Market Recap for Thursday, May 23, 2019

Energy (XLE, -3.35%) has been a relative laggard for the past 8 years, mostly due to a rising U.S. Dollar Index ($USD). The group took another big blow yesterday as crude oil prices ($WTIC, -5.71%) tumbled and had its worst day of 2019. It raises the possibility of another swoon back to test the lower $40s per barrel:

While many headlines blamed the trade war for the big drop yesterday - and it most definitely played a hand in it - the bigger story was the breakdown in crude oil prices. Technically, the drop below both the 20 week EMA and 50 week SMA could fuel more selling.

While many headlines blamed the trade war for the big drop yesterday - and it most definitely played a hand in it - the bigger story was the breakdown in crude oil prices. Technically, the drop below both the 20 week EMA and 50 week SMA could fuel more selling.

Meanwhile, technology (XLK, -1.76%) suffered through another poor session as telecommunications equipment ($DJUSCT, -2.29%) gave back some of its recent gains that were led by Cisco Systems' (CSCO) earnings report. Computer hardware ($DJUSCR, -1.85%) was also among the weak performers as Network Appliance (NTAP, -8.11%) delivered poor results and a not-so-great outlook.

Defensive groups managed to hold up fairly well with utilities (XLU, +0.86%) and real estate (XLRE, +0.49%) the only two sectors to finish in positive territory. Among industry groups, the specialized consumer services ($DJUSCS, +1.11%) had a solid day after Copart (CPRT, +7.95%) delivered a solid earnings report and outlook. Check out the Sector/Industry Watch section for more details on the DJUSCS.

Pre-Market Action

Theresa May has resigned as UK Prime Minister over the Brexit crisis, but that's had little negative impact on global markets. China's Shanghai Composite ($SSEC) was flat overnight and I was anxious to see whether support would hold on its chart:

Last night's action isn't reflected on the above chart, but the SSEC closed up a half point to 2852.99. So far so good. Europe is having a solid morning thus far with the German DAX ($DAX) bouncing 90 points (+0.76%) at last check.

Last night's action isn't reflected on the above chart, but the SSEC closed up a half point to 2852.99. So far so good. Europe is having a solid morning thus far with the German DAX ($DAX) bouncing 90 points (+0.76%) at last check.

A big development yesterday was the 10 year treasury yield ($TNX) breaking through double bottom support at 2.36%. And it wasn't close. The TNX finished yesterday at 2.30%. It was a definitive breakdown and one worth watching.

Dow Jones futures appear to be taking a cue from Europe as they're higher by 111 points as we approach today's open.

Current Outlook

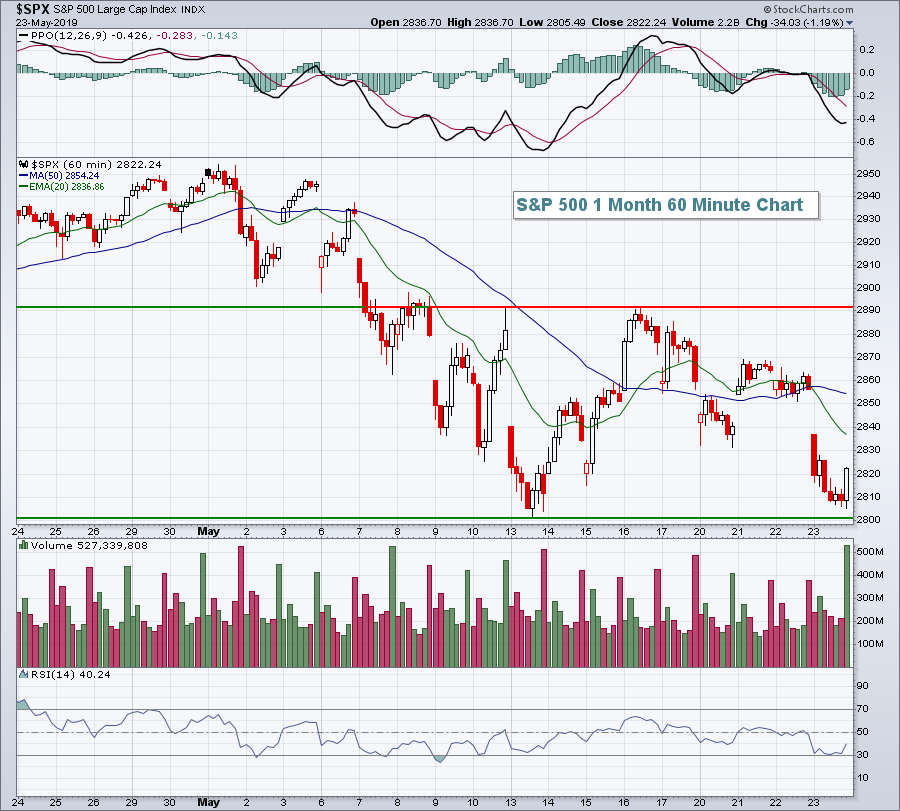

On an intraday basis, the S&P 500's bounce in the final hour on Thursday was kind of a big deal. After nearing a short-term support level, buyers returned. That beat the heck out of the alternative, which would have been an emotional breakdown to encourage more sellers this morning. Instead, the late-day buying has resulted in solid futures this morning. Here was the rally yesterday after 3pm EST:

Those two lines - support and resistance - are what I'm watching right now. If the S&P 500 dips back below 2800, that could be a big problem with the Volatility Index ($VIX) on the rise again, so be careful.

Those two lines - support and resistance - are what I'm watching right now. If the S&P 500 dips back below 2800, that could be a big problem with the Volatility Index ($VIX) on the rise again, so be careful.

The good news is that today's close marks the beginning of a very strong seasonal period for the S&P 500. See the Historical Tendencies section below for more details there.

Sector/Industry Watch

Specialized consumer services ($DJUSCS) has been a relative leader since the December bottom and it's been quite a run - so much so that the group even managed to breakout on both an absolute basis and relative basis yesterday, despite the overwhelming selling that took place in our major indices:

Copart (CPRT) and MercadoLibre (MELI) are two strong relative performers in the group worth considering.

Copart (CPRT) and MercadoLibre (MELI) are two strong relative performers in the group worth considering.

Historical Tendencies

I've posted on a couple occasions about the upcoming seasonal strength on the NASDAQ and Russell 2000. It most definitely applies to the S&P 500 as well. Since 1950, the May 26th through June 5th period has produced annualized returns of +29.12%. While this annualized return falls well short of the returns of the NASDAQ and Russell 2000, it's nonetheless triple the 9% that the S&P 500 has enjoyed throughout the year over the past seven decades.

Key Earnings Reports

(actual vs. estimate):

FL: 1.53 vs 1.61

Key Economic Reports

April durable goods released at 8:30am EST: -2.1% (actual) vs. -2.2% (estimate)

April durable goods ex-transports released at 8:30am EST: +0.0% (actual) vs. -0.1% (estimate)

Happy trading!

Tom