Today's charts include: SPY, ANF, BIIB, CHH, CL, FLML, GLD, IBB, ITB, LEN, MDC, NIKE, QQQQ, SEPR, SVU, VRTX, WMT, XLP, XLY.

The next update will be Thursday (May 14th) morning around 9AM ET.

*****************************************************************

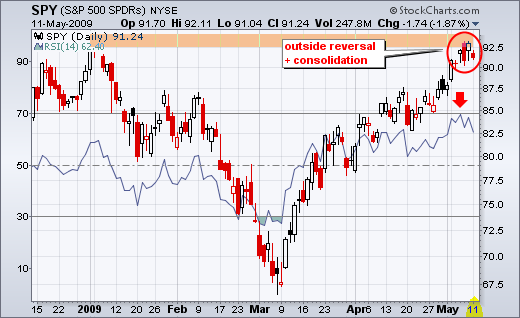

Let's start with the broad market. Even though the S&P 500 ETF (SPY) remains in a medium-term uptrend, it is hitting resistance from the January high and looking ripe for a correction or consolidation. First, the ETF is trading at resistance from the January high. Second, SPY advanced over 35% without a correction. Third, RSI reached 69.56 last week, which is as close to 70 (overbought) as you can get. Fourth, an outside reversal formed on Thursday. This pattern is equivalent to a bearish engulfing pattern. Notice how SPY opened above Wednesday's high and closed near the Wednesday's low. The red candlestick completely engulfed the prior white candlestick for an outside reversal day. Risk of a pullback looks quite high at current levels.

*****************************************************************

The Nasdaq 100 ETF (QQQQ) remains in a medium-term uptrend, but also looks vulnerable to a correction or consolidation. QQQQ broke resistance around 31.5 with a 35% advance in nine weeks. Broken resistance turns into the first support zone to watch. QQQQ is also showing signs of relative weakness in May. The indicator window shows the price relative, which compares the performance of QQQQ to SPY. This indicator broke its March low with a sharp decline last week. Relative weakness in large tech stocks is not healthy for the market overall.

*****************************************************************

The Gold SPDR (GLD) is battling resistance around 90 to keep its wedge breakout alive. This chart shows two conflicting patterns. The pink likes show a bullish wedge with a break above the upper trendline last week. Despite this breakout, GLD has not been able to follow through and this is causing me to consider the alternatives. From a potentially bearish standpoint, the blue lines show a rising flag over the last few weeks. A break below flag support (86) would confirm this pattern and argue for a break below the April lows. Support is holding – for now - and the bulls still have the edge.

*****************************************************************

I am showing the Home Construction iShares (ITB) chart again today. ITB met resistance from the December highs and declined with high volume last week. Like SPY, the medium-term trend remains up, but ITB looks just as vulnerable to a correction or pullback that could retrace 50% of the March-May advance. The bottom window shows the 10-Year Note Yield ($TNX) rising above 3% (30) in late April and continuing higher in May. Mortgage rates are also rising and this could affect the homebuilders.

Within the group, Lennar (LEN) is trading near resistance from the Dec-May highs. The pattern over the last 5-6 months looks like an inverse head-and-shoulders. A move above the Dec-May highs would break resistance and argue for further strength. It ain't broken yet though.

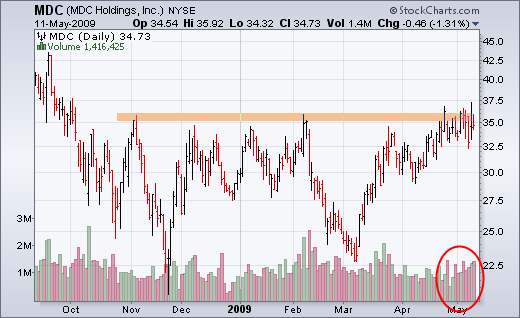

MDC Holding (MDC) is another homebuilder trading near resistance. The stock surged towards resistance in mid March, pulled back and surged to resistance again in April. Trading has turned quite volatile around resistance with downside volume picking up pace.

*****************************************************************

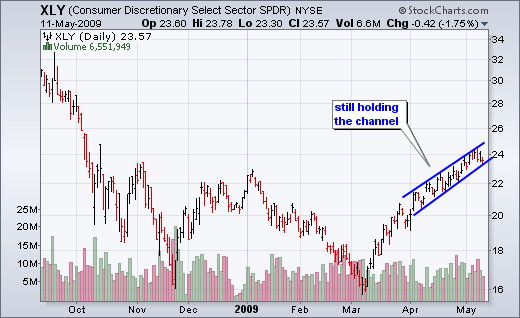

The Consumer Discretionary SPDR (XLY) has been the hottest sector since March. XLY surged in March and then zigzagged higher within a tight channel the last six weeks. Even though the channel is holding, the ETF is way overbought and ripe for a correction that could retrace 50% of this advance. A channel break would be the first sign of weakness.

Within the sector, Choice Hotels (CHH) formed a bearish wedge over the last two months. Even though the wedge has yet to be broken, selling pressure is picking up as downside volume expanded in May.

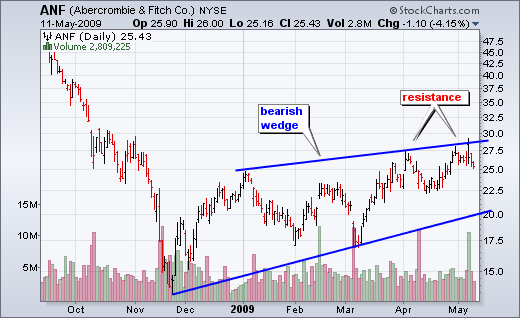

Abercrombie & Fitch (ANF) also sports a rising wedge, but this one extends for six months. ANF met resistance twice around 27.5 over the last few weeks. Notice how the stock opened above 27.5 last Thursday and then closed below 26. Although it was not quite an outside reversal, this intraday about-face shows increase selling pressure.

After hitting resistance in mid April and stalling the last four weeks, Nike (NKE) looks vulnerable to a correction for several reasons. First, resistance stems from the 62% retracement. Second, NKE started showing relative weakness as the price relative broke its February trendline. Third, downside volume has been outpacing upside volume the last two weeks. You may also wish to checkout the charts for DECK and KSWS.

*****************************************************************

The Consumer Staples SPDR (XLP) perked up last week with a break above consolidation resistance. XLP is still underperforming over the last two months, but last week's breakout is a start.

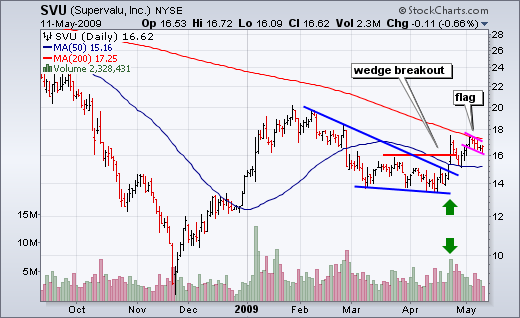

Within the group, Supervalu (SVU) broke wedge resistance with a high-volume surge at the end of April. The stock hit resistance from the 200-day and consolidated with a small flag the last five days. A break above flag resistance would signal a continuation higher.

Colgate Palmolive (CL) broke triangle resistance with a high volume surge above 60. The stock then consolidated the last six days with a flat flag. Watch for a break above flag resistance to signal a continuation higher. You may also wish to checkout the charts for DLM, FARM and HNZ.

*****************************************************************

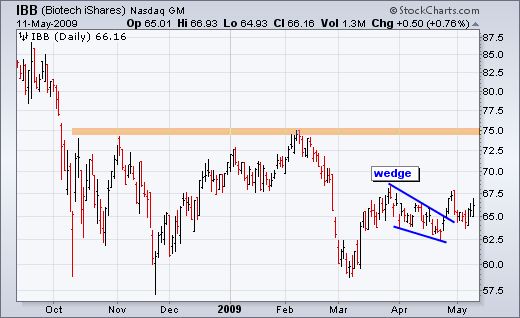

Despite a down day for the broad market ETFs on Monday, the biotech ETFs were strong and finished with modest gains. After breaking wedge resistance in late April, the Biotech iShares (IBB) pulled back to test the breakout area (~65). The ETF bounced over the last three days to keep this wedge breakout alive. Moreover, the bounce over the last three days occurred in the face of market weakness and biotechs are suddenly showing some life.

Within the group, Sepracor (SEPR) sports a bullish setup with a sharp surge and falling wedge correction. You know the drill. After breaking resistance with a massive surge at the beginning of the year, Serpacor retraced 62% with a falling wedge correction. Both the pattern and the retracement amount are typical for corrections. Trading has been rather choppy the last two months with lots of resistance around 15. SEPR is once again on the verge of a breakout with a surge to resistance over the last two days.

Vertex Pharmaceuticals (VRTX) broke wedge resistance with a big surge in late April. The stock pulled back rather sharply in May, but the decline actually looks like a falling flag. Check out the 30 minute chart. VRTX broke flag resistance with a surge over the last two days.

Flamel Technologies (FLML) is a low priced stock with above average risk. It is not for the faint of heart. On the price chart, Flamel consolidated with a triangle from early April to early May. The stock moved higher with good volume on Monday, but has yet to break consolidation resistance. A move above 6.5 with good volume would be bullish.

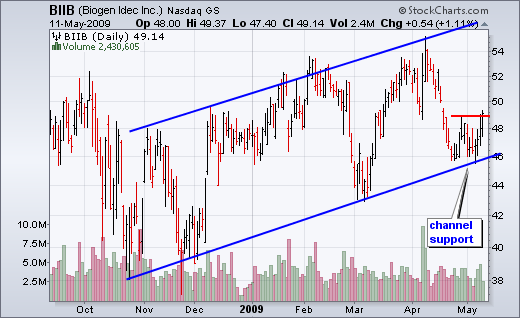

Biogen Idec (BIIB) is getting a bounce off channel support.

*****************************************************************