I'm driving through the gas fields of southern Alberta today. Temperature is -32 C or minus 25 F.

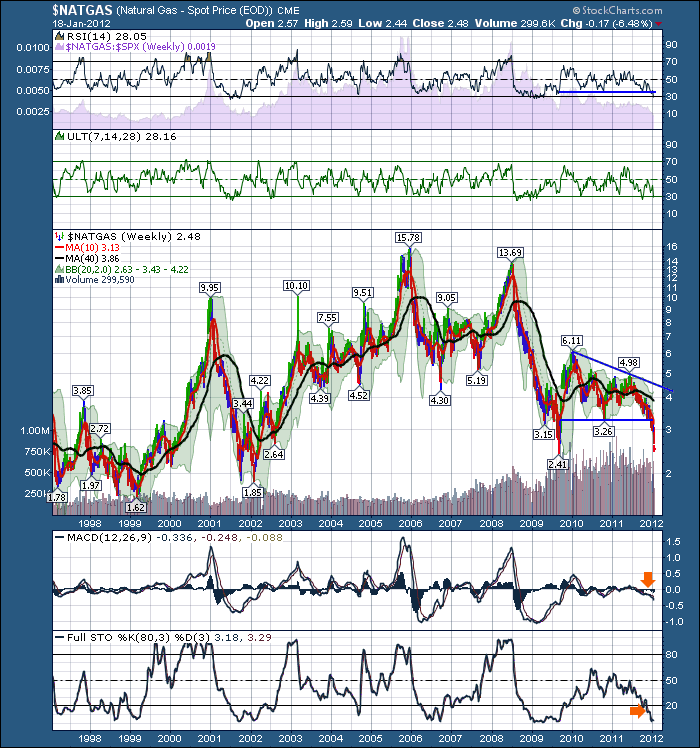

How can Natural gas pricing stay this low...I don't know. But here is the real question.

How low can these Natural gas stocks go? Can they continue to get bank loans if the cash flow dries up?

Some companies produce a fluid called condensate with the natural gas which is even more valuable than regular crude oil due to the advanced chemicals contained in the condensate. So they have some wells that still make revenue, but wells that are called dry gas are below profitability according to Encana's president.

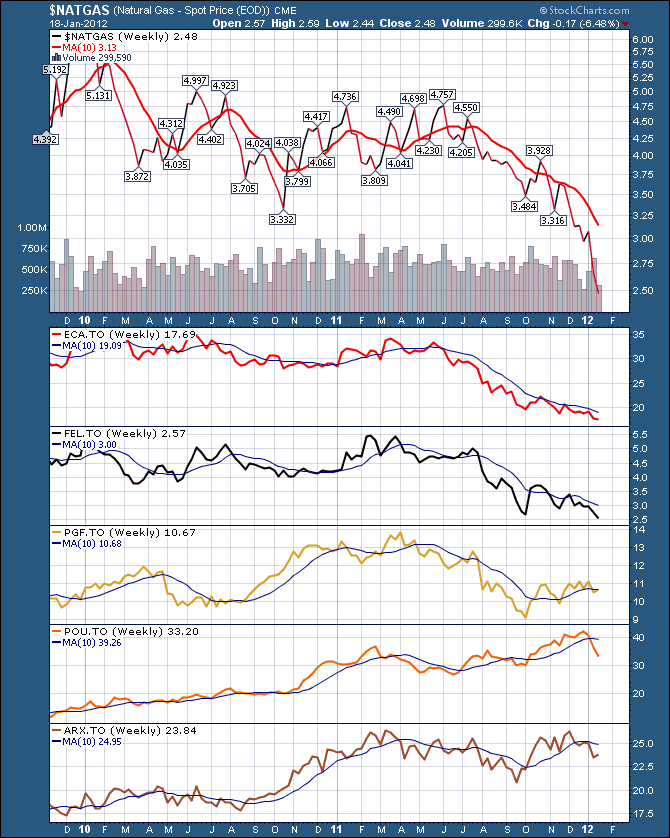

So during my road trip, this will be a short blog. Here are the gas stocks. I started nibbling on some of these today. Either the gas price gets better soon, or the majors will start buying the juniors... something will break...Maybe my account. Some of these are 50% off the summer prices. Unbelievable. Crescent Point's market cap passed Encana....Yikes!

Here are some of the stocks and a closer look at the plummet in Nat Gas.

THe bootom line, they are all below their 10 week averages.

Here is a chart of the Natgas ETF or the HNU.TO chart. Notice the gap pattern. The ULT seems to be indicating at least a bounce is due.

Caution is warranted but Encana at 2009 lows seems unbelievable. Mark Fisher reminded the CNBC audience today that a few years back Natural gas in the Rockies region went to ...zero - yeah - zero - because storage was full.

Good Trading,

Greg Schnell, CMT