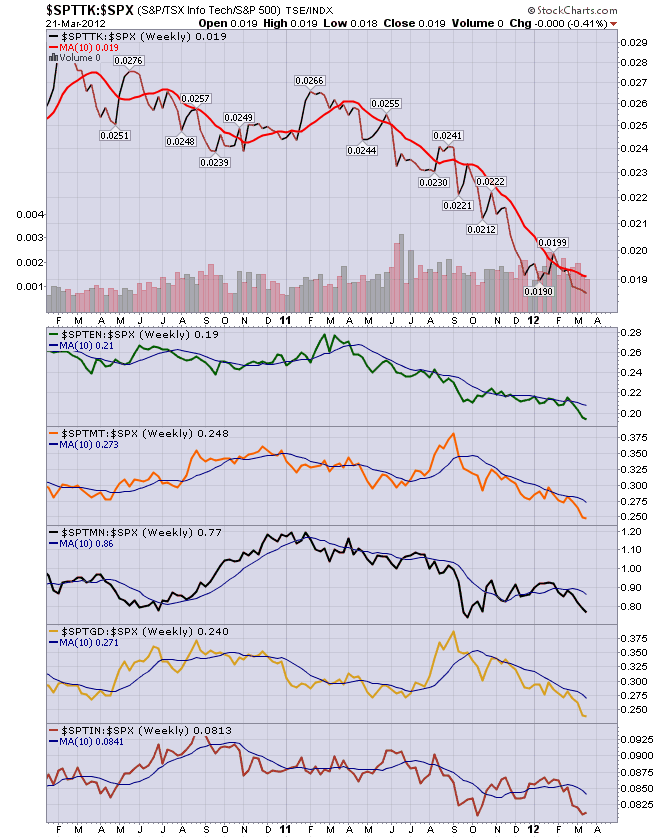

If you have been reading the blog for a while, you know that I find comparing sectors and stocks to the SPX a valuable tool. Well, here are the Canadian sectors compared to the $SPX. As you can see, all of these sectors continue to underperform the $SPX. they are all tilted down... Read More

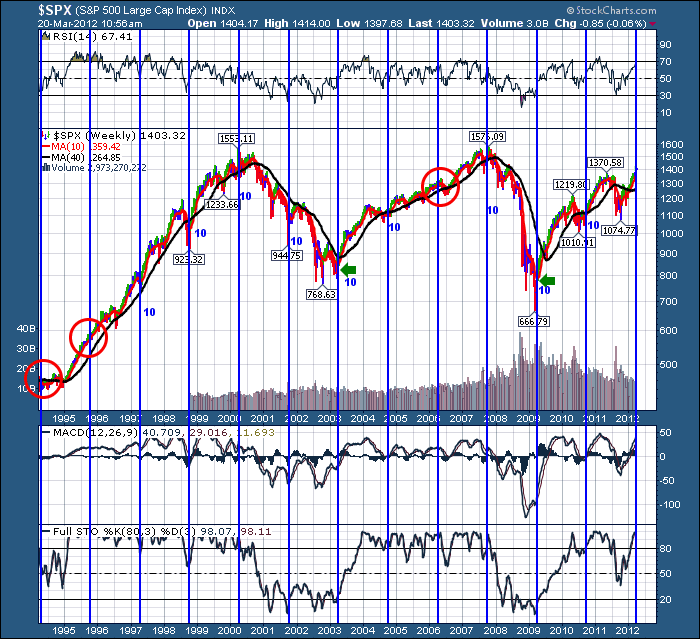

The Canadian Technician March 20, 2012 at 02:26 PM

With all our cycle work over the last week, I took a look to find buying cycle lows. Lets describe how we started these lines. Well, the 2 best buy points on the chart are at the 2003 and 2009 lows... Read More

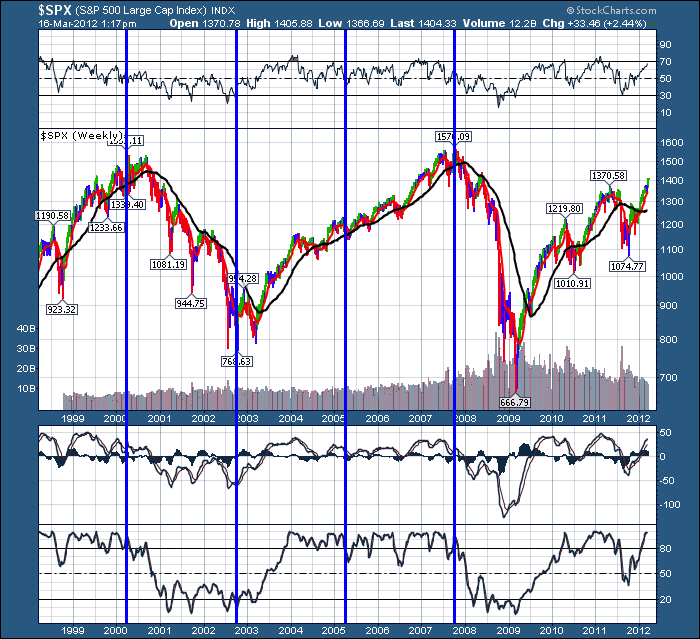

The Canadian Technician March 16, 2012 at 05:48 AM

The more you speak to the veterans in the industry, the more they talk about cycles and intervals. Recently, Tom McClellan of McClellan Oscillator was in Calgary to speak. He spoke of cycles and time shifted intervals. Cycles indicate a repetitive low - low pattern... Read More

The Canadian Technician March 12, 2012 at 03:23 PM

As a follow up to the article on utilities, here is the relative strength in purple, starting to move higher. Looks like the love of stability is starting to return... Read More

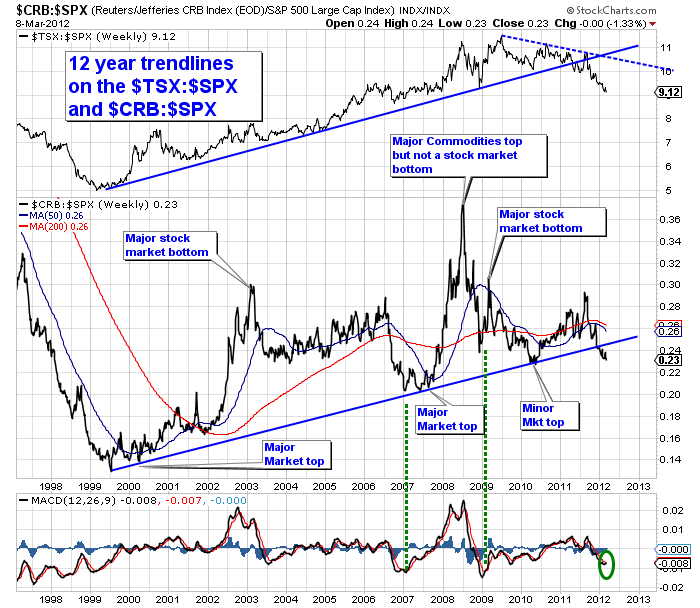

The Canadian Technician March 12, 2012 at 01:11 PM

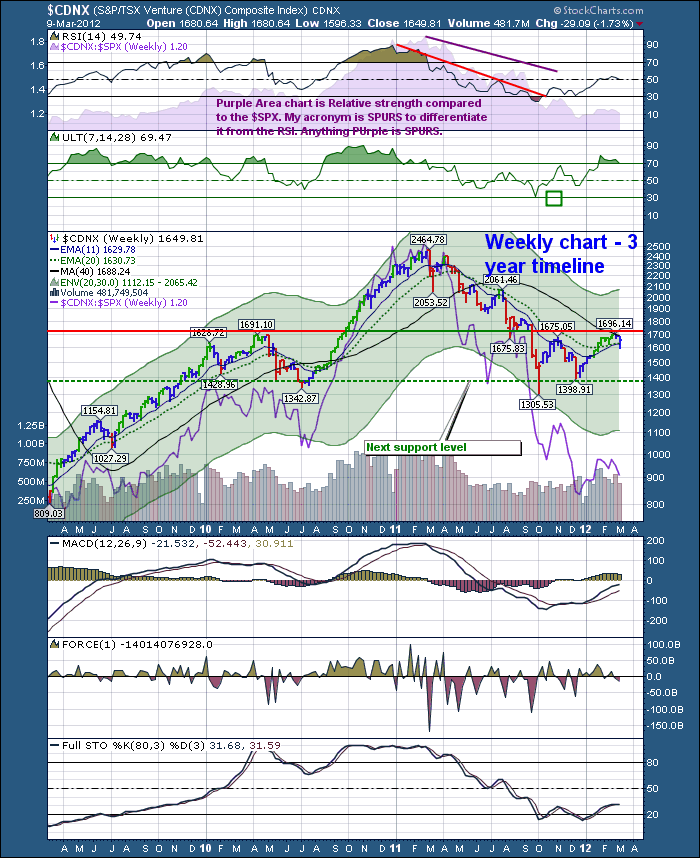

One of the benefits of being a stockcharts member is the multiple ways to display data and save it for future looks. On the weekend I was scanning through my various chartlists. This chart popped up in my "Canadian Technician" chart list... Read More

The Canadian Technician March 09, 2012 at 04:51 AM

I got a comment back on the Long Term $TSX chart from earlier in the week. One of our fellow CSTA members from Ontario, Bob Hunziker, sent in this great chart. Why is it great? When we spend too much time on short term charts we fail to see the big picture... Read More

The Canadian Technician March 06, 2012 at 03:49 PM

These charts rolling over here are spectacularly troubling! At the bottom of the list is a 13 year chart of the TSX. It is never good when the MACD resides below zero. So, maybe it's a one day deal, but be aware. In 2008 the SPX spent the entire year under the 200 dma... Read More

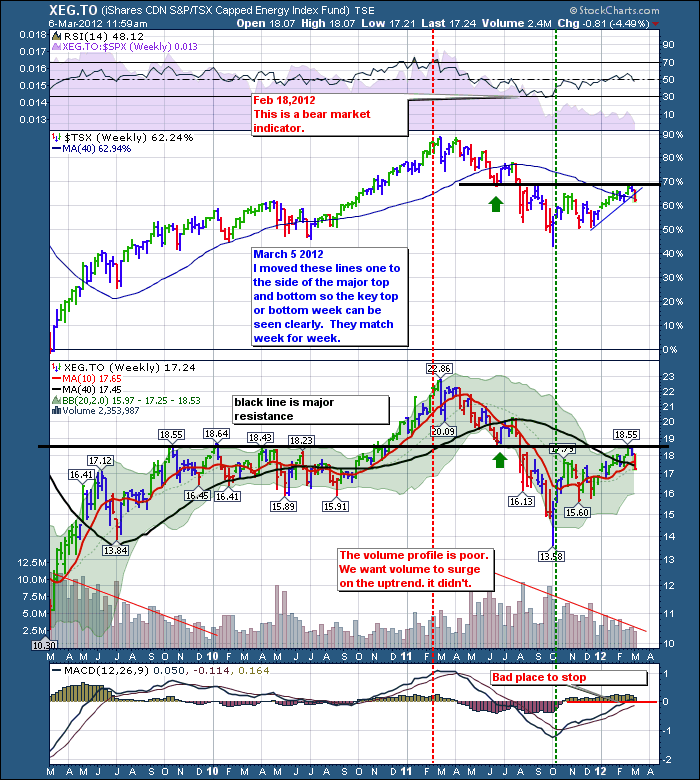

The Canadian Technician March 06, 2012 at 04:35 AM

Canada's energy sector ETF. I posted this chart on Feb 18. This is a problem. This chart has not been able to break resistance. Caution is advised as the $TSX tracks this chart pretty closely. Remember when the $TSX topped out in 2011? Same time this chart topped out... Read More

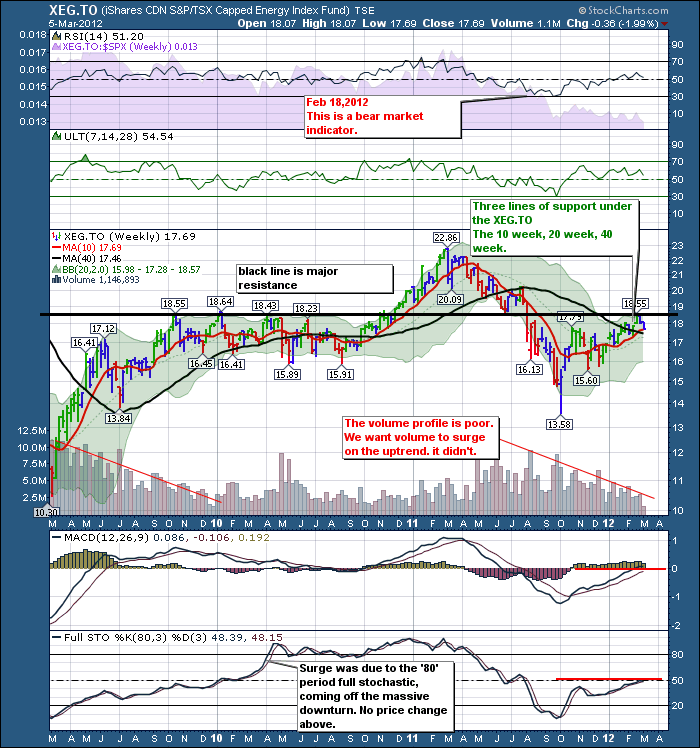

The Canadian Technician March 05, 2012 at 08:27 AM

Today I want to show a chart that would define ‘poised to move up' but has not already made 25% rather than a chart with downward momentum like the CNQ chart illustrated last week. This is really a direct comparison to the blog I did on CNQ... Read More

The Canadian Technician March 03, 2012 at 11:25 AM

This is the equivalent of the famous stockcharts blog - "Don't ignore this chart!" This stock has been one of Canada's institutional favorites. It has soared with every oil price rise for 2 decades and plummeted in the 2008 commodities dive. So Oil hit $110 this week... Read More

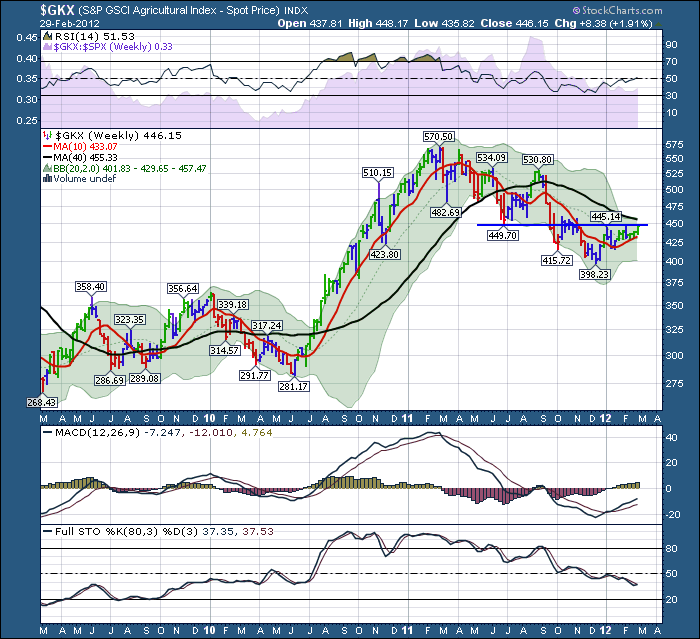

The Canadian Technician March 01, 2012 at 03:48 PM

Today was very interesting. It really felt to me like a day of major trend changes, but the charts just hinted rather than roared. Some of the interesting data was on the Agriculture index, livestock and defensive sectors seem to be gaining relative strength... Read More