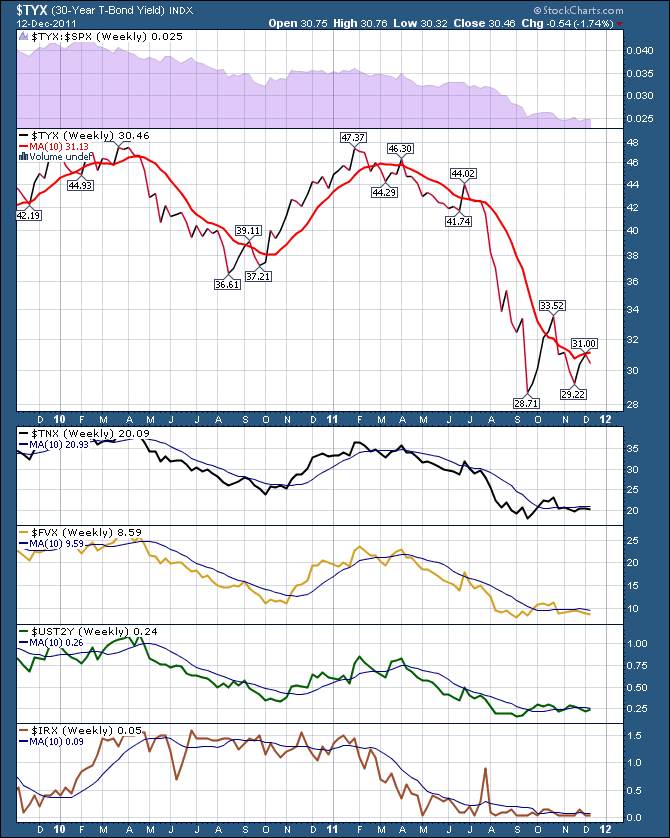

Just a quick note tonight about bonds in this crucial time. 30 year, 10,5,2 year and the 3 month $IRX.

Everything is still trading under the 10 week. On the two previous Euro Summits the $IRX - 3 Month Yield chart would rally briefly. This summit did not even motivate a rally and we closed the week on the bottom of the chart.

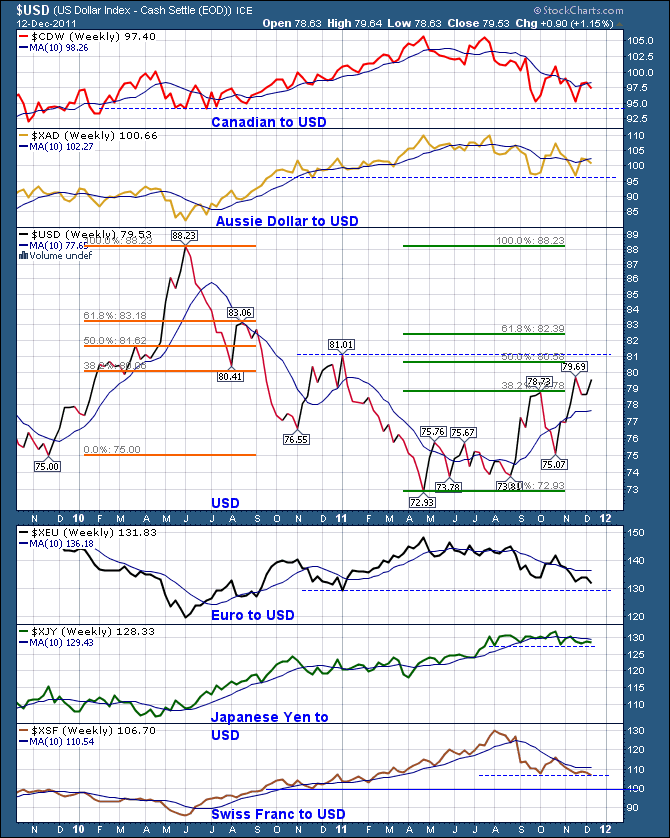

The $USD is at an important place on the chart.

Here is the Daily $USD.

We are testing a breakout on this $USD chart. This breakout would imply lower prices for commodities.

With the Fed meeting this really adds to the pressure on this chart.

Lastly, the $VIX weakened today on a big selloff day. Very odd. Is a rally is coming with no protection required because of the Fed?

We'll wait and see.

Good Trading

Greg Schnell, CMT